Sales within the retail ice cream and frozen novelties segments have been traveling in two different directions of late.

Heading south on a highway riddled with potholes, the ice cream/sherbet category saw sales tumble 1.5% to $7,605.6 million during the 52 weeks ending Sept. 5, 2021, according to data from Chicago-based market research firm IRI. Unit sales declined 0.9% to 1,924.6 million.

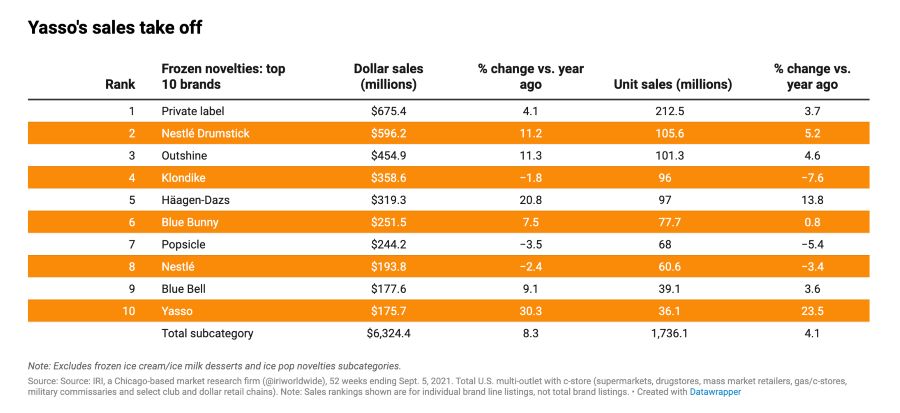

The northbound frozen novelties category, meanwhile, managed to maneuver around the highway hazards. The category’s dollar sales rose 8.4% to $6,871.3 million; unit sales jumped 4.0% to 1,844.9 million.

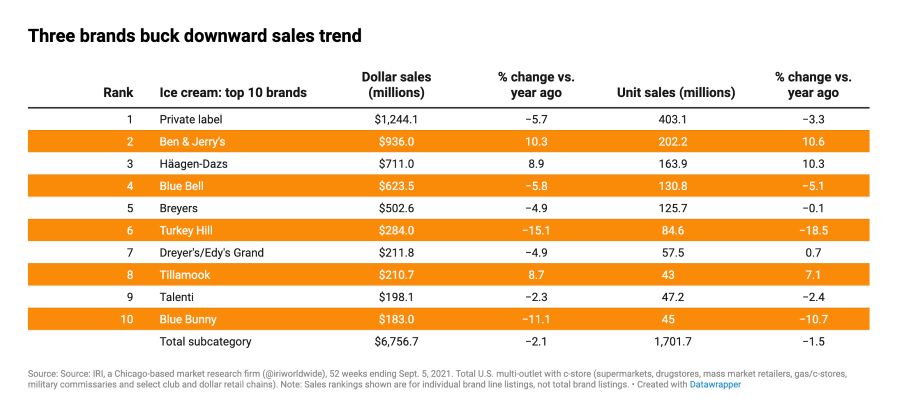

Within the ice cream/sherbet category, the largest subcategory — ice cream — lost the most ground. Its dollar sales fell 2.1% to $6,756.7 million, while its unit sales dropped 1.5% to 1,701.7 million. All other subcategories (frozen yogurt/tofu, ice milk/frozen dairy desserts, and sherbet/sorbet/ices) saw positive dollar sales results, and all but one (frozen yogurt/tofu) realized positive unit sales growth.

Within the frozen novelties category, meanwhile, all subcategories (frozen novelties, frozen ice cream/ice milk desserts, and ice pop novelties) experienced positive dollar and unit sales growth. Frozen ice cream/ice milk desserts outperformed the total category, posting an 11.6% increase in dollar sales to $334.1 million and an 11.0% upsurge in unit sales to 18.8 million.

The slight decline within the ice cream/sherbet segment follows a sharp COVID-19 pandemic-related growth curve in 2020. As Joe Brooks, vice president of brand marketing for Le Mars, Iowa-based Wells Enterprises, explains, fewer consumers were looking to reduce or avoid sugars in their diet during the year’s stressful times.

“At Wells, we’ve seen firsthand the impact of an increase in sales, which can be attributed to consumers staying indoors during the pandemic and wanting to reach for their favorite comfort foods,” he says.

Indulgence has the right of way

Even as they begin to venture back to work or school, many consumers are still turning to ice cream and frozen novelties for comfort. What’s more, for a significant subset of those consumers, comfort means premium, indulgent offerings.

