To position milk as one of these beverage options, product developers must innovate-and then innovate some more. Indeed, innovation keeps this dynamic world moving forward.

"How will you drive growth in your company? The answer is through innovation," says Robert Tucker, president of The Innovation Resource, Santa Barbara, Calif., and the keynote speaker at the Dairy Management Inc.™ (DMI) Innovation Forum 2005. "Although cost-cutting efforts can build your bottom line because they increase the spread between gross and net, they cannot increase top-line revenue; they cannot fuel growth.

"To do that you must offer customers something new," continues Tucker. "This is something that they cannot get anywhere else but from you, something that solves their problem in a superior way. To do that you must come out with new products and strategies that cause existing and new

customers to buy more of what you sell. To do that, you need to go after new

customer groups with new offerings that add revenue to your top line.

Doing these things is the essence of innovation."

Invest to innovate

Dairy processors sell milk, and, of course they want to sell more of it. Thus, according to Tucker, to sell more milk, dairy processors must invest in innovation. One way to innovate is to leverage dairy's healthful halo, along with its superior functionality and sensory attributes, into a variety of beverage formulations. In essence, product developers are taking nature's most perfect food-milk-and including it in new beverages to be enjoyed at different times of day."Innovation is defined as introducing new or improved products, processes and strategies that create new value for your customers and for your organization," adds Tucker. "Many of today's most useful innovations were products consumers never knew they needed. For the most part, they all have led to an increase in sales. Depending on the degree of innovation, that increase translates to incremental, substantial or breakthrough growth."

Do you think consumers knew they needed ready-to-drink, individual bottles of Starbucks® Frap- puccino®? In its 10th year of distribution, Starbucks Frappuccino had about $200 million in sales in 2004. Quite impressive for a product consumers did not ask for.

Each Starbucks Frappuccino is approximately half milk, with the other half being sweetened coffee. Packaged in single-serve, portable, shelf-stable bottles, Starbucks is making sure consumers can always have a Starbucks beverage, even when they cannot stop at a Starbucks café or kiosk.

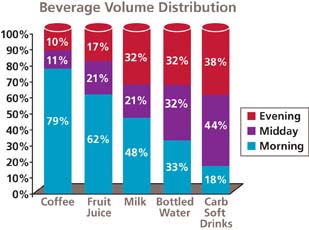

Source: TNS NFO eSIP 2003

Note: The Electronic Share of Intake Panel (eSIP) study is conducted by TNS NFO. eSIP monitors individuals' beverage consumption both at home and away from home through a national panel of 36,000 individuals per year.

Out-of-the-home beverages

According to Madlyn Daley, v.p., branding information services at DMI, it is imperative that dairy marketers identify the means to ensure that milk is readily available for all beverage occasions and that milk gets delivered to all the right places. This may be as simple as packaging current flavored milks in single-serve bottles. It may be more complex and involve adding functional ingredients to milk or using dairy as an ingredient in a beverage formulation. It might even mean incorporating extended shelflife technology to broaden distribution.

Milk's nutritional benefits have always made it an attractive food to be consumed with meals, particularly at home and in school. In fact, 89% of all fluid milk

is consumed in a home. Unfortunately, the meal occasion where milk is most popular-breakfast-is vulnerable, as more and more consumers are eating on the run, and that traditional bowl of cereal and milk is not very portable.

"Milk is up against tough competition," says Daley. Other beverages, including bottled water, carbonated soft drinks, energy drinks and sports beverages, are much more popular outside of the home, particularly for a beverage break. These beverages are positioned to suggest refreshment, replenishment and enjoyment.

Repositioning milk can make it more competitive with these other beverages. Such innovation presents a significant growth opportunity, one dairy processors cannot afford to ignore, according to Stan Kostman, president and COO, Beverage Marketing Corp. (BMC), New York.

"Knowing that different beverages are typically consumed at different times of day presents an opportunity to better position milk for less popular consumption times," says Daley. For example, satisfaction and complete nutrition are very important for elementary school students, yet this demographic's schedule is more hectic than ever. Dairy beverages that take the form of smoothies and fortified lattes make dairy an on-the-go breakfast beverage.

According to the 2003 eSIP study, kids often turn to beverages other than milk when they want something fun, sociable or easy to carry. "Kids regard milk as not being able to quench their thirst. This holds white milk's share down at non-meal occasions," says Daley. "The good news is that flavored milk gets high marks for its taste, as well as being fun and a treat. It is viewed as something you would drink with friends."

When it comes to moms, they have their own set of priorities. Dairy Foods worked with Parenting Magazine's online MomConnection.com panel to find out what attributes are most important in beverage selection. In a survey conducted in May 2005, 66% of the 997 moms who responded said taste is extremely important when deciding what beverages to purchase for their family. And though cost was important (23%), being a good source of nutrition ranked second with 34% of respondents saying this attribute was extremely important. One mom said, "Stop making the stuff that is so bad for kids [so] appealing to them."

