As we noted in our State of the Industry report last month, protein and convenience demands have shined a light on the cheese category, and product innovation is booming. The natural cheese category is doing well. Most of the category’s segments saw dollar and unit sales increase. Yet the processed cheese category continues to struggle. According to a survey from Chicago-based Mintel, one in six consumers who buy or eat cheese (17%) indicate they avoid processed cheese altogether.

The natural cheese category’s dollar sales increased 5% to $12.7 billion and unit sales were up 3% to 3.6 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Oct. 4, 2015. For the processed cheese category, dollar sales were down 1.3% to $3.1 billion, and units dropped 5.1% to 830.2 million.

The natural cheese category includes these segments:

- Shredded cheese ($4.7 billion, units up 1.5%)

- Chunks ($3.7 billion, units up 1.1%)

- Slices ($2.0 billion, units up 10.8%)

- String/Stick ($1.2 billion, units up 4.4%)

The processed cheese category includes these segments:

- Imitation cheese-slices ($1.9 billion, units down 6.8%)

- Cheese spreads/balls ($479.6 million, units up 4.3%)

- Imitation cheese-loaf ($427 million, units down 6.1%)

- Imitation cheese-shredded ($69.7 million, units down 13.7%)

Leading the natural category in overall sales with $4.7 billion, the shredded cheese segment saw dollar sales increase 4.1%, with units up 1.5% to 1.4 billion. Private label led the segment with $2.7 billion in sales. Dollar sales improved 4% and units were up 1.7%. Among the top 10, American Heritage (Schreiber Foods) saw dollar sales jump 100.7% and units skyrocket 129%. Tillamook’s dollar sales rose 18.8% and units rose 13.6%. Dutch Farms also saw dollar sales improve, up 15.2% and units up 13.5%. Struggling were Borden (Dairy Farmers of America) and Kraft Philadelphia (Kraft Heinz Co.), as both companies saw dollar sales drop — 6.4% and 12.5%, respectively. Unit sales for both were also down, 11.5% and 11.2%, respectively. Sargento’s dollar sales increased 1.2%, but units fell 0.9%.

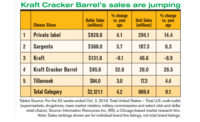

The cheese slices segment showed promising numbers (see related table). Dollar sales improved 11.4% to $2 billion and unit sales jumped 10.8% to 610.9 million. Kraft Cracker Barrel’s sales increased the most among the top 10, with dollar sales rising 55.1% and units jumping 68%. Sargento’s dollar sales rose 12.2%, and units were up 13%. Tillamook saw dollar sales increase 25.1% and unit sales improve by 26.3%. Crystal Farms’ dollar sales rose 30.4% and unit sales jumped 28.6%. Boars Head also had success, dollar sales were up 29.4% and units rose 22.7%.

In the string/stick cheese segment, dollar sales increased 6.2% to $1.2 billion, and unit sales improved 4.4% to 411.7 million. Kraft Heinz brands showed the most promise among the top 10. Kraft Cracker Barrel’s dollar and unit sales skyrocketed 255.3% and 82.1%, respectively. While Kraft’s string cheese dollar and unit sales jumped 41% and 56.9%, respectively. On the flip side, Kraft’s Polly-O brand did not see similar success. Dollar sales were up 3.6%, but unit sales fell 9.9%. Likewise, Weight Watchers also struggled, with dollar sales down 14.6% and units decreased 14.4%.

Processed cheese sales try to keep up

Though most of the sales numbers on the processed cheese side weren’t good, two segments showed some promise with increases. Cheese spreads/balls saw dollar sales increase 5.6% to $479.6 million, and unit sales improved 4.3% to 121.4 million. Among the top 10, Palmetto Cheese (Get Carried Away LLC) had the biggest increases with dollar and unit sales up 27.7% and 28.2%, respectively. Also doing well was Alouette Cheese. Dollar sales increased 17.3% and unit sales jumped 17.9%. Boursin (Bel Brands USA) took a hit in the segment — dollar and unit sales dropped, 18.7% and 19.3%, respectively. The aerosol/squeezable cheese spreads segment also showed sales up. Dollar sales rose 6.2% to $95.1 million and unit sales rose 4.1% to 25.2 million.

The rest of the processed cheese segments showed dollar and unit sales down overall. The imitation cheese-shredded segment took the biggest hit, with dollar sales down 8.2% to $69.7 million and units dropping 13.7%. Imitation cheese-slices also struggled. Dollar sales fell 3.4% to $1.9 billion and units dropped 6.8%.