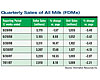

Overall milk volume, according to USDA’s calculations, was up just about .5% through the first 10 months of 2008. That compares favorably to a year before, when soaring prices held overall volume flowing downward. The small uptick is reminiscent of what we reported in our Milk Outlook in February 2007. At that time USDA figured there had been a boost of about 1% for most of 2006 compared to 2005.

This is illustrated plainly in recent quarterly figures from Information Resources Inc., the Chicago-based market research firm. Dollar sales skyrocketed in later 2007 and early 2008. In the second and third quarters of 2008, prices began to moderate. But unit sales in the FDMx channels from IRI dropped by just about 3.4% in each of the last three quarters, so it might take some time before those unit sales spring back.

These figures are for food, drugstore and mass merchandisers, but do not include Walmart or convenience store sales.

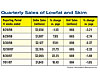

Volume losses for lowfat and skim milk have been less than for overall milk. As the table indicates, even as prices surged in 2007 and early ’08, volume losses never got worse than about 2.7% in any quarter. In the most recent quarter, with dollar sales moderating, lowfat units in the FDMx channels are down 3.2%. It might be that some whole milk consumers migrated to lowfat milk during the price peak and then came back to whole milk.

Looking at flavored milk, we see that dollar sales did not spike as they did with white milk. Unit sales however, which have been slowing steadily in the FDMx channels for sometime took a real dive (more than 10% a quarter) at the end of 2007 and in early 2008.

Finally, we take a look at the top brands of lowfat and skim milk by dollar sales. This measure, from IRI’s FDMx channels usually provides some unique insights.

Private label actually has a slightly smaller market share than it did for the 13 weeks ended Sept. 30, 2007. Hood Lactaid 100 continues as the top national brand, as it has been for many years, and Horizon remains the No. 2 brand. Both Horizon and Dean’s brands experienced tremendous dollar sales gains for the period. But unit sales, not shown in the pie chart, were down for all the top brands with the exception of Horizon, which experienced a 15.4% jump in units, as the Dean Foods Co. was able to rectify raw milk supply problems.

Next month’s Dairy Market Trends will take a look at ice cream. Keep an eye on future issues of Dairy Foods for more about the new multichannel milk study conducted by MilkPEP and Prime Consulting.