Today’s ice cream eaters want it all. In a crowded and competitive freezer aisle, some consumers look for brands that distinguish themselves with innovative new flavors. Some want fewer calories and cleaner labels. Others are just looking for an occasion to indulge with over-the-top premium inclusions.

According to Mark Meyer, senior vice president, demand at Wells Enterprises, Le Mars, Iowa, one of the biggest challenges facing today’s ice cream industry is meeting these numerous, often conflicting consumer demands.

“As consumer preferences continue to evolve, there isn’t a single solution that will meet all of the needs,” Meyer said. “The category needs to attract new consumers by addressing a variety of options for each consumer segment and occasion — be it indulgent, a full dessert, a snacking occasion, low-calorie, high-protein, low-sugar, or nondairy.”

When consumers search the freezer aisle for the ice cream option that best matches their desires, they are likely doing so less frequently than in years past. According to “Ice Cream and Frozen Novelties US,” an April 2018 report from global market research firm Mintel, while overall sales in the ice cream and sherbet category have been stagnant, most households do still purchase ice cream. However, they have established habits in terms of frequency of purchase, and less than a third are heavy users who eat frozen treats weekly.

“Consumers may need an extra nudge to increase frequency,” Mintel said. “Frozen treats with hints of wholesome ingredients and healthy notes conveyed through product claims and real ingredients may allow consumers to more frequently consume them with less guilt.”

Guilt-free indulgence

The trend toward wellness and healthy eating continues to affect the ice cream industry, with better-for-you brands outperforming the rest of the sector, according to Mintel’s report.

As only one in 10 consumers thinks frozen desserts can never be healthful, ice cream brands still have an opportunity to connect with healthy eaters. In fact, many of the companies with which Dairy Foods spoke are increasing their focus on creating better-for-you offerings that tempt even the most health-conscious consumers.

One of the best-known better-for-you brands is Halo Top from Los Angeles-based Halo Top Creamery. Its signature pints offer fewer calories and higher protein without skimping on flavor. According to Doug Bouton, president and chief operating officer at Halo Top, the company plans to expand its presence in the ice cream category. As part of that expansion, the brand recently released Halo Top Pops — mini ice cream pops designed for portion control.

“We have our flagship better-for-you pints that essentially have created a new subset of the ice cream category, but we think some of the more traditional subsets of [ice cream] are fairly stagnant and ready for innovation,” Bouton said.

Halo Top Pops contain only 50 to 60 calories each and are also low in sugar and high in protein. They come in Strawberry Cheesecake, Mint Chip, Peanut Butter Swirl and Chocolate Chip Cookie Dough flavors.

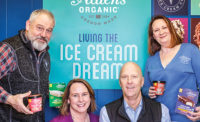

Michelle Hunt, vice president of marketing and innovation at Eugene, Ore.-based Alden’s Organic Ice Cream, said she has also seen increased demand for portion-controlled offerings. Consumers are gravitating toward single-serve products such as ice cream sandwiches and ice cream bars.

“What this tells us is that consumers love to indulge, but they want to put some boundaries on it,” she said.

According to Perry’s Ice Cream, Akron, N.Y, one major trend in healthy eating is probiotics. To meet this consumer demand, it reimagined its frozen yogurt line to include live and active cultures. The new offerings include Fruit Vegetable Swirl, a line of family-sized fruit and vegetable sorbets swirled with frozen yogurt, and Yo Buddie Bars, which are single-serve novelties that come in six-packs. Both products are made with real fruit and vegetable juices and clean ingredients. The Fruit Vegetable Swirl frozen yogurts come in Berry Grape Twist and Strawberry Tang Twist. Yo Buddie Bars’ flavors include Berry Grape and Raspberry Watermelon.

“These products offer our consumers flexibility with the choice of Yo Buddie single-serve or family-size [sorbets], which also makes for an easy and delicious base for on-the-go recipes such as smoothies,” said Gayle Perry Denning, vice president of strategic branding at Perry’s Ice Cream.

Pierre’s Ice Cream Co., Cleveland, is also capitalizing on the probiotics trend. According to Laura Hindulak, vice president of marketing, the company will be releasing probiotic frozen yogurt pints this spring.

“The benefits of probiotics are recognized and offer an area of growth within the industry,” Hindulak said.

Flavor forward

While many consumers gravitate toward better-for-you options, they aren’t willing to sacrifice flavor. Instead, they look for ice cream that is both great-tasting and healthy.

Rich Draper, co-founder and CEO of The Ice Cream Club, Boyton Beach, Fla., said he’s seeing the success of artisanal brands that experiment with new flavors. And despite healthy eating trends, “indulgence and taste still rule.”