“There is one ice cream trend that has always existed and continues to resonate with consumers, which is indulgent ice cream made with fresh cream and milk,” notes Sara Schramm, marketing brand manager for Blue Bell Creameries, Brenham, Texas. “This trend remains our focus when we produce Blue Bell ice cream.”

This year, Blue Bell Creameries launched a variety of limited-time ice cream flavors that meet the trends toward premium and indulgence, she says. They include Cookies ‘n Cream Cone, Chocolate Sheet Cake and Coconut Cream Pie. The Cookies ‘n Cream Cone flavor was inspired by — and captures the taste of — the Blue Bell Cookie Cone novelty, which was retired in 2015.

“But it is still one of the most talked about on social media,” Schramm says. “When designing the packaging for this flavor, we even took some of the original artwork elements from our Cookie Cone to pay homage to the popular snack.”

As for the Chocolate Sheet Cake flavor, it was inspired by a favorite Texan dessert: Texas sheet cake. It boasts milk chocolate ice cream, chocolate sheet cake pieces, chopped pecans and a chocolate icing swirl.

“When developing new flavors each year, we often look at desserts and sweet treats that consumers enjoy,” Schramm explains. “Sometimes we take it a step further and look for regional and local dessert specialties that could appeal to all consumers.”

Perry’s Ice Cream Company Inc. also introduced a number of indulgent limited-edition ice cream flavors this year. The latest, the company’s 1.5-quart winter limited-edition ice cream offerings, made their debut in September. Flavors include Peppermint Stick, (pink peppermint ice cream with red and green peppermint candies) and White Christmas, (mint and white chocolate-flavored ice cream with red and green mint pieces). The Akron, N.Y.-based company also announced the return of its Zero Visibility flavor (coconut rum ice cream with shredded coconut pieces), which is available only every five years.

“With a hint of rum flavor to ‘warm your bones,’ Zero Visibility honors the hearty spirit required to weather the unpredictable Great Lakes region winter season,” says Nichole Buryta, brand manager.

Meanwhile, Edy’s and Dreyer’s — brands of Oakland, Calif.-based Dreyer’s Grand Ice Cream Inc. — announced the 2021 introduction of a more permanent indulgent ice cream lineup: the Rocky Road Collection. The newly unveiled collection is in tribute to the O.G. Rocky Road, which was created by the brands’ founders, William Dreyer and Joseph Edy. The Rocky Road Collection is said to be “inspired by the spirit of iconic flavors and nostalgic childhood recipes, amped up for today’s families with a new twist of extreme indulgence.”

The six flavors introduced as part of the collection include three preexisting flavors — Original Rocky Road, Mocha Almond Avenue and Chocolate Peanut Butter Park — as well as the new Salted Caramel Pretzel Path, Brownie Brick Road and Cookie Cobblestone. The flavors retail in a 1.5-quart carton; Brownie Brick Road also is available in a 14-ounce container.

Ben & Jerry’s, Burlington, Vt., also pushed the indulgence envelope with this year’s launch of Ben & Jerry’s Topped, a line of seven unique pint flavors covered with a chocolatey ganache. The flavors include Chocolate Caramel Cookie Dough (chocolate ice cream with caramel swirls and gobs of chocolate chip cookie dough topped with caramel cups and chocolatey ganache), Over the Top (chocolate ice cream with peanut butter swirls and peanut butter cups topped with mini peanut butter cups and chocolatey ganache), Salted Caramel Brownie (vanilla ice cream with salted caramel swirls and fudge brownies topped with caramel cups and chocolatey ganache) and more.

For its part, High Road Craft Ice Cream is proud of its new High Road pint collection, notes Keith Schroeder, CEO and cofounder of the Marietta, Ga.-based company. Varieties of the chef-crafted ice cream include All the Berries & Some Cake Too, Vanilla Fleur De Sel and more.

“We worked hard to nail particular styles of indulgence: a) dazzle me, b) comfort me, c) show me your best vanilla, etc.,” he says. “It was a blast to try to formulate a greatest hits lineup from our 11-plus years as makers.”

National and regional brands are not the only players in the premium, indulgent ice cream segment. Retailers also are getting into the game with private label offerings, notes Schroeder.

“Unique premium private brands are here to stay, and I expect to see growth in this segment over the next 24 months,” he says. “Many retailers are winning with flavors and formulations unique to their regions.”

