In the cheese aisle, it seems consumers are still reaching for that natural slice, chunk or shredded cheese option versus their processed cousins. With consumers becoming more health-conscious every day and more informed about their food, the natural cheese category continues to dominate.

Data from SymphonyIRI Group, Chicago, show that sales in the natural cheese category are up 5.7% to $11.3 billion and units rose 1.7% to 3.3 billion, in the 52 weeks ended Oct. 7, 2012. Compare that to the processed cheese segment, which saw sales decrease 0.2% to $3.2 billion and units decrease 3.9% to 947.2 million in the same time period. (See pie chart.)

In the natural cheese category, these three segments stood out with impressive sales numbers:

• Refrigerated grated cheese ($145 million sales, units up 10.7%)

• Natural slices ($1.5 billion sales, units up 8.8%)

• Natural string/stick cheese ($1 billion sales, units up 3.3%)

By comparison, similar segments in the processed cheese category didn’t have the same success:

• Processed/imitation cheese – shredded ($46.5 million sales, units down 2.4%)

• Processed/imitation cheese – slices ($2 billion sales, units down 4.6%)

The refrigerated grated cheese segment saw the greatest success; unit sales increased the most in the natural cheese category. Sales were up 8.3% and units rose 10.7% to 43.7 million. Among the top 10 in this segment, Kraftsaw the biggest unit sales increase of 845.8% to 4.2 million. Also seeing success was Sigma Alimentos’ FUDbrand with units up 55.7% to 402,070. Not far behind was Argitonicheese (from Imperia Foods Inc.) with unit sales that rose 48.6% to 177,444. Private label dominated the segment in overall sales at $87.9 million, but the sales dropped 0.2% and its units were up only 1.5% to 31.1 million.

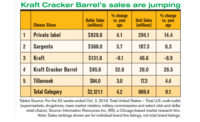

Also seeing positive numbers in sales and units was the natural slices segment, possibly driven by the popular portion-control trend. Segment sales showed an 8.9% increase, with units up 8.8% to 481.4 million (see table). Among the top 10 in this segment, Sargento and Kraft brands dominated. Sargentosaw an 18.8% increase in sales, with units up 22% to 89.2 million. Kraft Big Slicemade its mark with sales jumping 64.3% and units also up 65.2% to 23 million. Sargento’s new Natural Blendssaw the biggest unit sales increase for the segment, up 86.4% to 8.7 million. While private label once again led in overall sales at $590.7 million, the unit sales were up just 7.2% to 216.4 million.