Home » Keywords: » juice sales

Items Tagged with 'juice sales'

ARTICLES

A turnaround for aseptic juices at retail

The ready-to-drink juice category greatly outperformed its sister categories.

June 2, 2022

Jolly times for refrigerated juices

The category posted strong dollar and unit sales gains at retail.

May 20, 2021

2020 State of the Industry: Nondairy beverages put on a happy face

On-trend product development is helping key segments avoid a sad-clown frown.

November 2, 2020

Retail sales of refrigerated juices rebound

But shelf-stable juice categories continue to struggle.

May 27, 2020

Refrigerated juice sales squeezed

The juice sector experienced overall losses; however, several subsets had positive growth

June 4, 2019

Orange juice sales continue to tumble

But sales of fruit drinks and health-boosting juices are on the rise.

June 4, 2018

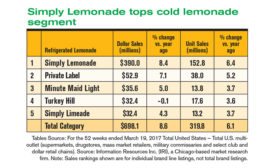

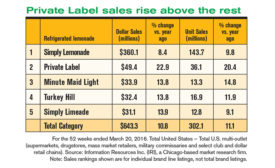

Sales are sweet for refrigerated lemonade, fruit drinks

While some refrigerated juice and drink sales are struggling, sales are up for fruit drinks, lemonade and veggie juice blends.

June 6, 2017

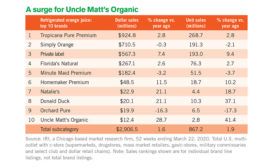

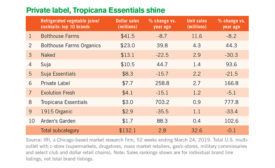

Functional, clean label trends drive growth of vegetable juices, juice smoothies

Consumers are looking for beverages with no added sugar, and functional and clean ingredients. This has presented challenges for some juice manufacturers.

May 11, 2017

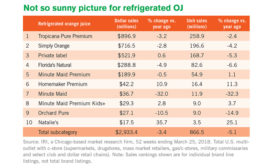

Sales of veggie juices, lemonade sales are all juiced up

Sales are promising for vegetable juices, juice drinks, smoothies and lemonade. Orange juice sales struggle.

June 8, 2016

Get our new eMagazine delivered to your inbox every month.

Stay in the know on the latest dairy industry trends.

SUBSCRIBE TODAYCopyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing