In last May’s Market Trends report, we shared a strong growth story for most cultured dairy categories at retail. In fact, we reported double-digit dollar and unit sales growth for both the cream cheese/cream cheese spreads and sour cream categories — and strong dollar and unit sales performance for kefir and cottage cheese (for the 52 weeks ending Feb. 21, 2021, according to data from Chicago-based market research firm IRI). Yogurt was up in dollar sales, but down in unit sales, likely reflecting a move to larger multi-serve tubs on the part of many consumers.

The data, of course, reflected a timespan in which consumers were eating and preparing more meals at home, thanks to the COVID-19 pandemic. A year later, the numbers suggest a return, at least in part, to more food service occasions.

Declines for three major categories

The cream cheese/cream cheese spread, cottage cheese, and sour cream categories all posted dollar and unit sales declines for the 52 weeks ending Feb. 20, 2022, according to IRI data.

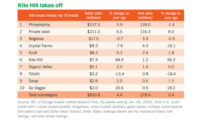

The largest of those categories, cream cheese/cream cheese spreads, saw dollar sales fall 3.2% to $2,136.5 million and unit sales tumble 5.5% to 750.1 million. Faring the worst in that category was the whipped cream cheese subcategory. Dollar sales fell 7.1% to $229.4 million; unit sales declined 5.4% to 72.4 million. The top-performing subcategory, meanwhile, was “cream cheese, all other forms,” which posted dollar and unit sales gains of 9.6% (to $2.8 million) and 8.5% (to 0.7 million), respectively.

Cottage cheese also struggled. The category posted a 5.4% downturn in dollar sales (to $1,054.3 million) and a 4.0% weakening in unit sales (to 422.5 million).

As for sour cream, it lost the most ground among the three categories. Dollar sales fell 5.7% to $1,362.6 million, and unit sales plunged 7.2% to 655.2 million.

Better news for kefir and yogurt

Two other dairy categories showed more positive results. Dollar sales within the refrigerated kefir category jumped 2.1% to $103.1 million. Unit sales rose 0.7% to 30.0 million.

Meanwhile, yogurt — the largest cultured dairy category by far — posted mixed results. Dollar sales were up 4.3% to $7,975.2 million. But unit sales declined 1.3% to 3,974.6 million — perhaps reflecting a continuation of the popularity of multi-serve tubs.