Mintel says the 2002-07 growth is impressive, considering that the top three segments-milk, carbonated drinks, and fruit juices-which accounted for 62% of the total market sales in 2007, displayed flat or declining sales during the same review period.

“Much of the growth has come from a new generation of beverages that offer something extra to the consumer such as energy, vitamins, or antioxidants,” the report states. “To that end, enhanced bottled water, energy drinks, and RTD tea have been the hot products both for sales and for new product introductions as consumers demand more from their beverages.”

Hispanics and blacks are growth-driving demographics for beverages, Mintel says, as these groups are not only projected to experience impressive population growth, but also show interest in beverages-regular soda, juice drinks, and whole milk, which the general population is moving away from.

Diverse, competitive market

All of these beverages are crucial to the milk processor, who may bottle and market some of them, and who competes against all of them from time to time. The overall market, though growing consistently since 2003, has faced intense internal competition among beverage segments as growth in non-carbonated drinks has come at the expense of carbonated beverages. During 2002-07, carbonated beverage sales grew a mere 5%, while non-carbonated beverage sales rose by 30%, primarily due to increasing concerns for health.

Now lets look at some of those beverage segments that are most important to you.

Juicy Fruits

Back in the day, juice was considered a healthy beverage. But more recently, the natural merits of fruit juices are sometimes in conflict with their high sugar content. So today’s products are upping the ante with premium positioning, organic certification and added functionality.Orange juice remains the most popular juice offering, holding the top five positions in refrigerated juices, and bringing in nearly $2.8 billion in sales through grocery, drug and mass merchandise outlets for the year ending May 18, according to Information Resources Inc. Total sales for refrigerated orange juice, however, grew a scant 0.1% for the category.

The refrigerated juice category as a whole increased 3.5% in dollar sales on the success of premium brands such as Coca-Cola’s “Simply” lineup - Simply Orange grew 37 percent, Simply Lemonade nearly 62%, and Simply Limeade 36%.

New and innovative functional benefits also continue to make their way into juice products.

Naked Juice, Azusa, Calif., added probiotic ingredients to juice with the rollout of its Probiotic 100 Percent Juice Smoothie.

Nestlé USA and Jamba Juice partnered on packaged versions of Jamba Juice with “boost” ingredients such as protein, vitamins and herbs.

NBI Juiceworks, Orlando, Fla., also is working the functional angle with new products such as Sun Shower Nectarine Juices and Superfood Smoothies. NBI has enhanced most of its products with blends of vitamins, amino acids, electrolytes and herbs.

Meanwhile, “superfruit”-based juices have gained mainstream traction in recent years. Pomegranate is now a well-established juice flavor, paving the way for other emerging uperfruits including açaí and goji berry. But the superfruit landscape is always changing, and new juice introductions are redefining today’s “it” antioxidant-rich flavors.

Tea Parties

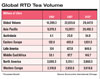

Americans prefer their tea iced. Ready-to-drink teas are one of the most successful beverage categories this year, enjoying an increase of almost 9% to nearly $1.2 billion in sales through food, drug and mass merchandise outlets, according to Information Resources Inc. North American volume for RTD teas last year was 3.1 billion liters, Euromonitor reports. Western Europe consumed 2.6 billion liters, while most other regions never neared the billion-liter mark.But even the United States’ growing penchant for iced tea doesn’t come close to the volumes consumed in Asian countries. Euromonitor says the Asia Pacific region consumed 15 billion liters of ready-to-drink tea in 2007. And that figure is expected to jump to more than 20 billion liters by 2012. The United States is expected to grow a comparatively modest 729 million liters.

While it’s unlikely the United States will reach Asian tea volumes anytime soon, beverage companies are doing their best to provide as many choices as possible. So far this year, Mintel International’s Global New Products Database has measured 93 new RTD teas and 191 bagged and loose leaf teas.

The headliners tend to be green - both in tea variety and ecoconscious values - and premium.

