Last year at this time, Dairy Foods had good news to share about the ready-to-drink juice/juice drink categories. The two largest of the four categories — refrigerated juices/drinks and shelf-stable bottled juices — made impressive dollar and unit sales gains during the 52 weeks ending March 21, 2021, according to data from Chicago-based market research firm IRI.

This year, those categories’ gains were much smaller. However, one category that failed to impress last year saw significant dollar and unit sales increases.

Aseptic an overachiever

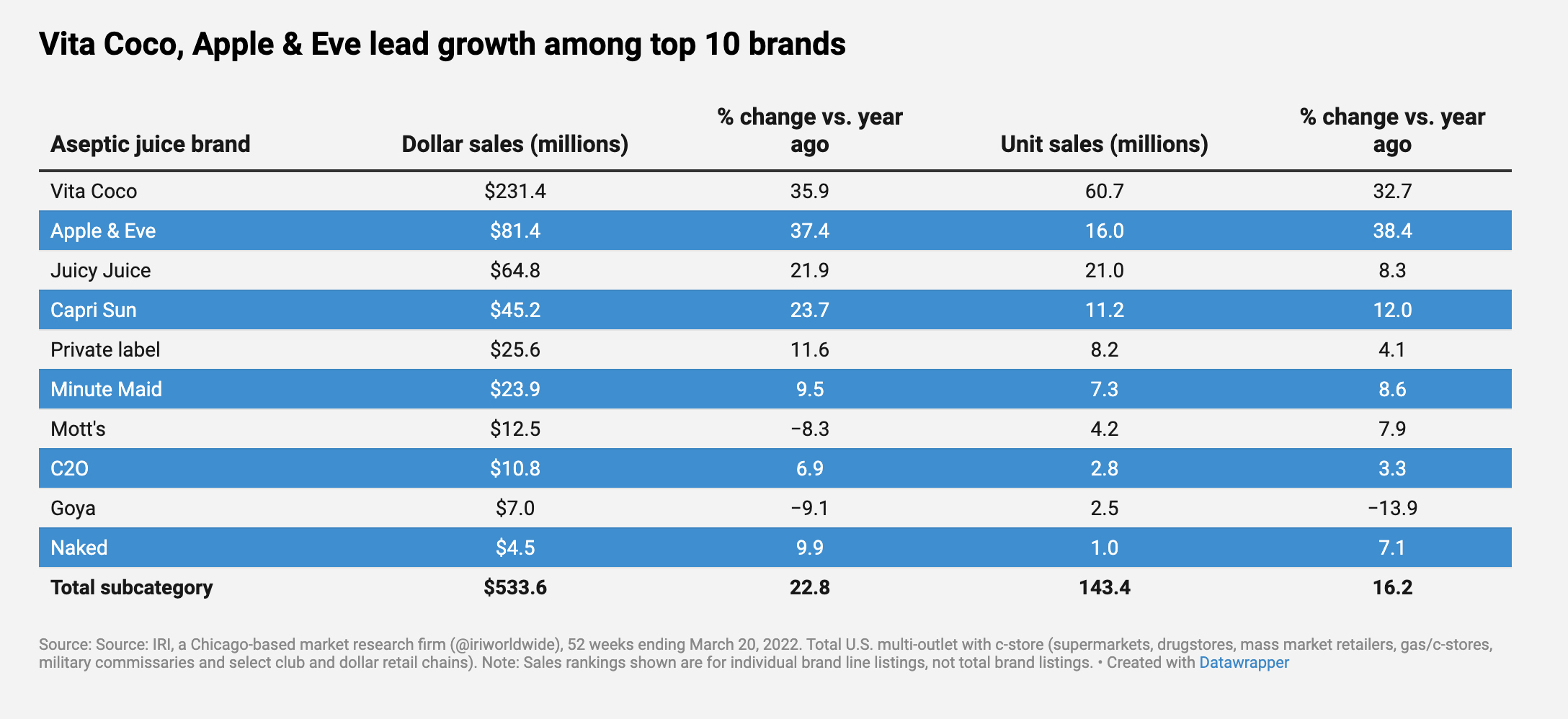

That overachieving category is aseptic juices. The overall category saw dollar sales increase by 18.5% to $1,713.9 million during the 52 weeks ending March 20, 2022, the IRI data show. Unit sales shot up 11.3% to 566.8 million.

The aseptic juice drinks subcategory posted dollar and unit sales increases of 16.6% and 9.7%, respectively. The aseptic juices subcategory, meanwhile, saw a 22.8% escalation in dollar sales and a 16.2% rise in unit sales.

Smaller gains for largest categories

The news was a little less bright — but still very positive overall — for the two largest juice/juice drink categories.

Shelf-stable bottled juices realized a 4.2% dollar sales increase to reach $8,092.1 million. However, the category’s unit sales fell 2.8% to 3,183.2 million.

Within that category, the shelf-stable bottled fruit nectar subcategory was the winner in terms of dollar and unit sales increases. Dollar sales jumped 35.3%, while unit sales grew 24.6%. The shelf-stable bottled fruit juice blend subcategory also performed well, posting 14.4% and 8.4% dollar and unit sales increases, respectively.

Meanwhile, the refrigerated juices/drinks category saw positive sales growth in both dollars and units. Dollar sales rose 4.1% to $7,799.4 million. Unit sales improved 1.8% to 2,528.3 million.

A number of subcategories greatly outperformed the total category. In fact, seven subcategories — refrigerated juice and drink smoothies, refrigerated blended fruit juice, refrigerated vegetable juice/cocktail, refrigerated apple juice, refrigerated cranberry cocktail/drink, refrigerated cranberry juice/cranberry juice blend, and refrigerated grapefruit cocktail/drink — posted double-digit (or greater) dollar and unit sales growth.

Bad news for canned

Like it did last year, the shelf-stable canned juices category posted dollar and unit sales declines. Dollar sales fell 2.5% to $1,311.9 million, while unit sales plunged 11.1% to 654.6 million.

One subcategory — shelf-stable canned fruit juice — did see a dollar sales gain of 12.4%. However, its unit sales tumbled 1.2%.