Is the constant drumbeat about Americans’ obesity problem taking its toll on sales of frozen dairy indulgences? Or has the product become too expensive in this stagnant economy? Or is there another explanation for the drop in unit sales of ice cream?

As tracked by SymphonyIRI Group, Chicago, the ice cream/sherbet category rose 4.8% to $4.57 billion in the 52 weeks ended June 10, 2012, while unit sales dropped 3.6% to 1.26 billion. The category consists of the following segments:

• ice cream ($4.15 billion sales, units down 4%)

• frozen novelties ($2.65 billion, units down 1.4%)

• frozen yogurt/tofu ($229.3 million, units up 6.6%)

• sherbet/sorbets/ices ($185.7 million, units down 4.9%)

• frozen ice cream/ice milk dessert novelties ($184.5 million, units down 17.4%)

• ice pop novelties ($82.9 million, units down 6.6%).

The average unit price of ice cream increased 30 cents. It could be that shoppers are buying private-label brands. Private-label ice cream outperformed branded ice cream; dollar sales increased 8.4% on a 24-cent average price increase and unit sales were up 0.5%.

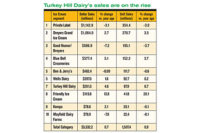

Among the top 10 in the ice cream segment, the Turkey Hill (a unit of Kroger) and Blue Bell brands showed double-digit increases in revenues and solid increases in unit sales. Nestle’s Dreyer’s and Edy’s Fun Flavors brands were hit hard — revenues dropped nearly 20% and units dropped 27%.The top branded ice cream, Unilever’s Breyers, dropped 6.8% in revenues and 18.7% in units.

The story is similar in the $2.6 billion frozen novelties segment. In the 52-week period, revenues rose while unit sales dropped. The top performer was Unilever’s new Magnum stick novelties (No. 10) introduced to the United States from Europe last summer. Sales increased 236% to $57 million and units were up 208% to 15.3 million. Unilever’s Klondike frozen novelties were up 11.6% (to $117.7 million) and 2.7% to 36.8 million units.

Were shoppers looking for lower-calories indulgences? The data are mixed. Unit sales of Skinny Cow from Unilever dropped 10.4% but those of Weight Watchers frozen novelties from Wells Dairy were up 2.7%. The so-called healthy halo surrounding frozen yogurt might have helped that segment. Unit sales were up 6.6% and revenues up 12% to $229.3 million. Kemps frozen yogurt (Dairy Farmers of America) posted a 51% gain in unit sales of its frozen yogurt and a 34.6% gain in its Kemps Live Healthy frozen yogurt brand. For a different view of the healthy story of frozen yogurt, look to Ben & Jerry’s (Unilever). Unit sales of its Lighten Up brand dropped 19% while a newly launched frozen yogurt brand jumped 50,902%.