As we move further from the COVID-19 pandemic, it would be fair to expect a decline in private-label sales.

Not so fast. Private label and co-packing continues to remain strong and probably will not slow down any time soon. The overall U.S. private-label market grew nearly 5% (or $10 billion) to $236.3 billion in 2023 compared to the prior year, according to the Private Label Manufacturers Association (PLMA).

“Among the 10 food and nonfood departments that Circana tracks for PLMA, all but tobacco (off 16%) experienced store brand dollar sales growth during 2023. Leading the sectors in terms of sales expansion were beauty (plus 10.5%), general food (up 10%), beverages (up 8.9%) and home care (up 8.7%). Next in line were frozen (plus 4.4%), general merchandise (up 4%), health (up 2.4%), refrigerated (up 1.8%) and liquor (plus 1%),” PLMA reveals in its “2024 Private Label Report.”

Private-label dairy dollar sales reached $33.7 billion for the 52-week period ending Jan. 28, a small decline of 1% year over year (YoY), while unit sales increased 2% to 10.6 million, according to Chicago-based market research firm Circana. Natural cheese (private-label dollar sales up 4% YoY), yogurt (private-label dollar sales up an impressive 20% YoY) creams/creamers (private-label dollar sales up 8% YoY) processed cheese (private-label dollar sales up 5% YoY), cream cheese/cream cheese spreads (private-label up 11% YoY), whipped toppings (private-label dollar sales up a robust 20% YoY), margarine/spreads (private-label dollar sales up 15% YoY) sour cream (private-label sales up 4% YoY), and cottage cheese (private-label dollar sales up 14% YoY) all had excellent years. The only sticking points were dairy milk (private-label dollar sales down 6% YoY) and fresh eggs (private-label sales down 15% YoY).

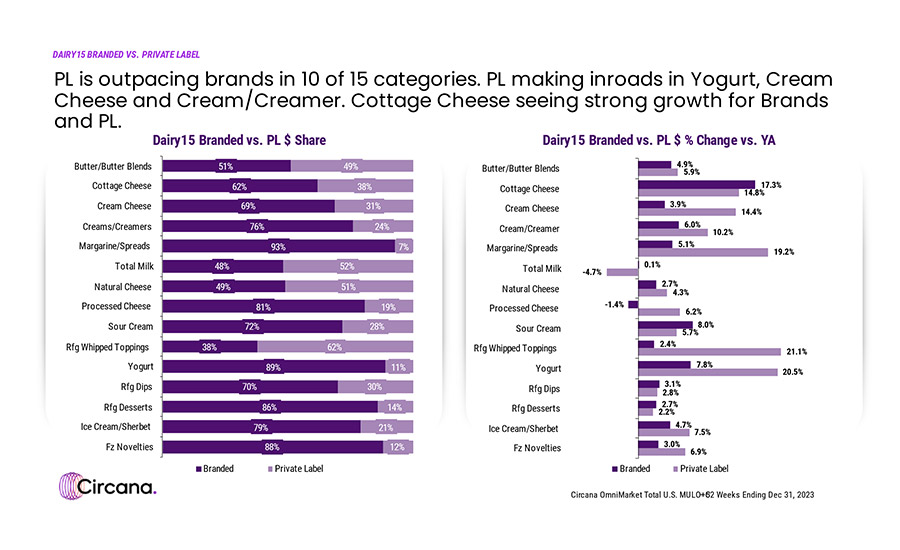

“Private label is outpacing brands in 10 of 15 dairy categories. Private label is making strong inroads in yogurt, cream cheese, cream/creamers and margarine/spreads, and continues to be a strong player in refrigerated whipped toppings,” John Crawford, vice president, Client Insights-Dairy, for Circana, tells Dairy Foods. “Cottage cheese is seeing strong growth for both brands and private label as TikTok lifted the entire category.”

Natural cheese recently surpassed milk as No. 1 among dairy categories in terms of private-label dollar sales, reaching $9.5 billion for the year ending Jan. 28, according to Circana data. However, although dairy milk private-label sales were down YoY, it is important to note it still holds the No. 2 spot, accounting for $9 billion in private-label sales for the same timeframe.

