Dairy Market Trends

For years, milk processors have doted on the fact that fluid products bring in the bulk of their sales. Over time though, several companies have successfully branched out into other non-dairy arenas by producing tea, juice and energy drinks. Thankfully for them, doing so brought forth a plethora of new revenue opportunities.

Tea time

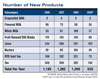

Despite this past year’s economic doldrums, tea launches continue to outpace the likes of milk and juice.According to a report conducted by Chicago-based Mintel, the tea category has introduced an average of 360 new products per year from 2006 to 2008. Additionally, tea producers continue on a steady pace by introducing 184 new products from January through August 2009.

Ready-to-drink iced tea, on the other hand, doesn’t produce as promising of numbers. From 2006 to 2008, this particular category amounted to an average of 186.3 new products per year and has only eked out 73 introductions this year, as of August, which is a whopping 158 behind last year’s figure, according to the Mintel study.

However, tea lovers may have to turn to alternative non-dairy beverages to get their health fix. The Mintel study outlines that the category overall is down 2.3% from last year, as of August, in meeting certain health claims.

For instance, 139 new tea products match the organic claim, while 114 meet kosher requirements, Mintel says. But tea producers have only introduced eight low-, no- or reduced-calorie products, which is 7.5% down from last year’s figure and only 35 new products, or 2.9% fewer items, with no additives or preservatives.

Meanwhile, 74 new product claims meet environmentally friendly packaging criteria, which is only five below last year’s final figure of 79 but is 74 more than what was reported for 2006, according to the study.

According to foodbizdaily.com, the “explosion” of new tea products is due to non-claim, value-added benefits including treating tumors, cholesterol, diabetes, weight loss and other degenerative ailments. The products’ high amount of antioxidants and herbal infusions make for a healthy product regardless of the product’s fat, organic or all-natural claims.

Juiced down

Unlike tea, juice producers have toned down their plans to develop new products, according to Mintel statistics.For example, juice producers have come out with 141 fewer new products overall than last year, as of August, and 160 fewer items than from 2007. Simultaneously, fruit-flavored drinks took a big hit with 2.1% fewer new product introductions than last year and 2.5% less than 2006, the Mintel report says. Figures for new nectar drinks plummeted even more, dropping from last year’s rate by 64 new products and 40 from the previous year.

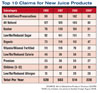

Additionally, new juice products in general met fewer claims than in previous years, even for those that reported an increase from 2006 to 2008, according to the Mintel report.

The no additives or preservatives claim, for instance, paired up with 1.8% fewer new products than last year, while vitamin- and mineral-fortified juice products only claimed 22 new product introductions, as of August, versus 111 from 2006 and 119 from 2007.

Plus, 127 juice items claimed all-natural benefits in 2006, stabilized at 120 in 2007, shot up to 165 in 2008 to diminish to 62 as of August 2009.

Other categories such as organic juices reflected similar roller-coaster results. For example, organic claims raked in 73 new products in 2006, averaged at 115 for 2007-2008 and then nose-dived to only 47 new product introductions as of August 2009.

Milk-ness

While juice and tea products display faltering figures in terms of new product introductions, the milk category mimics these declining numbers, but at a much lesser rate.For instance, milk processors only introduced three new evaporated milk products in 2006 and only two this year, as of August, according to Mintel.

Even so, flavored milk processors came out with 96 new products in 2006, only to watch the figure drop by 23 items in 2007, 14 in 2008 and now 33 as of August.

Likewise, white milk claimed the lead in 2008 with 109 new products, but again, only to drop 2.9% this year.

Meanwhile, this year’s milk products struggled to marry key claims. For example, only 40 new products to date consist of a low-, no- or reduced-fat claim, which is down by 52 new products meeting those claims since last year.

Other claims that were brushed to the wayside are vitamin- and mineral-fortified, kosher and organic milk. And only four new products met the no additives or preservatives claim, which declined 5.5% from last year’s Mintel results.

On the other hand, low-, no- or reduced-allergen factors claimed nine new products, which is only one below last year’s figures.

Additionally, seven new products met the added calcium claim, which is surprisingly up one from last year and only four below 2007’s results.

Whether companies are releasing new teas, juices or milk products, the economy has certainly taken its toll on today’s processors and enforced limitations on how quickly and how many new products are developed.