Natural cheese continues to dominate the cheese aisle as the popularity of healthier products remains high with consumers. Meanwhile, most processed cheese products continue to miss the mark as sales drop.

In the 52 weeks ended Jan. 27, 2013, the natural cheese category saw a 3.3% increase in dollar sales to $11.4 billion and units were up 2.7% to 3.4 billion, according to data from SymphonyIRI Group, Chicago. On the flip side, the processed cheese category continued to struggle with dollar sales down 2.6% to $3.1 billion and units dropped 3.6% to 937.8 million in the same time period.

In the natural cheese category, these four were among those with significant increases:

• Natural shredded cheese ($4.1 billion sales, units up 2.5%)

• Natural string/stick cheese ($1 billion sales, units up 3.2%)

• Natural crumbled ($341.6 million sales, units up 3.7%)

• Refrigerated grated cheese ($153.3 million sales, units up 17.6%)

By comparison, most segments in the processed cheese category struggled, but two stood out with promising unit sales numbers:

• Processed/Imitation cheese — slices ($1.9 billion sales, units down 4.3%)

• Cheese Spreads/Balls ($494.6 million sales, units down 1.3%)

• Processed/Imitation cheese — all other ($108.6 million sales, units up 18.8%)

• Processed/Imitation cheese — shredded ($48.3 million sales, units up 2.7%)

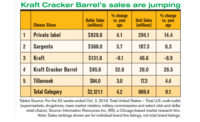

Seeing the most success in the natural cheese category was the refrigerated grated cheese segment. Dollar sales were up 15.9% and units rose 17.6% to 46 million. Though private label led the segment with $87.1 million in overall sales (units were up 3.5%), Kraft Foodswasn’t far behind with $33.3 million sales. Kraft’s dollar sales were up 148.8% and units rose 283.6%, the best among the top five. (See table.)

Private label also dominated the natural shredded segment with $2.4 billion sales, up 2.8%. The units were also up slightly, 1.5%. But seeing the most success in this segment was Crystal Farms; dollar sales were up 7.2% to $135.7 million and units rose 7.7%.

In keeping with the portion-control trend, the natural string/stick cheese segment showed promising numbers. The dollar sales rose 5.1% to $1 billion and units were up 3.2%. Among the top five, Sargento Food Co.had the most success with dollar sales up 11.2% and units up 12.4%. Kraft wasn’t far behind with dollar sales up 11.9% and units up 9.8%.

Another segment showing promise for the natural category was natural crumbled. The dollar sales rose 5.6% and units were up 3.7% to 95.6 million. Kraft led this segment in overall sales as well with $110.3 million, up 6.9%, and units rose 7.5%. But private label saw the biggest increases with dollar sales up 17.4%, the units rose 13.6%.

Though most segments struggled in the processed cheese category, one gave the natural category a run for its money. The processed/imitation cheese-all other segment saw dollar sales up by 39.8% and units rose 18.8% to 26.8 million. Leading the way among the top five was Schreiber Foods Inc., its dollar sales skyrocketed 2,060.2% and units jumped 1,104.1%. (See table.) Perhaps other processed cheese companies should pay attention to what Schreiber Foods is doing in this segment.