While supermarket volume sales of ice cream have been flat at best, there is plenty of evidence suggesting that ice cream and especially novelties, are doing very well elsewhere.

“Foodservice is upping its availability of ice cream on menus across all restaurant service levels-from quick service to fine dining,” the report states. “The proliferation of ice cream shops and their rising popularity in part because they afford customization is a double threat to at-home ice cream. The consumer who buys ice cream to eat at the location is competition that eliminates one opportunity, buying a pint to go is yet another.

“Purveyors from other premium treat manufacturers are getting into the ice cream game-i.e. Fannie May Candies has added ice cream to its menu with flavors based on its popular chocolates. Competition is growing in other ice cream retailers such as gelato and frozen yogurt that play well to health-sensitive consumers who do not want to sacrifice flavor.”

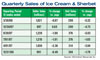

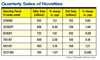

Cold to the core

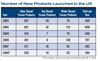

While novelties, frozen yogurt, and out-of-home represent the growth opportunities, ice cream is still the frozen-solid core.“Ice cream remains one of America’s favorite treats,” states David Morris, senior analyst at Mintel. “Slow churn and super-premium innovations have brought exciting new variety to the taste and texture people know and love.” Ice cream’s familiarity is what drives sales. In 2007, ice cream accounted for nearly 60% of total sales from ice cream, frozen novelties, sherbet and frozen yogurt combined. Frozen novelties made up over a third of sales (36%), while sherbet and frozen yogurt accounted for just 5%. Behind those figures, however, it seems people may be cooling towards old-fashioned ice cream. Though ice cream sales dominated the market in 2007, they were also 3.9% behind sales levels from 2002. The culprit? Frozen novelties, sales of which grew 7.2% from 2002 to 2007. “Convenience and healthy eating trends drive more people to frozen novelties to satisfy cravings,” comments Morris. “These products are portable and portion-controlled. Plus, rapid new product development is giving consumers many new frozen novelty dessert choices.” Morris believes that frozen novelties may be the key to continued success. With today’s health-conscious consumer looking for a balance between nutrition and indulgence, “options such as light, portion-controlled ice cream bars or lower calorie frozen yogurt are sure to resonate.”

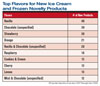

The cherry on top

According to Mintel Oxygen Reports, ice cream is still the overwhelming frozen favorite among Americans, but recently, there has been growth in two emerging segments-gelato and sorbet.Gelato, the dense, creamy Italian counterpart to traditional American ice cream, appears to have gained traction among both processors and consumers. Its growth is likely driven by Americans’ growing international travel habits and their desire to seek out more unusual, authentic taste experiences at home. Consumer research conducted by Mintel shows that nearly 8 out of 10 consumers report eating gelato as a way to have something a bit different than ice cream every once in a while. Some 45% of consumers like the texture and consistency of gelato over ice cream and 36% think it tastes better.

Admittedly, gelato and sorbet represent a fraction of the U.S. ice cream and frozen novelty market, but recent successes suggest their true potential remains untapped.