According to Mintel, consumers likely have established ice cream favorites. Over half of its survey participants said they often buy the same brands of ice cream, while 47% said they often buy the same flavors. One way for companies to inspire consumers to break out of their habits is to release new innovative flavors to compete with the tried-and-true.

Blue Bell Creameries — based in Brenham, Texas — is one company creating innovative, indulgent flavors to attract new consumers and keep existing ones. Recent flavor introductions include Mardi Gras King Cake, Bride’s Cake and Chocolate Peanut Butter Cookie Dough.

“Each year, we continue to develop new and exciting ice cream flavors which help drive our sales and keep consumers coming back to the freezer in search of something new,” said Sara Schramm, marketing brand manager at Blue Bell Creameries.

It’s not just about new flavors: Many ice cream eaters are looking for premium offerings. Meyer said Wells Enterprises is noticing increased demand for higher-quality and artisan ingredients. He added that Wells Enterprises launched Blue Bunny Load’d Sundaes to meet this demand. The sundaes are so popular that the company is adding eight new flavors to the line this year.

Alden’s Organic focuses on fun inclusions to appeal to consumers who want a premium experience. According to Hunt, one of the company’s most popular products right now is Sasquatch Tracks, which combines vanilla ice cream with fudge ribbons and peanut butter cups.

However, for many consumers, there’s such a thing as too much of a good thing. According to Mintel’s data, just over a quarter of consumers said they want to see more indulgent options, “suggesting that offerings in this category for the most part are delivering on consumer expectations of decadence.”

Another way ice cream companies appeal to consumers’ taste buds is by offering timely seasonal flavors.

To celebrate Valentine’s Day this year, Perry’s Ice Cream released two limited-edition flavors: Berry Into You and Bad Breakup. Berry Into You, a new release for 2019, is strawberry ice cream with strawberries, shortcake pieces and vanilla cream swirls. Bad Breakup is sea salt caramel chocolate ice cream with fudge milk swirls and fudge-filled hearts.

Pierre’s also jumped on the seasonal trend. It launched limited-edition Peppermint ice cream sandwiches over the winter holidays. Hindulak said the company plans to release more limited-edition flavors in spring 2019.

Despite consumer’s interest in new flavors, the classics still matter. According to the International Dairy Foods Association, Washington, D.C., the top two ice cream flavors in the United States are vanilla and chocolate. In fact, in its 2017 “International Dairy Foods Association Ice Cream Survey,” the association found that “nostalgic and comforting” is one of the top trends in ice cream product development.

Schramm said Blue Bell still focuses on the tried-and-true. It regularly brings back older flavors based on consumer demand, including Ice Cream Cone, Strawberry Cheesecake, Peaches & Homemade Vanilla and Happy Tracks.

Investing in nondairy

As it is in other parts of the dairy industry, the popularity of vegan diets and nondairy offerings is disrupting the ice cream category. However, many brands see this as an opportunity instead of a challenge: They are releasing nondairy products of their own.

“I think there remains enormous opportunity within the rapidly growing dairy-free and vegan segment,” Bouton said. “When we first broke into the scene, our fans began continuously requesting nondairy options, so [Halo Top] launched our nondairy and vegan pints as our first product extension in fall 2017.”

Halo Top recently expanded its vegan line with three new flavors made with coconut milk: Mint Fudge Cookie, Chocolate Hazelnut and Peanut Butter & Jelly.

The Ice Cream Club also released a nondairy line, based on input from its customers. The coconut-based frozen dessert is available in Chocolate, Chocolate Peanut Butter, Coconut Almond Fudge, Coffee Almond Fudge, Cookies n’ Crumbles, Peanut Butter Fudge Supreme, Rum Raisin, Strawberry, To Die For, Toasted Coconut and Vanilla Bean flavors.

“Dairy still far outpaces the nondairy,” Draper said.

He added that creating a nondairy line was an effort to provide a full slate of product offerings to The Ice Cream Club’s consumers.

Perry’s Ice Cream is also expanding to nondairy products. It released an oat-based pint line in March 2019. The Oats Cream lineup is available in seven flavors: Apple Strudel, Blueberry Pancake, Coconut Caramel, Oat Latte, Peanut Butter Coffee Cake, Peanut Butter & Cookies and Snickerdoodle. The pint’s packaging is inscribed with a brand message stating, “Ice cream hasn’t been for everyone…until now. Meet Perry’s Oats Cream.”

“We recognized a growing need to bring to market a great-tasting plant-based frozen dessert,” said Robert Denning, president and CEO of Perry’s Ice Cream. “Perry’s Oats Cream is truly on-trend for today’s changing consumer preferences.”