Coca-Cola and PepsiCo both went the green route this spring, with Coca-Cola’s Nestea Green Tea Citrus and Diet Green Tea Citrus, and Pepsi’s new eco-friendly 50-ml. bottle for its Lipton ready-to drink teas. Coke has also invested in the cultishly successful organic pioneer Honest Tea.

Steaz, Newtown, Pa., is taking on the soft drink category with sparkling teas. The company introduced decaffeinated sparkling green teas in 12-ounce cans that are not only organic but approved for use in school nutrition programs.

White tea also is growing in popularity. Inko’s added Blueberry White Tea and Honeydew White Tea. And Revolution Tea, Phoenix, used white tea as the base for a new beverage concept called Revolution 3-D, which it describes as “multi-dimensional,” combining super fruits, vitamins and white tea.

Bottled water

Bottled water has seen the best of both worlds in the last 10 years, coming out of nowhere to become a mainstream player in the beverage industry, only to face a backlash in the last two years that threatens further growth potential.Environmentalists and the media have zeroed in on bottled water packaging as a source of landfill waste and are waging a battle against the segment.

Never the less, sales for the category were up 8% for the year ending May 18, Information Resources Inc. reports. That’s down from about 17% for the same period the prior year, but it’s difficult to determine if that’s price-related or environmentally motivated. Private label bottled waters, which traditionally top branded waters in sales, picked up an additional 1.3 % market share and more than 18% in dollar sales during the past year. Nestlé Pure Life, another lower-priced brand, gained nearly 19% in dollar sales.

The Major players include Nestlé Waters North America, which controls just under 30% of the bottled water market. Aquafina is PepsiCo’s leading brand, but PepsiCo also has its line of enhanced waters (marketed under the Propel label) that place it squarely in competition in the growing “enhanced” or “good for you water” sub-segment, where it competes with Coca-Cola’s recently purchased Glacéau vitaminwater and fruitwater.

Private-label water sales increased 11% in 1997, to 20.3% of the market sales, even though store brands did not increase their share of the market. While competition depends in part on price (“water is just water” and the lower-priced product represents the better bargain), store brands are lagging behind national brands in the growing enhanced/functional sub-segment.

While more players are on the field these days, the winners are the old standbys, and one in particular, Gatorade. The PepsiCo brand holds nine of the Top 10 positions in supermarkets, drug stores and mass merchandise outlets, reports Information Resources Inc. But results were mixed for the various Gatorade sub-brands. Sales of the flagship product were down 9.3% during the 52 weeks ended May 18, and Gatorade Frost, Gatorade Fierce and Gatorade X-Factor also saw sales declines.

New to the Gatorade lineup, Gatorade Tiger, a brand developed in conjunction with golfer Tiger Woods, picked up 1.2% market share in only a few months on the market. And G2, a brand designed to compete with enhanced waters for “off-the-field” hydration, now holds 3.7% market share, less than a year after rollout.

G2 is an electrolyte beverage with half the calories and carbohydrates of traditional Gatorade. The company is differentiating the product from the core Gatorade formulation, saying it is designed for post-workout consumption vs. more strenuous activity.

Coca-Cola’s Powerade made an impressive showing, with a 13% dollar sales increase through IRI’s measured outlets. Although not on the Top 10 list, Coca-Cola also rolled out its own low-calorie sports drink with Powerade Zero, which replaced Powerade Option.

Gatorade’s Propel Powder Packets hold a little more than a quarter of the sports drink mix market.

A number of sports drinks from the natural products segment also have emerged. Recharge from R.W. Knudsen, Chico, Calif., contains 50% juice and 50% water as well as electrolytes. Zico coconut water plays on the natural electrolyte content of coconut water, with 670 mg. of potassium. And Liv Organic, which replaced the Liv Natural brand, was designed to contain the same carbohydrates and minerals of traditional sports drinks, but uses agave as a sweetener.

Energy drinks are no longer content to stay in their own category, according to Mintel.

As energy drinks become more commonplace, Mintel sees “energy” expanding beyond the aluminum can. “Energy bars are familiar to many Americans,” states Krista Faron, senior new product analyst at Mintel., “but other energized foods, such as candy, chips, milk and cereal, are definitely not. We expect the concept of energy, both physical and mental, to greatly influence food product development.”

