In the juice category, a majority of subcategories experienced a drop in unit sales, consistent with many other dairy categories, according to data from Chicago-based research firm Circana (formerly IRI and NPD) for the 52 weeks ending March 26.

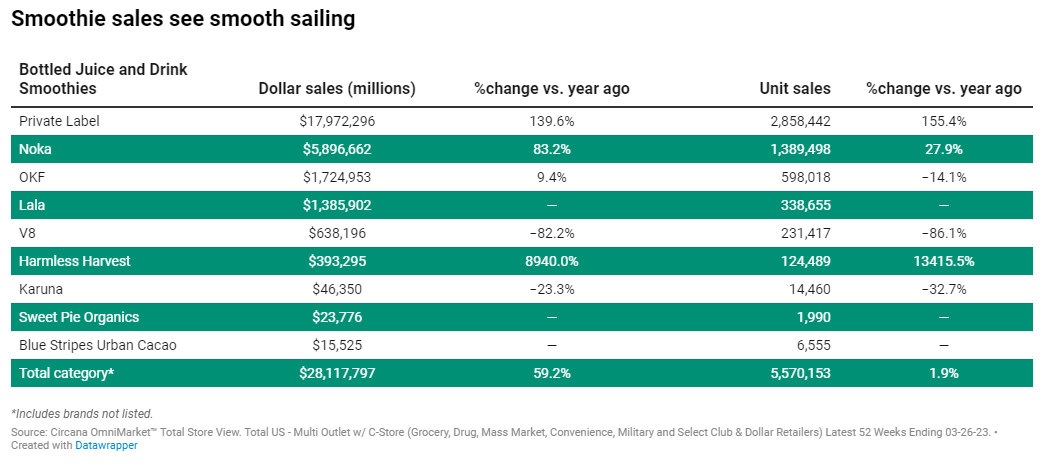

However, four subcategories bucked the trend. First on the list is juice and drink smoothies, which enjoyed a 59% year-over-year (YoY) dollar sales increase to $28 million, as well as 2% unit sales growth to 5.6 million. Private label was a shining star, whose sales rose by triple digits YoY to $18 million. Private label now accounts for more than half of the total juice and drink smoothie market, per Circana data.

Yet, private label was not the only the only bright light in this subcategory. Los Angeles-based Noka Organics enjoyed a YoY dollar sales increase of 83% to $5.9 million, as well as a unit sales jump of 28% to 1.39 million. In addition, albeit on a smaller scale, Harmless Harvest cannot be ignored. For the 52 weeks ending March 26, the Oakland, Calif.-based company saw dollar sales rise 8,940% to $393,295, while unit sales rocketed 13,415% to 124,489, Circana data reports.

Another subcategory bright spot is aseptic juices. Overall, its sales jumped 15% YoY to $615 million, and unit sales rose 3% to 147 million. Leading the aseptic juice category for the 52-week period ending March 26 was New York City’s Vita Coco, whose dollar sales came in just shy of $270 million, good for a 17% YoY increase, while unit sales rose by 5% to 63 million.

The third subcategory bright spot was in bottled fruit juice blends, whose dollar sales increased by 14% to $423 million, and unit sales rose 2% to 119 million for the same yearlong period, states Circana. Topping this category was Atlanta-based good2grow, whose sales topped the $100 million mark, good for a 24% YoY advancement, while its unit sales jumped 13% to 28 million. On good2grow’s heels was Juicy Juice, a division of Stamford, Conn.-based Harvest Hill Beverage Co., whose dollar sales jumped 28% to $93 million, while unit sales climbed 14% to 26 million.

The final subcategory earning accolades is bottled cherry juice, whose dollar sales jumped 19% YoY to $86 million. Unit sales rose 6% to 16 million. The leader in this category, RW Knudsen Family saw dollar sales just shy of $30 million, more than double any competitor. The Chico, Calif.-based company’s unit sales generated 6% growth to 4.2 million.

Subcategories that earned the dollar sales up and unit sales down moniker are bottled fruit drinks, bottled cranberry cocktail, bottled apple juice, bottled lemonade, bottled cranberry ice blend, bottled lemon/lime juice, bottled grape juice, bottled cider, bottled prune/fig juice, bottled pineapple juice, bottled fruit nectar and bottled aloe vera juice, Circana data reveals.

Conversely, subcategories that missed the mark on both dollar sales and unit sales for the 52 weeks ending March 26 included bottled tomato/vegetable juice/cocktail, bottled orange juice, bottled sparkling juice and bottled grapefruit juice.

Despite these mixed-to-subpar subcategory results, there were individual companies who stood above the fray. In the bottled fruit drink category, for example, No. 1 seller, Keurig Dr Pepper’s Snapple, saw dollar sales rise 13% YoY to $383 million, while unit sales advanced by 2% to 164 million.

good2grow had a strong year in the bottled apple juice subcategory, with dollar sales increasing 26% to $118 million, to go along with a 14% rise in unit sales to nearly 33 million.

No. 1 in terms of sales in lemon/lime juice, ReaLemon’s dollar sales rose 11% YoY to $83 million, while unit sales increased 2% to nearly 27 million.