With many U.S. consumers picking up cooking/baking at home during COVID-19 shutdowns, the butter category seemed to be on easy street in 2020. But this year, the category is facing hazards on the road.

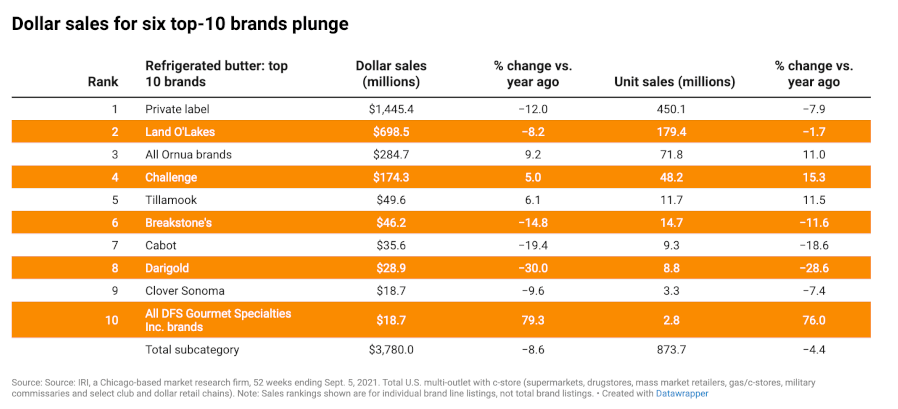

According to data from Chicago-based research firm IRI for the 52 weeks ending Sept. 5, 2021, dollar sales at retail for butter and butter blends plunged 8.0% to $3,482.8 million. Unit sales dipped 4.4% to 976.8 million.

While butter has struggled to maintain its pandemic gains, it is important to note that the category’s sales are still up from their pre-pandemic levels, explains Jinny Lam, director of cheese and butter, Tillamook County Creamery Association (TCCA), Tillamook, Ore.

“The pandemic drove panic buying where butter saw unprecedented levels of sales,” she notes. “And while the pandemic behaviors are slowing down, so have butter sales, but are [they] still higher than pre-COVID levels.”

The data support this claim. In Dairy Foods’ November 2019 issue, we noted that butter/butter blends dollar sales totaled $3,131.4 million and unit sales were 840.6 million during the 52-week period ending Aug. 11, 2019 (according to IRI data).

And 2021 sales losses aren’t just for dairy butter, either. The non-dairy margarine category is also down considerably: 6.5% in dollar sales and 9.6% in unit sales.

Cooking still in driver’s seat

While purchasing butter for use as an ingredient is less of a factor than in the height of the pandemic, at-home dining is still habitual for many consumers, explains Adeline Druart, president of Vermont Creamery and a vice president with Vermont Creamery’s parent company, Arden Hills, Minn.-based Land O’Lakes. She notes that people are interested in “recreating ‘restaurant-like’ dishes at home and spending more on quality food for at-home consumption,” even as some pandemic restrictions have subsided.

And butter is a key ingredient for these culinary-minded consumers.

“The pandemic reinvigorated consumers’ love for baking, so butters with a higher fat content like Tillamook extra creamy butter were compelling because of how they perform, especially in pastries,” Lam emphasizes.

Venae Watts, co-owner of Minerva Dairy, Minerva, Ohio, agrees that home chefs are driving category growth — and different types of butters are needed for various cooking applications.

For baking, consumers look for unsalted butter and/or something with higher butterfat. For savory applications, they might purchase a sea salt option or a butter infused with a flavor. Another need is “on-counter butter,” or butter “ready for a quick spread on a slice of banana bread or [to] toss into the pan on the stove,” she points out.

Watts adds that “savory finishing butters are trending, letting the home chef add layers of complexity to their dishes.”

One new cooking-friendly offering comes from Austin, Texas-based Vital Farms: pasture-raised butter with sea salt and avocado. According to the company, this combination of three simple high-quality ingredients — butter, 100% pure avocado oil, and sea salt— along with the offering’s 85% butterfat content, creates a flavorful and creamy tub butter that is perfect for any cooking occasion.

