In our November 2020 State of the Industry report, we shared the incredible growth story of cheese at retail. Natural cheese saw a 15.8% jump in dollar sales (to $15,291.0 million) and a 9.0% increase in unit sales (to 4,356.4 million) during the 52 weeks ending Sept. 6, 2020, according to data from Chicago-based market research firm IRI. Processed cheese realized a 13.5% gain in retail dollar sales (to $3,175.1 million) and a 6.8% increase in unit sales (to 776.4 million).

That upswing in sales, tied directly to the COVID-19 pandemic, is a thing of the past. In fact, IRI data show that dollar sales for natural cheese at retail declined 2.7% (to $15,960.8 million) during the 52 weeks ending Jan. 23, 2022, while unit sales fell 4.0% (to 4,398.2 million). Processed cheese realized 4.5% and 6.4% dollar and unit sales declines, respectively (to $3,184.4 million and 748.2 million). The final totals, however, are still higher than those recorded for our November 2020 State of the Industry report, reflecting gains in between the two reporting periods.

Natural cheese: not as bad as it seems

The dollar and unit sales declines for the natural cheese category can be attributed to just a few underperforming subcategories — two of which are the largest.

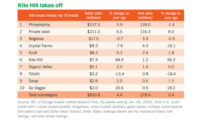

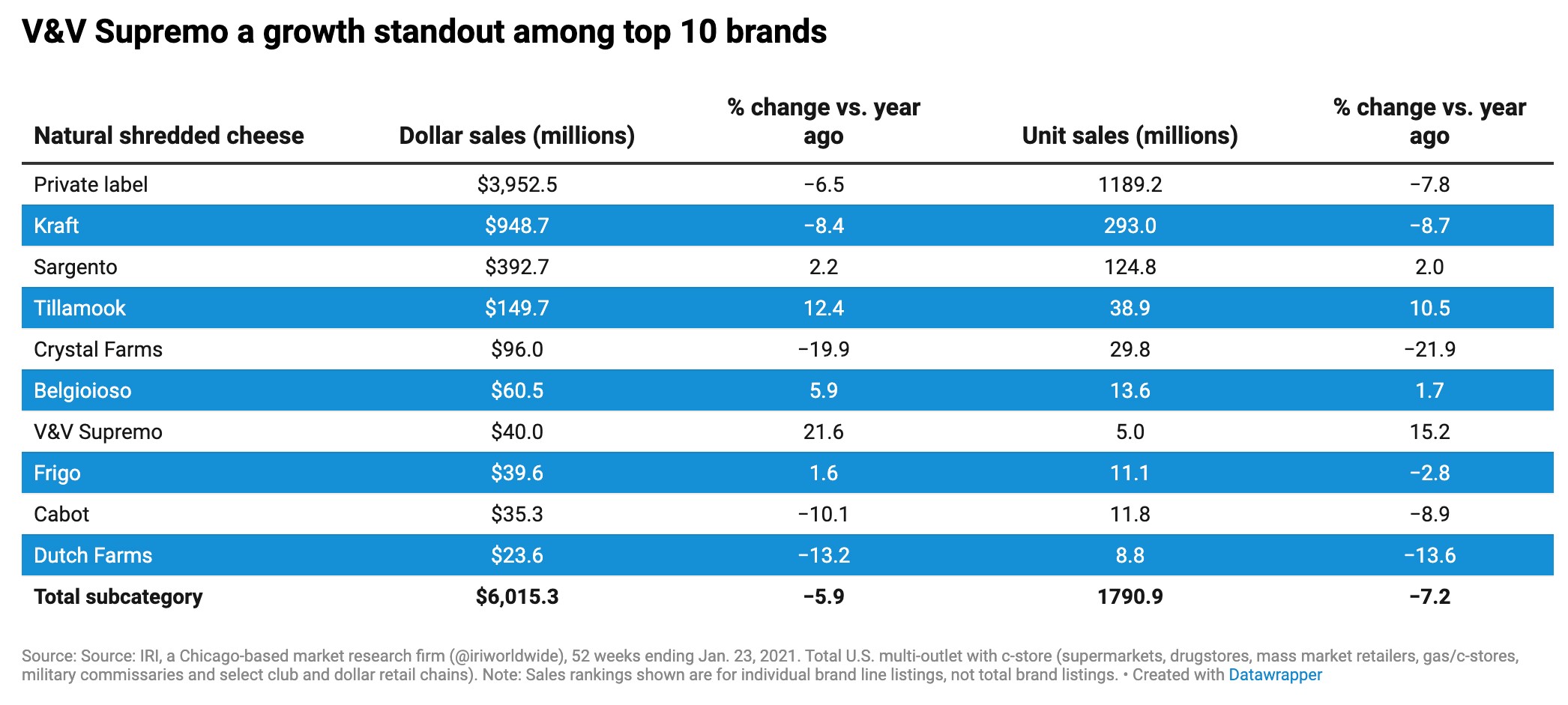

Dollar sales within the natural shredded cheese subcategory fell 5.9% to $6,015.3 million, while unit sales tumbled 7.2% to 1,790.9 million. Natural cheese chunks, meanwhile, posted a 4.4% dollar sales decline (to $4,113.1 million) and a 5.7% unit sales decrease (to 969.6 million). And dollar sales within the ricotta cheese subcategory plummeted 8.4% to $256.0 million, while unit sales plunged 9.4% to 71.8 million.

It was all good news in the rest of the category, though, with natural cheese cubes leading in terms of growth. The subcategory saw dollar sales take off 11.6% to reach $178.7 million. Its unit sales grew 15.7% to 53.7 million.

The refrigerated grated cheese subcategory also performed very well. Dollar sales climbed 8.3% to $138.6 million. Unit sales rose 6.0% to 35.1 million.

And the subcategory IRI refers to as “all other forms” of natural cheese significantly outperformed the total category, too. Its dollar sales increased 5.8% to $390.6 million, and its unit sales rose 5.7% to 93.3 million.

The rest of the subcategories posted more modest growth. The crumbled natural cheese subcategory recorded a 5.5% jump in dollar sales (to $504.2 million), but only a 1.9% increase in unit sales (to 117.3 million). The natural string/stick cheese subcategory posted a 2.8% gain in dollar sales (to $1,478.3 million) and a 0.6% increase in unit sales (to 396.2 million). And natural cheese slices saw a 1.2% rise in dollar sales (to $2,885.9 million) and a 0.3% improvement in unit sales (to 870.4 million).

Mixed results for processed cheese

Like its natural cheese category cousin, the processed cheese category had some good news and bad news.

The largest subcategory —processed/imitation cheese slices — lost the most ground. Dollar sales fell 7.8% to $1,739.7 million, while unit sales tumbled 9.7% to 453.6 million.

The processed/imitation cheese loaf and “all other” processed/imitation cheese subcategories also suffered. The former subcategory realized a 3.7% falloff in dollar sales (to $513.3 million) and a 3.9% drop in unit sales (to 74.2 million). The latter subcategory, meanwhile, saw a 4.1% decline in dollar sales (to $135.6 million) and a 6.5% decrease in unit sales (to 27.3 million).

Three subcategories fared much better, however. The aerosol/squeezable cheese spread subcategory saw dollar and unit sales gains of 9.1% and 7.6%, respectively (to $103.8 million and 29.1 million). Dollar sales within the processed/imitation shredded cheese subcategory, meanwhile, grew 2.9% to $123.9 million, but unit sales fell 1.8% to 34.7 million. And the cheese balls/spreads subcategory posted a 1.7% improvement in dollar sales (to $568.1 million) and a 0.4% increase in unit sales (to 129.3 million).