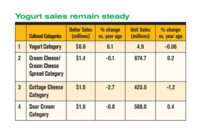

The cultured dairy segment is seeing its ups and downs. Yogurt, once the driving force, has seen sales struggle of late. Concurrently, other cultured categories such as cream cheese and sour cream are holding their ground or trying to push ahead.

The refrigerated yogurt category, the segment leader, saw dollar sales drop 1.5% to $7.4 billion, and unit sales plummet 8% to 4.5 billion in the 52 weeks ending Jan. 28, 2018, according to data from Chicago-based market research firm IRI.

Much smaller in comparison, with $28.3 million in sales, the shelf-stable yogurt/yogurt drink subcategory showed promise — dollar sales jumped 43.5% and unit sales increased 20.1%. Materne North America led the subcategory with $14.2 million. Dollar and unit sales skyrocketed 172.6% and 157.8%, respectively. Private label struggled, however; dollar sales decreased 20.5% and unit sales dropped 20.7%.

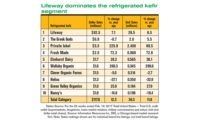

Yogurt’s kefir cousin also took a hit this year — subcategory dollar sales dropped 6.2% to $110.6 million, and unit sales declined 3.9% to 37.1 million.

Cream cheese sales are split

The cream cheese category’s dollar sales improved 2% to $1.7 billion, but unit sales dropped 0.4% to 660.9 million. The category consists of five subcategories, which are split with sales up and down.

The soft cream cheese subcategory leads with $764.8 million. Dollar sales rose 4.3%, and unit sales were up 1.8% to 275 million. Coming in second, the brick cream cheese subcategory saw dollar sales decline 1.4% to $739.9 million, and unit sales dip 2.8% to 325 million.

Sales in the whipped cream cheese subcategory saw an upturn; dollar sales improved 7.4% to $176.4 million, and unit sales increased 2.6% to 60.5 million. The “all other forms of cream cheese” subcategory saw the most impressive sales improvements — dollar sales jumped 210.1% to $1.2 million, and unit sales saw a 279.4% boost to 0.3 million. The smaller cream cheese balls subcategory took the biggest hit — dollar sales dropped 28.7% to $0.5 million, and unit sales fell 24.1% to 0.1 million.

Sour cream sales not all sour

The sour cream category saw dollar sales improve 1.3% to $1.2 million, and unit sales were up 0.3% to 624.7 million. Daisy Brand led the category with $645.4 million; dollar sales were up 5.2%, and unit sales advanced 4.3% to 292.6 million. But Dean’s was the winner in the category; dollar sales saw an impressive 153.4% increase, and unit sales jumped 135.4%. Cacique also saw an upsurge — dollar sales increased 28.2%, and unit sales improved 21.9%.

Tillamook took the biggest hit, with dollar sales down 16.1%, and unit sales down 18%.

Cottage cheese sales curdle

The cottage cheese category didn’t fare as well. Dollar sales dropped 2.5% to $1.1 billion, and unit sales dipped 1.1% to 429.8 million. Private label was the category leader with $392.6 million. But dollar sales dropped 2%, though unit sales increased 0.8%.

Dean’s Country Fresh was the big winner — dollar sales saw an impressive 92.5% upturn, and unit sales jumped 98.2%. On the flipside, regular Dean’s cottage cheese saw dollar sales drop 37.4% and unit sales decrease 40.8%.