Whether it’s an electrolyte-packed sports drink or a dose of caffeine from an energy drink, consumers really like their energy-boosting beverages. Sales for both sports drinks and energy drinks are jumping.

Dollar sales for the energy drink category increased 4.5% to $12.1 billion, and unit sales were up 4.1% to 4.5 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Dec. 25, 2016. Likewise, the sports drinks category enjoyed similar success — dollar sales rose 5.4% to $6.6 billion, and unit sales increased 4% to 3.6 billion.

Non-aseptic energy drink sales all hopped up

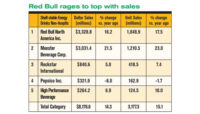

The shelf-stable non-aseptic energy drink segment showed dollar sales jumping 5.2% to $10.9 billion, with unit sales up 4.7% to 4.1 billion. Segment leader Red Bull struggled with sales — dollar sales dropped 0.7% and unit sales were down 1.7%. Among the top 10, Monster Energy’s dollar sales increased 4.9% and unit sales were up 1.4%. Dollar sales for Red Bull Sugar-Free improved 9.7% and unit sales jumped 10.3%. Monster Energy Zero Ultra’s dollar and unit sales increased 18.9% and 14.2%, respectively.

Java Monster (Monster Beverage Corp.) saw dollar sales climb 15.3% and unit sales rise 14.6%. Dollar and unit sales were down for Noss, 1.6% and 3%, respectively. Red Bull The Summer Edition saw dollar sales skyrocket 62.9% and unit sales jumped 68.3%. Meanwhile, Rockstar’s dollar sales dipped 1.5%, and unit sales also decreased 1.4%.

Energy shot sales lose energy

The energy shot segment struggled; dollar sales were down 2.1% to $1.1 billion and unit sales fell 2.8% to 337.4 million. Though 5 Hour Energy (Living Essentials) dominated the segment with $1 billion sales, sales dropped 1.7% and unit sales were down 2.4%. Among the rest of the top 10, Tweaker (Leo Scientific) saw dollar sales jump 25.2% and unit sales rise 24.6%. Dollar and unit sales dropped for Stacker 2 Xtra (NVE Pharmaceuticals), 10.2% and 11.9%, respectively. Sales of private label shots also struggled — dollar sales decreased 22.5% and unit sales dropped 13.5%. Stacker 2 Extreme saw impressive numbers: dollar sales were up 53.5% and unit sales jumped 45.1%.

Non-aseptic sports drink sales see surge

Dollar sales for the shelf-stable sports drinks non-aseptic segment rose 5.5% to $6.5 billion. Unit sales also increased 4.1% to 3.5 billion. Gatorade Perform (The Quaker Oats Co.) led the segment with $3.2 billion in sales (a decrease of 0.8%), although unit sales were down 2.9%. Among the others in the top 10, dollar sales for Powerade Ion4 (Coca Cola Co.) were also down 1.6% and unit sales fell 3.2%. Gatorade Frost saw impressive sales numbers — dollar sales jumped 71% and unit sales climbed 64.9%.

On the flipside, another Gatorade line saw dollar sales drop 15.1% and unit sales fell 22.9%. Dollar sales for Gatorade Fierce were up 5.3% and unit sales rose 6.7%. Gatorade G2 Perform’s dollar and unit sales decreased 2.8% and 5.9%, respectively. Dollar sales for Powerade Zero Ion4 improved 4.4% and unit sales were up 3.5%. Bodyarmor (Coca Cola Co.) saw a huge boost — dollar sales jumped 126.5% and unit sales increased 141.7%.