The ice cream category can be a very competitive place. Overall, the ice cream/sherbet category saw little improvement and unit sales actually decreased, partially thanks to frozen yogurt. Meanwhile, the frozen novelties and ice cream segments showed some promise.

The frozen yogurt segment dragged down the total sales in the ice cream/sherbet category (more on that below). The category showed dollar sales up 1.4% to $6.3 billion, but saw a 0.5% decline in unit sales, to 1.6 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Nov. 1, 2015. The frozen novelties category fared a little better, with dollar sales up 3.7% to $4.7 billion, and unit sales up 0.5% to 1.5 billion.

The ice cream/sherbet category consists of these segments:

- Ice cream ($5.5 billion, units up 0.7%)

- Frozen yogurt/Tofu ($297.4 million, units down 12.6%)

- Ice milk/Frozen dairy dessert ($244.1 million, units down 4.7%)

- Sherbet ($195.9 million, units down 4.3%)

The frozen novelties category consists of these segments:

- Frozen novelties ($4.3 billion, units up 0.8%)

- Frozen ice cream/ice milk desserts ($218.9 million, units down 1%)

- Ice pop novelties ($148.9 million, units down 5.1%)

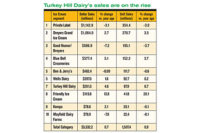

In the ice cream segment, dollar sales rose 2.4% to $5.5 billion, while unit sales were up just 0.7% to 1.4 billion. There were several winners and one big loser in the top 10. (See the table.) Private label dominated overall sales with $1.4 billion. Its dollar and unit sales were both up 4.3%. Ben & Jerry’s saw dollar sales jump 19.6% to $620.8 million and units increased 15.8%. Breyers’ (Unilever) dollar sales improved 15.9%, with units up 13.2%. Häagen-Dazs (Nestlé) saw dollar sales improve 7.5% and unit sales rose 4%. Talenti, another Unilever brand, saw numbers skyrocket — dollar sales were up 48% and units jumped 46.2%. The big loser of the top 10 was Blue Bell, with dollar and unit sales that plummeted 53.5% and 54.8%, respectively. This drop can be attributed to the company’s big recall last year due to Listeria. Though it wasn’t among the top 10, Tillamook’s dollar and unit sales jumped 43.8% and 34.2%, respectively.

Frozen yogurt meltdown

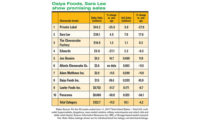

Helping to drag down the ice cream category’s overall numbers was the frozen yogurt/tofu segment. The segment’s dollar sales dropped 10.1% to $297.4 million, and unit sales fell 12.6% to 78.7 million. There were a few companies among the top 10 that saw sales increases, including Kemps, with dollar sales up 8.5%. Its unit sales improved 6%. Dollar sales for So Delicious (WhiteWave Foods) rose 25.3% and units jumped 25.7%. Dannon’s Oikos saw dollar sales increase 24.4% and units were up 22.9%. Not doing well was Ben & Jerry’s frozen yogurt; dollar sales dropped 28.5% and units fell 31.1%.

The ice milk/frozen dairy dessert segment struggled, as dollar sales were down 1.2% to $244.1 million, and units dropped 4.7% to 70.7 million. Among the top 10, only one company had promising numbers. All Arctic Zero’s dollar sales jumped 51.6% and units rose 54.8%. Two Breyers brands led the segment in overall sales, but struggled with unit sales. Breyers Blasts’ dollar sales were up 0.6%, but units fell 2.4%. Breyers frozen dairy dessert showed dollar sales up 0.9%, but unit sales decreased 1.1%.

Frozen novelties sales pop

On the frozen novelties side, dollar sales showed a 3.9% improvement to $4.3 billion, though unit sales increased only 0.8% to 1.4 billion. Most in the top 10 saw positive numbers, except The Skinny Cow (Nestle). Its dollar sales fell 6.9% and units dropped 6.6%. Nestlé Drumstick had promising sales, up 10.6%, with unit sales up 7.4%. Wells Blue Bunny also fared well — dollar sales increased 8.6% and units rose 4.2%. Dollar sales for Magnum (Unilever) jumped 11%, while unit sales improved 5.4%. Häagen-Dazs once again had positive numbers — dollar sales rose 8.8% and units were up 4.4%.