Dairy is the answer. It tastes great and is a good source of nutrition. And it can be formulated into new products for new consumption occasions that appeal to kids and the whole family.

Source: TNS NFO SIP

Note: The Share of Intake Panel (SIP) study was conducted by TNS NFO. SIP monitored individuals' beverage consumption both at home and away from home through a national panel of 12,000 individuals per year.

What do you call these beverages?

Dairy is the ideal base and ingredient for formulating beverages that appeal to consumers' needs and preferences. However, keep in mind that standards dictate the language on milk, flavored milk and other dairy beverage labels.According to the Code of Federal Regulations (21CFR 131.110), for milk, a bovine lacteal secretion, to be called milk, the final product must contain not less than 8.25% milk solids not fat. Fat can be reduced or eliminated in milk, per definitions set forth by the Nutrition Labeling and Education Act (NLEA). The standard also allows for the addition of characterizing flavoring ingredients, with or without coloring, nutritive sweeteners, emulsifiers and stabilizers. Flavoring ingredients can be either fruit or fruit juice (including concentrated forms) or natural, artificial, or natural and artificial food flavorings. The standard also allows for the addition of vitamins A and D. This means no other fortifiers, no non-nutritive sweeteners and no non-standardized milk products are allowed.

"This is when the two-food approach comes into play in labeling," explains Cary Frye, v.p. of regulatory affairs, International Dairy Foods Association (IDFA), Washing-ton, D.C. "Milk, in essence, becomes an ingredient." For example, milk containing added fiber cannot simply be called milk. Labels must read: Milk with fiber. Basically, the product is based on two foods (milk and fiber), not one (milk).

Labeling becomes more important when forms of milk are used that are not included in the standard for milk. "If milk protein concentrate is used in the formulation, it can no longer be called milk," explains Frye. "The name of the product must appropriately describe the food. However, if milk is the predominant ingredient, the product can be described as a milk or dairy beverage." And if it contains a substantial amount of U.S. milk, it can potentially sport the REAL® Seal.

Interestingly, for dairy beverages, ingredients that comply with the standard for milk, such as nonfat dry milk rehydrated with enough water to measure at 8.25% milk solids not fat, can be declared on ingredient statements simply as nonfat milk. However, Grade A milk products such as milk made from rehydrated milk powder are subject to additional labeling requirements of the Pasteurized Milk Ordinance and must be marked as "reconstituted" or "recombined." Using this approach to formulate dairy ingredients into new or existing beverage segments where dairy is not normally present can potentially increase total dairy volume sales.

Indeed, new ingredient opportunities for milk have the ability to expand milk's demographic appeal. "Sports and energy drinks, as well as coffee beverages, are strong in the young adult age segment where white milk struggles," says Daley. "Dairy in weight loss beverages pulls in strictly adult users where white milk consumption is weak."

Interestingly, BMC believes that dairy ingredients have the potential to be a big player in wellness/functional beverages, which BMC projects to be the fastest-growing beverage segment in the United States from now until 2008. This category is set to outstrip carbonated soft drinks in growth and share of market-and dairy is poised to shine in many of these new beverages.

"The window of opportunity is open for expanded use of dairy ingredients in beverage offerings," says Julia Kadison, senior v.p., consulting services, BMC. "The dairy industry's challenge is to capture its fair share of wellness/functional beverage growth.

"Protein-enhanced beverages will be a strong platform for innovation," Kadison says, creating an ideal situation for protein-rich dairy ingredients such as whey proteins and fractions, ultrafiltered milk, milk protein concentrate and more.

More than half a billion gallons of beverages could contain dairy, requiring roughly 100 million pounds of dairy ingredients, according to BMC. Some 65% of that beverage volume represents currently untapped opportunities for dairy ingredients, meaning the potential for dairy is enormous.

Dairy ingredients will be formulated into products where dairy is typically not used. These include energy drinks, isotonics, enhanced waters and fruit drinks. Dairy is also projected to remain strong in more expected areas such as sports nutrition drinks, yogurt drinks/smoothies and meal replacement beverages.

"Dairy ingredient suppliers and processors can be more proactive," encourages Kadison. "The opportunities are out there waiting for you."

BMC believes that dairy processors' ultimate competitive market position in the beverage category depends in part on whether speed to market by "other" beverage marketers will outmaneuver the product and process advantages that dairy processors possess. "Dairy processors have advantages with higher levels of product functionality and production and distribution systems," says Kostman. On the other hand, "marketers such as carbonated soft drink manufacturers have advantages with speed to market and customization to specific age segments, particularly to teens. They can also gain some advantage by using new beverage process and package innovations such as aseptic plastic."

Dairy processors cannot afford to not aggressively innovate in the beverage category. They have all the right tools to innovate, and innovation is the key to increasing milk sales.