Speaking of flavors, Schroeder believes consumers do not want anything too “far out there,” even if the product is premium and indulgent.

“Right now, I think the consumer is fatigued with ‘shock value’/adventure flavors, and [is] looking for reliable products with exceptional ingredients that evoke a certain vibe,” he says. “All over the social media world, consumers are saying ‘I want the best chocolate ice cream. Give me something that has food magazine appeal. Turn me on to flavors that are popular elsewhere in the world. Walk me through a day in the life of how you created this treat.’”

Novelties take the indulgence on-ramp

Premium, decadent offerings are trending on the frozen novelties side, too.

For its part, Turkey Hill Dairy, Conestoga, Pa., recently debuted three indulgent lines. They include ice cream cookie sandwiches, fruit and cream bars and layered sundae cups.

According to the company, each ice cream cookie sandwich features two double chocolate chip cookies filled with Vanilla Bean, Peanut Butter, Chocolate or Choco Mint Chip ice cream. The fruit and cream bars — made with rich cream, milk and fruit — come in Strawberry, Coconut, Orange and Strawberry Lemonade varieties, while the single-serve sundaes are available in Caramel Brownie, Cookies & Cream, Cookie Dough Delight, Strawberry Shortcake, Peanut Butter Cup, Ultimate Fudge, Chocolate Cream Pie and Party Cake flavors.

Wells Enterprises also had indulgence in mind with the 2021 launch of Blue Bunny Load’d bars. The bars have “two times the mix-ins” and are loaded with “ooey-gooey” swirls and pieces in every bite, the company says.

“With five delicious varieties to choose from — Bunny Tracks, Cookie Dough, Super Fudge Brownie, Salted Caramel and Strawberry Shortcake — families don’t have to go far to bring that special parlor experience home,” says Stephen Dewart, brand manager, Blue Bunny.

Brands yield to consumers’ health and wellness needs

Another significant trend playing out within the ice cream and frozen novelties categories is escalating demand for better-for-you offerings.

“The pandemic has also brought a hyper-focus on wellness, pivoting from superficial to within,” Brooks points out. “According to McKinsey [& Company] research, consumers are seeking food that will help them accomplish their wellness goals in addition to tasting good.”

Matthew Thornicroft, communications manager for Cleveland-based Pierre’s Ice Cream Co., says his company is also seeing continued interest in such products.

“We’ve noticed increased popularity in Pierre’s better-for-you treats like Pierre’s Slender no-sugar-added, reduced-fat ice cream and Pierre’s frozen yogurt,” he says.

The company, which will celebrate its 90th anniversary in 2022, expanded its frozen yogurt lineup in 2020, Thornicroft notes, adding Sea Salt Caramel Toffee Crunch and Chocolate Monster (chocolate frozen yogurt with brownies, chocolate chip cookie dough and chocolate chips).

“Both flavors created excitement among Pierre’s fans and remain popular additions,” he says.

And better-for-you offerings were a particular focus of the frozen novelties category this year.

Boise, Idaho-based Killer Creamery announced the launch of Killer Sammies, billed as the first-of-their-kind zero-sugar ice cream sandwiches in the frozen novelties space. Gluten-free, all-natural and keto-diet-friendly, the offerings come in Chocolate and Vanilla. Each sandwich has 2 to 3 grams of net carbs and 5 grams of protein.

And Yasso Inc., Boulder, Colo., launched its first incubator brand, Jüve Pops, which covers a line of functional vitamin- and electrolyte-packed water-based pops. Made with real fruit, the hydration-minded pops have only 5-7 grams of sugar. According to Yasso, they come in five frozen flavors: Tangerine, Triple Berry, Strawberry, Lemon Lime and Coconut. They also come in freezable formats in Orange, Grape and Triple Berry flavors.

Wells Enterprises is targeting health-conscious frozen novelties consumers, too, with its new Halo Top Fruit Pops and Halo Top Keto Pops — both making their debut in spring. According to Kimberly Behzadi, senior associate brand manager for Halo Top, the Fruit Pops are made with real fruit and have 50% to 65% less sugar and fewer calories than other leading fruit bars. They come in five flavors, including Strawberry, Coconut, Lime, Mango and Pineapple.

The Keto Pops, meanwhile, are made with protein-packed ultrafiltered skim milk, which delivers fewer net carbs than regular ice cream and addresses a broad range of dietary needs, Wells Enterprises says. With net carbs ranging from 2 to 3 grams per pop, they come in Sea Salt Caramel, Peanut Butter Chocolate, Berry Swirl and Chocolate Cheesecake varieties.