Stand-ins

Soy milk is a subject that likely raises conflicting emotions for dairy processers. It came about as a beverage that presented an alternative to milk, as if there were something wrong with milk! But truth be told, a huge chunk of the soy milk sold in the U.S. is now produced, packaged and distributed by dairy companies like Dean Foods and Organic Valley and sold in the dairy case right next to the milk.IRI puts soy milk in sort of a catch-all sub category that also includes kefir and goats milk. That category’s dollar sales jumped 10% in the year ended Sept. 7, and unit sales were up 7.25%. One of the biggest gainers was private label, which had a 50% jump in dollar sales and now has 13% dollar share.

Value-added brands like Silk Plus also did very well, as did the organic soy products from Organic Valley.

Those buzzy beverages

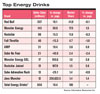

With their youthful, often counter-culture attitude, it may be difficult to think of energy drinks as a maturing category. But sales figures from IRI show that while energy drinks still enjoy strong growth, the category may be stabilizing.For the year ending May 18, energy drinks grew more than 18% through food, drug and mass merchandise channels, giving them the highest growth rate of any beverage segment this year. That figure is, however, half of the increase the category achieved the previous year.

While the category overall might be settling into a more “mature” growth rate, most of the Top 10 brands continued their double-digit pace during the past year. Category leader Red Bull jumped another 18% in dollar sales through IRI’s measured outlets, while Hansen’s Monster Energy added 30%.

As energy drinks become a more permanent fixture in the beverage marketplace, the category also is becoming more diverse. In the first half of this year Mintel’s Global New Product Database has measured 200 new energy drink introductions, compared with only 60 that rolled out in the first part of 2007.

Manufacturers are looking to unique demographics with their products, whether through brand name, formulation, flavor, packaging or marketing.

In a category full of young male-targeted beverages, Ocean Spray, Lakeville-Middleboro, Mass., showed a different side of energy drinks this spring when it rolled out Cranergy, a more female-oriented mix of cranberry juice, vitamins and green tea extract. Apple & Eve, Port Washington, N.Y., also put a new twist on energy and juice blends and took on the morning daypart with Awake. Hobarama LLC, Miami, introduced its Bawls Guarana brand to very specific audience this year, with Bawls Guarana G33k B33r.

The root beer-flavored product takes its name from “Leet Speek,” a language popular among high-tech fans who like to substitute letters with numbers.

Arizona Beverage, Lake Success, N.Y., took a decidedly urban direction with its All City NRG, a non-carbonated green tea-based energy drink. The product is packaged in 16-ounce cans that feature street-art inspired graphics.

Fast facts

- 14 of 92 new water products introduced in the first half of this year were designed for children.

- All natural is the most-used claim for new juice products, followed by kosher, no additives/ preservatives and low-, no- and reduced-sugar.

- Social-consciousness is hot in the tea category. 39 new hot tea products offer an ethical/human (read Fair Trade) proposition, 20 tout an environmentally friendly product and 16 an eco-friendly package.

- 137 new energy drinks have been categorized as “new products.” 28 were new packaging and 27 were line extensions.

- Lemon-Lime, Berry and “unflavored” tied for the top flavor choices among sports drink introductions so far this year.

- Non-cola flavors outperformed many cola brands, reflecting a market for fruit-flavored sodas among the general population and especially among Hispanics; Fanta, Sunkist, Crush, and Canada Dry fared better than many colas from 2006-07

Portions of this article are courtesy of Beverage Industry magazine.

Links

- State of the Industry 2008: Cheese is Convenient, Naturally

- State of the Industry 2008: Ice Cream--Sweet Success

- State of the Industry 2008: Yogurt Still the Bright Spot

- State of the Industry 2008: Butter--Spreading What's New

- State of the Industry 2008: Ingredients--Pricey Necessities

- State of the Industry 2008: Introduction

- State of the Industry 2008: Milk--Ups and Dows

- Amelia Bay