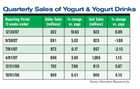

First we’ll look at sales numbers. Unit sales of yogurt and yogurt drinks have been fairly steady in recent quarters. This, despite a sharp increase in prices. Dollar sales were up by 5% in the period ended Sept. 30, with a 1.7% drop in unit sales. Dollars jumped 10.6% for the following quarter, ended Dec. 30, but unit sales actually grew .89%. These numbers are according to data from Information Resources Inc., through its FDMX measure of food, drugstore, and mass merchandiser retailers.

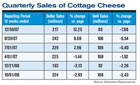

Cottage cheese is the second largest sub-category in cultured dairy, and its unit sales are feeling the pinch of higher prices much more than those of yogurt. Dollar sales have taken off since last July as prices increased, and specials were restricted. By the end of January dollar sales had jumped 12.2% for the quarter while unit sales tumbled 7.7%.

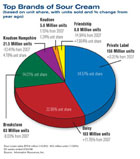

One interesting aspect of the sour cream market is the brand breakdown. Daisy is the only top brand that’s been growing in the last year, and it did so at an impressive pace. With unit sales leaping by nearly 12% it has fortified its spot as the top brand after private label. Daisy now holds a 22% unit share, compared to just 14% for Breakstone.

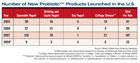

Today’s food and beverage manufacturers are all trying to capture the public’s growing interest in functional foods. The dairy industry has done an especially good job of enhancing its products with health and wellness benefits. The Mintel Global New Products Database (GNPD) reports that spoonable yogurt was the second most active sub-category among all US functional foods launched in 2007. It was preceded only by meal replacement beverages.

Dairies have delivered even more forward-thinking innovation. Beauty foods-a category of products that improve consumers’ appearances from the inside out-originated in Asia and are still best established in that market. Many of these beauty foods are dairy-based and use yogurt as the carrier for their functional benefits. Beauty yogurts frequently include ingredients such as amino acids, collagen and protein from sources as diverse as soy and silkworms. In Europe, beauty foods have also gained considerable traction.

Segments of this report were provided by Krista Faron of The Mintel International Group.