Looking ahead, a still-emerging trend within the better-for-you ice cream and frozen novelties space centers on “health benefit ingredients,” notes Brooks. These ingredients include those that support mental health such as magnesium and lavender, digestive health such as probiotics and prebiotics, and more.

“Flavor innovations that signal physical and emotional health will continue to resonate strongly with consumers,” he adds.

U-turns more common on road to purchase

In addition to being aware of seemingly polar product-related trends — indulgent versus better for you — ice cream and frozen novelties processors must be cognizant of trends on the consumer purchasing side. As Luconda Dager, president of Utica, Ohio-based Velvet Ice Cream Co., points out, the grocery business is undergoing rapid changes — thanks to both pandemic-related realities and evolving consumer-shopping behaviors.

“Grocery pickup and delivery has provided the convenience consumers want, so they are making fewer trips to the store but purchasing in larger quantities in most segments, including ice cream,” she says. “Online ordering seems to lessen impulse buys, which is creating more brand loyalists who order the same products on a routine basis.”

Pandemic-related supply chain issues have resulted in limited product availability on occasion. However, Dager says Velvet has noticed a willingness among shoppers to try new flavors of their favorite brand when their favorite flavor is not available. Consumers also seem to be opening up their online grocery purchases to retailers beyond their local grocer, especially for delivery when they see a tangible benefit.

“We also notice people are making more one-off stops in places like gas stations and drug stores,” she says. “It is incumbent on us as ice cream producers to ensure we are servicing those multichannel shoppers in outlets we may not have focused on in years past.”

Flagging hazards

Looking ahead, ice cream and frozen novelty manufacturers do face some challenges. One of those is a potential downturn in comfort eating.

“As the world begins to move past the pandemic and opens up, consumers are going to be conscious of their diets and the foods they consume,” Brooks points out. “That is why the most significant trend in the ice cream and frozen novelties segment right now is all about healthier offerings — to ensure we’re keeping up with the sales and growth experienced in 2020, healthier options will have to be offered as comfort eating declines.”

Speaking of the pandemic, some supply chain issues are lingering as well.

“Pricing increases from suppliers and — for a distributor like Velvet — logistics costs, including gas, cannot be easily made up in our already thin margins,” Dager points out. “Supply chain breakdowns at almost every level are causing delays in product manufacturing and product delivery.”

The most significant challenge for Velvet, therefore, is changing the way it works to accommodate supply chain issues such as bigger lead times tied to everything from ingredients to printed cartons, she notes.

“All affect how quickly and efficiently we can keep up with demand. The pressures to time things correctly and keep customers happy [are] a huge challenge,” she maintains. “We now have to prepare earlier and make adjustments that ensure we hit the mark.”

Thornicroft agrees that the pandemic-induced challenges related to supply chain disruptions, higher costs and cost unpredictability continue to be concerns.

“There is also the pressures to fulfill the requirements of the USDA’s Bioengineered Food Disclosure requirements by the end of this year,” he adds.

Competition is fierce within the segment, too.

“There’s a lot of competition on shelf, and we’re seeing that the economics of co-manufacturing doesn’t necessarily result in products with exceptional value for the consumer,” Schroeder says. “Too much money is tied up in carrying costs, order minimums, and now, not much ‘room at the inn.’ I think we’re going to see some new construction and new capabilities should companies and brands continue to have access to affordable capital.”

Meet the alternatives

- Bubbies Homemade Ice Cream and Desserts Inc., Aiea, Hawaii, debuted three new non-dairy mochi flavors in six-pack retail boxes: vegan Strawberry mochi, vegan Chocolate mochi, and a newly created flavor — vegan Mango mochi. Made with a base of coconut “milk” and wrapped in sweet mochi dough, the new varieties combine the traditional rice-based, Japanese-inspired, sweet, and delicate mochi dough with velvety-smooth coconut-based “ice cream,” Bubbies says.

- Graeter’s Ice Cream, Cincinnati, and food technology company Perfect Day, Berkeley, Calif., teamed up to launch Perfect Indulgence — Graeter’s first-ever line of vegan frozen dessert pints using Perfect Day’s innovative animal-free “dairy” protein. Flavors include Black Cherry Chocolate Chip, Cookies & Cream, Oregon Strawberry, Mint Chocolate Chip, Chocolate, Chocolate Chip, and Madagascar Vanilla Bean.