In 2020, when many adults were working — and many children were learning — from home, sales of frozen dairy treats really took off at retail. Data from Chicago-based market research firm IRI for the retail ice cream/sherbet category showed a 15.5% jump in dollar sales (to $7,789.2 million) and a 10.3% leap in unit sales (to 1,943.9 million) for the 52 weeks ending Nov. 1, 2020.

The party appears to be over, however. IRI data for the 52 weeks ending Oct. 31, 2021, show dollar sales within the total category falling 4.2% to $7,548.9 million. Unit sales declined 3.4% to 1,908.5 million.

Significant cool-off for ice cream segment

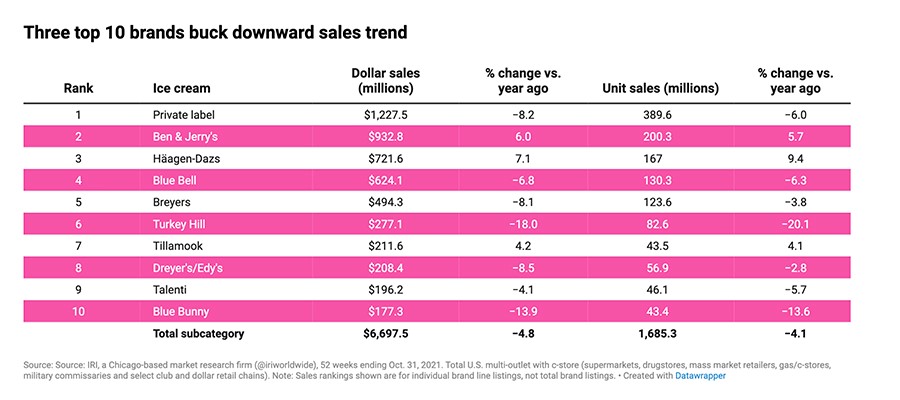

The biggest loser within the total category was the largest subcategory: ice cream. Its dollar sales fell 4.8% to $6,697.5 million, and its unit sales tumbled 4.1% to 1,685.3 million.

Three top 10 brands bucked the downward trend, however. Häagen-Dazs realized a 7.1% upsurge in dollar sales and a 9.4% rise in unit sales. Ben & Jerry’s, meanwhile, saw dollar and unit sales gains of 6.0% and 5.7%, respectively. And Tillamook posted a 4.2% increase in dollar sales and a 4.1% improvement in unit sales.

Faring the worst among the top 10 brands was Turkey Hill. The brand’s dollar sales dropped 18.0%, while its unit sales toppled 20.1%.

Blue Bunny also struggled. The brand posted 13.9% and 13.6% dollar and unit sales declines, respectively.

Slight downturn for frozen yogurt/tofu

Also realizing a sales decline — although less steep — was the frozen yogurt/tofu subcategory. Dollar sales fell 0.7% to $349.3 million. Unit sales dwindled 1.1% to 78.7 million.

Three top 10 brands, however, realized very impressive growth. Plant Oat’s dollar and unit sales took off 121.6% and 112.8%, respectively. Oatly, meanwhile, saw a 98.8% jump in dollar sales a 109.9% gain in unit sales. And Talenti’s dollar sales rose 63.8%, while its unit sales shot up 60.8%.

Posting the most significant declines among the top 10 brands was Halo Top. The brand’s dollar sales tumbled 42.4%, and its unit sales shrunk 43.2%.

Better news for two subcategories

The two remaining subcategories had better news to report. The ice milk/frozen dairy dessert subcategory saw dollar sales increase 3.9% and unit sales rise 5.8%. And the sherbet/sorbet/ices subcategory realized a 1.5% jump in dollar sales and a 1.2% gain in unit sales.

Among the top 10 brands, Blue Bunny was the standout in the ice milk/frozen dairy dessert subcategory. The brand’s dollar sales shot up 114.9%, while its unit sales skyrocketed 133.9%.

Halo Top also impressed. The brand realized 43.7% and 45.4% dollar and unit sales gains, respectively.

The combined Dreyer’s/Edy’s brands turned in the worst performance. Dollar sales fell 43.8%, and unit sales declined 44.9%.

Within the sherbet/sorbet/ices subcategory, The Frozen Farmer brand (which made its debut on “Shark Tank” in 2020) saw the most impressive growth among the top 10 brands. Dollar sales soared 5,594.4%, while unit sales escalated 5,786.4%.

Dean Foods, meanwhile, lost the most ground among the top 10. Dollar sales dropped 9.3%, while unit sales diminished 11.0%.