The milk category continues to have obstacles to overcome. As recent sales show, the skim/low-fat milk segment is still declining. But there is hope. The flavored milk segment showed both unit and dollar sales up. And trends are showing renewed interest in whole-milk products, which may be contributing to the success of whole milk, which also saw unit sales increase. (See Dairy Facts & Stats, page 78, for more about milk.)

Overall, the milk category sales were down, though not as severely as we’ve seen in past reports. Dollar sales fell 5.2% to $17.1 billion, and unit sales dropped 0.7% to 5.8 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Nov. 1, 2015.

IRI tracks the following segments in the fluid milk category:

- Refrigerated skim/low-fat milk ($9.4 billion, unit sales down 4.8%)

- Refrigerated whole milk ($4.7 billion, unit sales up 3.6%)

- Refrigerated flavored milk/eggnog/buttermilk ($1.4 billion, unit sales up 6.5%)

Sales are skimpy for skim milk

The largest segment in the category, skim/low-fat milk dollar sales dropped 10% to $9.4 billion, with unit sales down 4.8% to 3.1 billion. Only one brand reported in the top 10 had positive sales numbers. Hood Lactaid (HP Hood) showed dollar sales up 10.2% to $369.2 million, and unit sales improved 7.8%. Horizon Organic (WhiteWave Foods) saw dollar sales increase 0.2%, but unit sales dropped 8.4%. Prairie Farms’ dollar sales decreased 10.1%, and units fell 5.8%. Dollar and unit sales were down 7.7% and 2.5%, respectively, for Hiland Dairy (a unit of Prairie Farms). Among the top 10, Dean Foods saw the biggest drop. Dollar sales fell 51.6% and units decreased 50.7%. This drop is a result of the company’s transition over its new DairyPure brand. Not among the top 10, Kemps (Dairy Farmers of America) was the only other company with unit and dollar sales increases, up 2.6% and 5%, respectively.

Whole milk rising

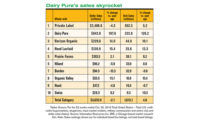

Sales numbers for the whole milk segment were mostly promising. The whole milk segment’s dollar sales fell 1.3% to $4.7 billion, but unit sales rose 3.6% to 1.5 billion. Private label, which dominates the segment in overall sales at $2.5 billion, saw dollar sales drop 1.8%, but unit sales improved 6.4%. Sales of speciality milks (organic and lactose-free) improved. Horizon Organic’s dollar sales jumped 17.9% and unit sales rose 7.4%. Hood Lactaid’s dollar sales jumped 20.6%, while unit sales increased 17.9%. Organic Valley saw an increase of 17.1% in dollar sales, and unit sales rose 8.7%. Not doing well in the segment was Borden and Oak Farms. Borden’s dollar sales decreased 5.7% and unit sales fell 4.6%. Oak Farms’ dollar and unit sales dropped 49.9% and 47.8%, respectively.

Flavor wins the game

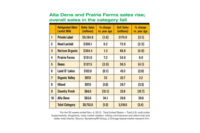

The refrigerated flavored milk/eggnog/buttermilk segment was a real beacon of light for the category (see table). The segment’s dollar sales increased 6% to $1.4 billion and unit sales jumped 6.5% to 660.5 million. All but one brand reported in the top 10 had dollar and unit sales increases. TruMoo (Dean Foods) saw dollar sales improve 8.8%, while unit sales jumped 14.2%. Prairie Farms’ dollar sales increased 10.5%, and unit sales rose 10.9%. Dollar sales improved 22.8% for Darigold, and unit sales were up 16.9%. Creamland TruMoo (Dean Foods) saw dollar and unit sales improve 6.3%, respectively. Hiland’s dollar sales were up 6.7% and unit sales rose 9.9%. Though Horizon Organic’s dollar sales improved 5.6%, unit sales fell 3.5%. Outside of the top 10, Hood (HP Hood) saw dollar sales drop 7.9%, with unit sales down 10%.