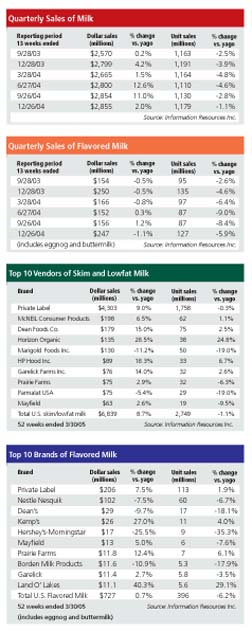

Dollar sales were growing at more than 10% in the second and third quarter last year, but tailed off a bit at the end of the year as prices began to recede.

Meanwhile sales of flavored milk experienced a similar pattern. The attrition in the unit column peaked in the second quarter at -9.0%. That was one of the only two quarters in which dollar sales actually grew. In the last period of the year, dollar sales were shrinking again, compared to the prior year, but units were losing ground more slowly.

IRI's flavored milk category includes buttermilk and eggnog, which explains the jump in sales in the last quarter each year, as eggnog is such a seasonal purchase for consumers.

Looking at the top vendors of lowfat and skim milk, dollar sales were up substantially for most in the 52 weeks leading up to March 20, while unit sales were down for half of them. Three of those that grew their volume sales did so by less than 3%. The other two-HP Hood and Horizon Organic had exceptional circumstances. HP Hood was in the midst of integrating the Kemp's and Crowley organizations and undoubtedly gained some market share in the process. Horizon saw a shrinking of the retail price differential between organic and conventional milk. And the organic milk supply market is less affected by fluctuations in the Class 1 prices. Horizon's sales increased by more than 25% for the period by both dollar and unit measures.

In the competitive flavored milk segment, the figures are all over the place. As noted previously in this column and in past installments, flavored milk has taken a blow in the past couple of years thanks to label readers. If raw milk price increases were passed on to consumers, and it's likely that they were in many cases, the segment now has a one-two punch to deal with.

Whatever the cause, segment leaders like Nesquik and Dean's have had significant losses in both dollar and unit sales. But Land O'Lakes, a brand licensed to Dean Foods Co., has climbed into the Top 10.