An abundance of other dessert options (like dessert yogurts, puddings and frozen pies) may be leaving its mark on the frozen novelty/frozen yogurt/sherbet segments because sales are down across the board. Meanwhile, ice cream sales ticked up slightly.

Sherbet sales dragged down the total sales in the ice cream/sherbet category. The category showed a minimal increase of 0.9% to $6.2 billion, while units fell 0.3% to 1.6 billion in the 52 weeks ended Oct. 5, 2014, according to Information Resources Inc. (IRI), Chicago. Ice cream actually performed better (see below). Meanwhile, sales for the frozen novelties category decreased 0.6% to $4.5 billion, and units were down 2.3% to 1.5 billion.

The ice cream/sherbet category consists of:

- Ice cream ($5.4 billion; units up 1%)

- Frozen yogurt/tofu ($332.4 million; units down 9.3%)

- Ice milk/frozen dairy dessert ($247.3 million; units down 7.3%)

- Sherbet/sorbet/ices ($200.5 million; units down 8%)

- The frozen novelties category consists of:

- Frozen novelties ($4.2 billion; units down 2.6%)

- Frozen ice cream/ice milk desserts ($213 million; units down 6.4%)

- Ice pop novelties ($153.9 million; units up 4.3%)

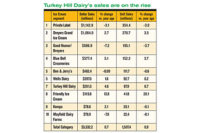

The ice cream segment showed promise with sales improving 2.2% to $5.4 billion, with units rising 1% to 1.4 billion. (See table.) There were a couple stars that stood out among the top 10, like Talenti (purchased by Unilever in December) with sales and units jumping 84% and 82.3%, respectively. Sales for Häagen-Dazs (a Nestlé brand) were up 5.7%, and units improved 5.3%. Turkey Hill’s (a unit of Kroger) sales increased 13.3% and units were up 15.9%. Though not in the top 10, Nestlé’s Dreyer’s/Edy’s saw sales and units jump 48.9% and 50.4%, respectively. Sales for Dean’s Country Fresh were up 33.7% and units improved 33.8%. On the flip side, Breyers (Good Humor) struggled; sales decreased 11.4% and units fell 13%.

Seeing a complete change from last year at this time, the frozen yogurt segment struggled. Sales decreased 7.7% to $332.4 million and units fell 9.3% to 90.5 million. Despite the negative numbers, a couple companies stood out with sales up dramatically. Dannon Oikos’ sales and units skyrocketed 35,825.9% and 39,917.3%, respectively. So Delicious (Turtle Mountain Inc.) saw its sales jump 34% and units were up 36.9%. Not doing well was Healthy Choice (ConAgra Foods) with dollar sales down 28.9% and units down 34.8%.

The numbers didn’t look good for the ice milk/frozen dairy dessert segment, where sales and units fell 7.3%. Despite this, Breyers’ sales were up 38.8% and units up 34.1%. Not doing well was Breyers Blasts — sales dropped 7.7% and units fell 8.4%. Also struggling among the top five, Dreyer’s/Edy’s sales decreased 22.2% and units were down 23.4%.

In the frozen novelties segment, sales were down a slight 0.6% to $4.2 billion and units decreased 2.6% to 1.4 billion. (See table.) Among the top five, Dreyer’s/Edy’s Outshine blew away the rest with a 67.8% increase in sales and a 61.7% jump in units. Private label led the segment with $444.6 million, but sales were down 4.6% and units fell 6.1%. Nestlé Drumstick’s sales were up 4% but units increased only 1%. Skinny Cow (another Nestlé Dreyer’s brand) struggled; sales and units decreased 17.9% and 27.6%, respectively. Blue Bell sales were up 12.8% and units increased 3.3%.

On the flip side, the ice pop novelties segment’s sales improved 1.7% to $153.9 million, with units rising 4.3%. Fun Pops (Alamance Foods Inc.) led the segment with $46 million (sales were up 13.2%, units increased 15%). Pop Ice (The Jel Sert Co.) did not fare as well, sales dropped 11.3% and units fell 8.8%.