The updated 2010 Dietary Guidelines for Americans pose a tremendous challenge for some dairy processors, as they scurry to reformulate certain product lines to meet the call for healthier foods. Between lower-sodium offerings and SKUs making fat-free label claims, these hot-button issues present a host of hurdles for the food manufacturing community.

For cheesemakers, though, this so-called “problem” may just be one of the already-in-place steps in delivering premium, top-quality products time and time again.

That’s why the cheese category continues to increase sales, according to Chicago-based SymphonyIRI Group.

Maintaining naturalness

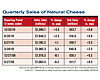

The natural segment raked in $7.6 billion in sales (up 1.1%) thanks to its top-grossing segments - shredded ($2.6 billion) and chunks ($2.4 billion), SymphonyIRI sales figures show for the 52 weeks ending Jan. 23. Shredded sales (as measured in dollars) were up 2.5%, but chunks declined 2.4%. Other natural cheese categories showing gains were crumbled (6.2%), slices (5.3%), string (4.7%), “all other forms” (3.8%) and refrigerated grated cheese (1.8%). Besides chunks, other natural cheese categories showing a decline in dollar sales were cube (12.6%), shelf-stable grated (2.7%) and ricotta (0.1%).

Certain Kraft SKUs experienced roller-coaster results: sales of some soared while others plummeted. For instance, in the “all other forms” category, Kraft Cracker Barrel brought in 365,368.7% change in sales from last year due to its limited-edition lineup of Holiday Reserve cheese. Sales of the company’s Deli Fresh slices rose 121.4% and Cracker Barrel slices sales increased 14.7%, SymphonyIRI sales statistics show. On the other hand though, the Northfield, Ill., company recorded a 51.3% dip for its Kraft brand slices, a 25.6% drop in sales for its Snackables and a 20.1% decline in sales for its Cracker Barrel string cheese SKUs.

The grated cheese segment also displayed up-and-down results, SymphonyIRI says, with sales for Bella Famiglia brand increasing by 252.5% since last year. But for Crystal Farms, a Lake Mills, Wis.-based division of Michael Foods Co., sales plummeted 37.5% for its pair of grated cheeses in Romano and parmesan kinds.

The crumbled category saw more positive marks with Alouette Cheese, New Holland, Pa., scoring 114.2% in sales for its Alouette brand cheese. This gluten-free crumbled cheese is ideal for salads, omelets, pizza and pasta, comes in blue, goat, gorgonzola and feta flavors and is equipped with a patent-pending resealable shaker top container that allows consumers to shake out the right amount of cheese each time.

Processed cheese melts away

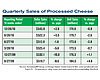

The processed sector eked out a small gain of 0.04% to $2.1 billion in sales, with processed/imitation slices accounting for $1.3 billion in sales, according to SymphonyIRI data. However, sales in the processed/imitation slice segment fell 4.1% overall.

For example, sales of Land O’Lakes SKUs dropped 43.6% since last year, whereas Borden and Veggie Slices from Galaxy Nutritional Foods, North Kingstown, R.I., saw a 9.7% and 6.4% dip in sales, respectively. For its part, sales of Kraft and Kraft Deli Deluxe dropped 31% and 13.9%, respectively.

However, where Kraft faltered, it also made up for it in other areas of the processed cheese category. For instance, sales for its shredded cheese products raked in a whopping 335,651.7%, 69,832.1% for the “all other forms” avenue and 56.3% for its lineup of loaf SKUs.

Other noteworthy sales increases include: Ortega aerosol/squeezable cheese spreads (479.7%); American Accent shredded (110.5%); Shullsberg brand of “all other forms,” produced by Shullsberg Creamery, LLC, Shullsberg, Wis. (38.1%); and Whitehall Specialties brand shredded cheese (40.6%).

Regardless of the issue at hand, the cheese category remains a shelf pleaser for all occasions.