Meanwhile, new product innovation also appears to be slowing a bit for ice cream, according to Mintel. Again, the exception is in places like churned and other low-fat products and organic ice cream.

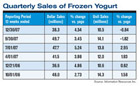

The frozen yogurt category has been reinvigorated of late, and for much of 2007 sales were growing by both dollar and unit measures. The growth seems to have tapered a bit in the last quarter of 2007.

Looking at the top brands of frozen yogurt for the 52 weeks ended 2007, it appears that much of the growth in this category has been driven by the brands of the Dreyers Grand Ice Cream Co., of California. Unit sales of the Dreyers/Edy’s brand grew by 6.2% and it is now the leading brand after private label with more than 17% of the market. The Haagen Dazs brand, also owned by Dreyers, was up 23.5% by unit sales and the combined share of the two brands is 25.4%, which is a bit larger than private label’s share.

Looking more closely at product launches for different subcategories, it’s easy to see that product developers are chasing trends. Where overall product development has been trending downward, there were more dairy-based weight control products rolled out in 2006 than in 2007. Also, 26 were introduced in the first five weeks of 2008. The number of churned products debuting in 2007 was lower than in 2006, but 91 products were launched during the two year period and, and seven more at the outset of 2008.

Finally, some numbers to put with the ongoing success stories told of in this month’s Ice Cream Outlook regarding organic ice cream. There were 49 introduced in 2007, as well as 31 in 2006.