In fact, natural cheese and milk far outpace any other dairy category. Following fresh eggs (accounting for $5.8 billion in dollar sales for the year ending Jan. 28), butter blends place next at $2.3 billion, followed by creams/creamers ($1.5 billion), whipped toppings ($1.3 billion) and yogurt ($1.05 billion) in the billion-dollar dairy private club. All other dairy categories dip below the $1 billion dollar sales line, Circana reveals.

Commenting about butter specifically, Venae Watts, chief operating officer at Minerva, Ohio-based Minerva Dairy, cites the strength of private-label brands. A year ago, Minerva Dairy announced expanded capacity to produce organic, oil-infused spreadable butter for co-packing and private-label, as well as its own brand.

“Different flavors and salts are buzzing as great opportunities to raise awareness to consumers about butter. As supplies are getting tighter, commodity butter price points are getting closer to artisan butter price points, so why not enjoy higher quality for a small price increase?” she asks. “Foodservice is starting to get into the appreciation for artisanal butter.”

Overall strength

On an overall basis, individual companies are not slowing down their private-label efforts. Take Target Corp. for example. On Feb. 15, the retail giant introduced its new low-price owned brand, dealworthy, designed to give consumers incredible value on nearly 400 everyday basics. With dealworthy, Target is offering more options at lower prices, starting at less than $1, featuring apparel and accessories, essentials and beauty, electronics and home items.

Target is not alone. Macy’s recently launched State of Day, a new restwear, sleepwear and innerwear brand, an “exciting addition to the company's ongoing reimagined private brands portfolio.”

Regarding private-label food, convenience store retailer 7-Eleven this year expanded its offerings, including Seven Select Peach Heart Gummis, Seven Select Chocolate Flavored Heart Pretzels, Seven Select Dessert Sliced Cakes and its Oatmeal Chocolate Chunk BIG Cookie.

Drugstore retailer Walgreens Boots Alliance’s already established Nice! Gummy Mango peelable candy has taken off thanks in part to a package refresh and a TikTok campaign. “Walgreens sold seven times more Gummy Mango candy than average last week because of the TikTok spike,” Ellen Idler, Walgreens associate category manager for everyday candy, noted in February.

Grocery retailer Sprouts Farmers Market is yet another company placing a big bet on private label, reporting on its Feb. 22 earnings conference call that its private-label dollar sales improved by 13% YoY during its 2023 fourth quarter, compared to the same period in 2022. The Phoenix-based company added 400 new private-label products to its portfolio.

The same desire for private-label products can be found at food solutions company SpartanNash, which in February launched a new private label brand, Finest Reserve by Our Family. The collection is currently a curated offering of artisan-crafted frozen pizzas, upscale pastas, sauces, dressings and marinades, premium spices, salts and seasoning blends, chocolate and wine, with more products to come.

“Research tells us that nearly half of today’s shoppers view value and affordability as the most important factors when deciding what groceries to purchase,” SpartanNash vice president, OwnBrands, Jason Cunningham, states in a news release. “We’re doubling down on our investment in our popular OwnBrands offerings to help shoppers maximize their budgets while still enjoying their favorite indulgences.”

PLMA President Peggy Davies explained some reasons for today’s explosion for private-label products and growth in a statement to Dairy Foods. “Over time, we’ve seen with each change in the economy, including the pandemic, retailer brands gain more acceptance and become the brand of choice with consumers. The recent economy, and the uncertainty near-term, has certainly had impact at the checkout. However, it’s the consistent quality, innovation in product and packaging and product assortment available that has shoppers buying a retailers’ own brand,” she said.

“Regarding today’s store brand shopper, we’re seeing a consumer who’s fully adopted the work-from-home lifestyle that focuses on convenience and products that meet those needs,” Davies adds. “In addition, over the last few years, consumers have shifted their attention to health and wellness not only for themselves in the types of products they consume but also for the environment in terms of sustainability.”

Opportunity knocks?

Private label is most certainly an opportunity for dairy processors.

“Private label is emerging as a winning solution, often at the expense of established brands, and over $1 billion worth of unit share has moved to brands such as Great Value, Aldi and Kirkland Signature. Brands must strengthen price pack architectures and refine value propositions to stay competitive,” according to Numerator’s “Four Transformative Visions for 2024” report.

