For the second year in a row, Dairy Foods has good news to share about the retail juice category, a segment that had been experiencing a multi-year decline. According to data from Chicago-based market research firm IRI, two of the four juice categories actually posted impressive dollar and unit sales increases during the 52 weeks ending March 21, 2021.

Chilled juices shine

Among the juice categories, refrigerated juices/drinks really impressed. The category’s dollar sales shot up 12.6% to $7,442.0 million. Unit sales climbed 9.1% to 2,467.9 million.

The refrigerated cranberry juices/cranberry juice blends subcategory posted the strongest gains, albeit on a small base. Dollar sales rose 342.9% to $0.9 million, while unit sales increased by 583.9% to 0.4 million.

The largest refrigerated juice subcategory — refrigerated orange juice — also fared very well. Dollar sales improved 15.1% to $3,395.7 million, while unit sales grew 11.2% to 980.1 million.

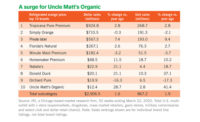

Several of the top 10 refrigerated orange juice brands realized 20%-plus dollar and unit sales gains, including Tree Ripe (up 35.4% and 38.8%), Natalie’s (up 28.8% and 21.4%) and Donald Duck (up 21.8% and 33.0%). Only one top 10 brand, Minute Maid Premium, saw a dollar sales decline (1.1%), although its unit sales were unchanged.

A number of other refrigerated juice/juice drink subcategories posted double-digit dollar and unit sales growth, too. These include refrigerated lemonade (with a 21.1% rise in dollar sales and a 16.3% improvement in unit sales), refrigerated vegetable juice/cocktails (up 17.0% and 22.0%), refrigerated cider (up 13.3% and 8.0%), refrigerated apple juice (up 17.8% and 17.5%), refrigerated grapefruit juice (up 10.7% and 5.0%), refrigerated cranberry cocktails/drinks (up 11.4% and 4.8%) and refrigerated fruit nectar (up 19.8% and 19.1%).

The biggest loser among the refrigerated juice subcategories, meanwhile, was the refrigerated grapefruit cocktails/drinks segment (dollar sales were down 45.1%, while unit sales fell 45.6%).

Shelf-stable bottled juices impress, too

Also bearing good news was the slightly larger shelf-stable bottled juices category. It posted a dollar sales gain of 8.5% to reach $7,729.6 million. Unit sales grew 2.9% to 3,256.9 million.

And a number of subcategories here realized double-digit dollar and unit sales gains. Those include shelf-stable cranberry cocktail/juice drinks (with a 20.5% increase in dollar sales and a 15.5% uptick in unit sales), shelf-stabled bottled lemon/lime juice (up 23.1% and 20.2%), shelf-stable bottled cider (up 16.7% and 13.3%), shelf-stable “other” fruit juice (up 17.4% and 12.6%) and shelf-stable pineapple juice (up 30.9% and 26.4%).

However, the largest shelf-stable bottled juice subcategory — shelf-stable bottled fruit drinks — underperformed the total category. Its dollar sales rose 2.3% to $2,331.1 million, but its unit sales fell 3.4% to 1,233.5 million.

Leading the pack of top 10 brands here, dollar-sales-growth wise, was Arizona. The brand saw a 24.0% gain in dollar sales and a 10.3% increase in unit sales. Snapple, Welch’s and V8 Splash also realized strong dollar sales growth. Snapple saw dollar and unit sales gains of 19.7% and 9.4%, respectively. Welch’s realized an 18.1% dollar sales gain (and a unit sales increase of 9.3%), and V8 Splash posted a 17.9% dollar sales jump (and a 13.9% unit sales increase).

Only two brands saw steep dollar and unit sales declines. Tampico’s dollar and unit sales decreased 17.9% and 17.3%, respectively. And Bai Cocofusion posted dollar and unit sales declines of 13.1% and 15.8%.

Aseptic flat; canned cold

The news was not quite as rosy for the two smaller juice categories, meanwhile.

Aseptic juices did see a 3.2% dollar sales increase (to $1,442.9 million). But unit sales declined by 0.4% to 507.8 million.

And canned juices realized decreases in both dollar and unit sales. Dollar sales fell 3.5% to $1.331.4 million, while unit sales tumbled 5.9% to 726.3 million.