Vital Farms says the new product is the first nationally distributed tub butter made from milk from pasture-raised cows and avocado oil; it also has the highest fat content of any nationally distributed product in the category.

To create the spreadable tub butter, cream is sourced from rich milk from pasture-raised cows on family farms in Georgia, Florida, and Ohio. Each cow enjoys outdoor access year-round to graze on pasture and eats a balanced diet of natural forages, including grass and hay, along with supplemental vitamins, minerals, and grains to support their overall health.

Gourmet offerings accelerate

According to Lam, many consumers think that all butter is created equal. And this misconception can motivate many people to just pick up whichever butter is on sale.

“But there is a huge variation in butter quality! Butterfat is incredibly important, as is flavor,” she emphasizes.

Watts agrees that consumer education on premium offerings is important, especially as more higher-end butter offerings are coming onto the shelf at retail.

“This expansion in the retail store chain set is premium butter focused,” she points out. “The general consumer used to call all the products in a butter set ‘butter.’ The educated consumer is learning that the generalization of the term ‘butter’ is not accurate.”

For its part, TCCA crafted higher-butterfat options that offer consumers more of a gourmet experience. And in 2021, the cooperative debuted new butter packaging to better emphasize its butterfat content.

“Because of the trends we’ve seen, we refreshed our butter packaging in 2020 to specifically call out our higher butterfat content (81%) — reinforcing the creaminess of our butter — as well as more clearly calling out the sea salt in our salted butter offering,” Lam says. “This new packaging is also flooded with color, making it stand out at shelf.”

And Evanston, Ill.-based Kerrygold USA, part of Dublin-headquartered Ornua Co-operative Ltd., introduced a gourmet butter product this year: Kerrygold Irish butter with olive oil. The offering is uniquely made with the milk from Irish grass-fed cows and marries the distinct taste of Kerrygold butter with olive oil, the company says.

Another gourmet option in the butter case is cultured butter, and it similarly struggles from lack of consumer knowledge, Druart point out.

“While the premium segment is growing faster than its regular counterpart, the biggest challenge is to educate consumers on the benefit of cultured dairy products,” she notes. “Many consumers don’t understand what culturing does to flavor — that by introducing live bacterial cultures and allowing it to ferment, it introduces a richer flavor to the butter.”

Vermont Creamery unveiled its 82% butterfat cultured butter in 2019 and is currently focused on “educating consumers on cultured high-fat butter nationally,” Druart emphasizes, adding that craft offerings across the dairy case are a potential area of growth.

“Many dairy categories are yet to be developed with a premium offering using cultured dairy for richer taste, unique flavors and/or higher fat content,” she says.

Flavors merge onto highway

Also trending in the butter category are flavored options that add a little something extra, notes Lam.

“We’ve … seen excitement around flavored butters, with competitive entries such as truffle, seeds and jalapeno,” she adds.

For its part, Minerva Dairy offers Garlic Herb butter. The product is currently available in select retail stores, but the company will be doubling its availability in 2022, Watts explains.

“This savory flavor-infused butter adds a layer of complexity when added to any dish,” she notes. “[The] quickest way to use Minerva Dairy Garlic Herb butter is to toss with vegetables.”

Following the flavor trend, New York-based M.A.D. Foods says it unveiled everyday finishing butters and butter alternatives. The four butters, with a minimum 82% butterfat, come in Black Truffle, Fire-Roasted Jalapeño, Roasted Garlic, and Parmesan Herb flavors. The finishing butters and butter alternatives are available in the New York City metro area and the Midwest, with additional flavors to follow.

Meet the alternatives

- Upfield, Toronto, introduced its Flora plant-based bricks in Canada. The offerings are a vegan, dairy-free, gluten-free and non-GMO plant-based butter alternative. They are made with sustainably sourced plant oils and come wrapped in plastic-free paper packaging.