Building an industry-leading private-label program can have a positive impact for a company in many ways, according to McKinsey & Co. It cites these three benefits:

- “Expanding profit margins. In addition to higher margins for ‘like-item SKUs,’ leaders in private-label products are now creating and offering premium products and services that elevate the category and enjoy premium margins.

- Increasing growth (volume and sales). Beyond offering customers savings (for example, “switch and save”), distributors can use their direct customer insights and data to create innovative products and services. These products can attract new customers and increase loyalty and purchase volumes (for instance, labor-saving products that create an increased value proposition for the customer).

- Enabling greater supply chain control. Distributors that control their supply chain can make optimized decisions for their businesses, including fill rates, changes in shipping modes, prioritization of orders, and inventory and cost trade-offs.”

“Fortunately, a robust private-label offering can be used as a powerful tool to address margin and volume challenges. In many industries, private-label products can carry about two times the gross margin that national brands can,” the McKinsey report, released in January, reveals. “Moreover, according to a recent McKinsey survey of B2B procurement leaders, about 92% of buyers say they plan to purchase private-label or distributor-branded products in the coming year and expect to increase their private-label purchase volume by approximately 21% over the next one to three years.

“Winning in private labels can be a critical factor in remaining competitive in an ever-shifting industry and is strongly correlated with improvements in gross margins,” the report asserts.

Strong future

According to the Food Industry Association, known as FMI, about 60% of shoppers say they have been buying private brands much more or somewhat more during the past 12 months.

“Price and value are the key reasons shoppers are buying private brands, but two-thirds of shoppers mentioned at least one other driver, such as quality, taste and meeting meal solutions needs,” says Doug Baker, FMI’s vice president of industry relations. “Private brands have grown their impact as a driver of shoppers’ choice of store. Fifty-three percent of shoppers say these brands are very or extremely important in picking a store, up from 46% in 2019 and 35% in 2016.”

Fifty-four percent of shoppers surveyed said they expect to buy private brands somewhat or much more in the future, FMI adds. “That compares to only 26% saying the same for manufacturer brands. This revealing statement bodes very well for private brands,” Baker suggests. “…Ninety percent of shoppers said they are somewhat or very likely to continue purchasing private brands even if inflation or the price of groceries decreases. This is the biggest proof I’ve seen to date that private brands have reached a new plateau.”

If trade show attendance is an indication of strength, business activity has reached pre-pandemic levels. In November 2023, PLMA conducted its “most successful” U.S. private-label trade show ever, a sold-out event that attracted a record number of 1,685 exhibitors and more than 13,000 retailers, suppliers and other visitors to Chicago.

“Overall, the industry is healthier than ever,” assures Davies. “One of every five food or non-food grocery products sold across the U.S. carries the retailer’s name or own brand and was supplied by a store brand manufacturer.”

Store brands are omnipresent in U.S. grocery stores. During 2023, of the 179 food categories that Circana tracks, store brand sales were recorded in 175, or 98% of the categories; in the 138 non-food categories, store brand sales appeared in 132, or 96%.

The future looks bright for private label, with “American consumers’ continuing affinity for store brands as well, particularly among the youngest cohort,” PLMA maintains.

A 2024 PLMA survey reveals that more than half of the 907 Gen Z shoppers who participated said they “always/frequently” choose a place to shop due to its store brands; 67% are “extremely/very” aware of store brands; 64% “always/frequently” buy store brands; “56% are “extremely likely/likely” to experiment with store brands to find “best value,” and 38% said choosing a store brand makes them feel “very positive/positive” about themselves. A majority of the Gen Z respondents said that terms like “valuable, reliable, variety, trustworthy and quality” describe store brands “very much or precisely.”

“Most of all, the ‘Store Brands Phenomenon,’ as we like to call it, continues to be well positioned,” Davies concludes. “Retailers and consumer product companies must ensure their offerings are ‘value-right,’ providing strong perceived value for money and quality in categories where shoppers are targeting cutbacks, irrespective of their income levels, according to a leading industry trade magazine. That’s a challenge we believe is built for the inherent qualities of store brands.”