As milk alternatives made from almonds, coconut and some other decidedly non-dairy sources increase in popularity, dairy milk sales continue on a downward spiral. According to Chicago-based IRI, dollar sales for the total milk category — which includes non-dairy milk alternatives — fell 1.1% to $15.8 billion in the 52 weeks ending Nov. 5, 2017, while unit sales dropped 1.6% to 5.7 billion.

Leaner options take a dive

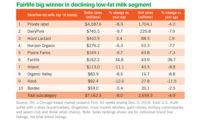

With the exception of soy “milk,” the refrigerated skim/lowfat milk subcategory — the largest segment in the total milk category — was the biggest loser. Dollar sales declined 5.2% to $7.8 billion, the IRI data show, and unit sales fell 5.5% to 2.8 billion.

Private label led the subcategory, with $4.5 billion in sales. But that number reflects a 5.5% decrease. And unit sales fell 4.9% to 1.8 billion.

Among the top 10 brands, only three — fairlife, Borden and Hood Lactaid (HP Hood) — posted sales gains. fairlife saw impressive 64.7% and 58.9% dollar and unit sales increases, respectively. Borden’s dollar sales rose 7.3%, and its unit sales increased 5.7%. Hood Lactaid, meanwhile, realized a 1.9% rise in dollar sales and a 0.5% increase in unit sales.

Faring the worst among the top 10 were DairyPure (Dean Foods), which saw dollar sales decline by 9.6% and unit sales fall by 11.3%, and the Dean Foods brand, which saw dollar sales fall 9.2% and unit sales slide 10.8%. Horizon Organic (DanoneWave) didn’t perform much better. Its dollar sales dropped 8.6%, and its unit sales fell 7.3%.

Strong gains for whole milk

A number of studies in the last few years link the consumption of full-fat dairy products with anti-obesity benefits. And if sales are any indication, more consumers are becoming aware of those benefits.

Refrigerated whole-milk sales jumped 3.8% to $4.8 billion, the IRI data show, while unit sales climbed 3.1% to 1.7 billion.

Private label claimed the greatest share of the subcategory. Dollar sales here increased 4.7% to $2.6 billion, and unit sales rose 4.6% to 974.6 million.

Among the top 10 brands, fairlife realized the biggest gains — dollar sales jumped 65.1%, while unit sales expanded 64.9%. Organic Valley, Hood Lactaid and Borden also saw strong growth, with dollar sales rising 18.8%, 13% and 12.9%, respectively. Unit sales for the three brands were up 16%, 11.3% and 11.5%, respectively.

Only two brands among the top 10 saw sales declines. Dollar sales for DairyPure fell 1.3%, while unit sales decreased 2.9%. And Horizon Organic realized a 0.3% dollar sales decline, but unit sales rose 2.6%.

Flavored options shine, too

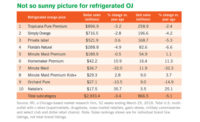

Also boasting positive performance was the refrigerated flavored milk/eggnog/buttermilk subcategory, which saw sales climb 2.9% to $1.5 billion. Unit sales, meanwhile, jumped 1.2% to 693.4 million.

Again, private label is the segment leader. Sales here rose 2.7% to $331 million. Unit sales expanded 3.5% to 159.1 million.

Like it did in the refrigerated whole-milk subcategory, fairlife posted the strongest gains among the top 10 brands. Its dollar sales skyrocketed 31.7%, while its unit sales jumped 27.4%. But Lala also impressed with a 24.5% increase in dollar sales and a 30.7% gain in unit sales.

Only two brands in the top 10 — both of them from Dean Foods — lost ground here. Deans Country Fresh saw a 7.1% drop in dollar sales and a 9.2 decrease in unit sales. TruMoo realized dollar and unit sales declines of 4.1% and 5.4%.