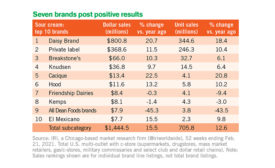

Sales Data

Unlike previous years, this year’s Dairy 100 rankings reflects changes in the market — with some new companies joining the list and others experiencing major growth or declines.

Read More

2021 State of the Industry: a divided highway for ice cream and frozen novelties

Sales of ice cream and frozen novelties traveled in two different directions in 2021.

October 26, 2021

The retail RTD coffee category is piping hot

The RTD tea category posted more modest growth, however.

September 17, 2021

Dairy imports surge in Chinese market

However, high shipping costs and COVID-19 have slowed exports to other countries.

September 7, 2021

A growth slowdown for retail refrigerated milk

But two refrigerated milk-alternative segments made strong sales gains.

August 16, 2021

Cold treats see a slight cool-off

But all segments within the retail ice cream/sherbet category still posted impressive gains.

July 21, 2021

Rising feed prices will affect US dairy prices

They also will impact other major dairy-exporting countries.

June 11, 2021

Jolly times for refrigerated juices

The category posted strong dollar and unit sales gains at retail.

May 20, 2021

Market disruptions no match for TikTok feta pasta

A recipe went viral, leading to a huge uptick in retail feta cheese sales.

May 3, 2021

It’s cultured dairy’s time to shine

Dollar sales rose steeply in most retail cultured dairy categories.

April 19, 2021

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox.

SIGN-UP TODAYCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing

.jpg?height=168&t=1623938483&width=275)

.jpg?height=168&t=1626962658&width=275)