The holiday season is key for this dairy subcategory, but there are other drivers as well, and lately they seem to be pushing things in a better direction.

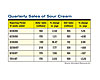

Quarterly sales figures for sour cream indicate that it has not escaped the pressures asserted by higher commodity prices. Increased retail prices drove dollar sales up sharply in 2007 and the early quarters of 2008, and there was the expected drop in volume.

But for the most recent period, the 13 weeks ended Sept. 28, dollar sales leveled off compared to the same period a year ago. Sure enough, unit sales were up just a bit. (see table right).

The situation with refrigerated dips is only a bit different. Dollar sales have been on the rise for much of the most recent six quarters, and for the most part, unit sales have slipped, but the declines have been less precipitous than with sour cream. The 13 weeks ended June 29 produced the worst drop in unit sales and dollar sales were off too. But in the most recent period dollar sales were back up and units had nearly leveled.

Looking at brands, private label is the leader in both categories, but there are strong brand leaders at work too.

Sour cream is often used as an ingredient for home cooking, especially for Hispanic cuisine, which has become a mainstream staple in the United States and is no longer limited only to Hispanic demographics. With more at-home eating expected in the coming year, and lower milk prices, 2009 could be a good year for sour cream.

In the dips category, T. Marzetti is the top brand after private label. Its dollar sales were down a bit for the period, and its unit sales were off by nearly 8%. Meanwhile, private label grew by both measures, as did Heluva Good.

Dean is also a major play in dips, but its dollar sales were down by 2.6% for the period. Dean’s unit sales slipped 6.6%. Kraft’s dollar sales were down by 13% and its unit sales dropped almost 20% for the same period.

New product launches of sour cream and dips are driven largely by flavor trends and sometimes health and wellness concerns. Mintel International’s Global New Products Database indicates that recent launches have included a Blue Cheese Pecan Dip, a kosher, free-farmed Fresh and Easy Organic Sour Cream, a Parmesan Pesto Dip, and standards like lowfat French onion, and buttermilk Ranch.

Mintel says too that the number of sour cream products launched in the U.S. in the first 10 months of 2008 had reached 25 making it one of the more active years for the category.

In January, Dairy Market Trends will look at ice cream and related frozen dessert products.