Like a sign above the bar at my favorite watering hole that says “Free Beer Tomorrow,” I feel like economists have been telling us that “Recession Starts Tomorrow” for more than a year now.

When I look at various measures of economic stress on consumers, things still don’t look terrible. Consumers are still sitting on excess savings from the pandemic, but they are trending lower. Credit card balances are still below pre-pandemic trend, but they are trending higher. Delinquencies are still below the pre-pandemic average, but they are trending higher. Consumer spending is still above pre-pandemic trend, but it is coming down. Overall, it seems that the consumer isn’t in a terrible place, but everything is trending in the wrong direction.

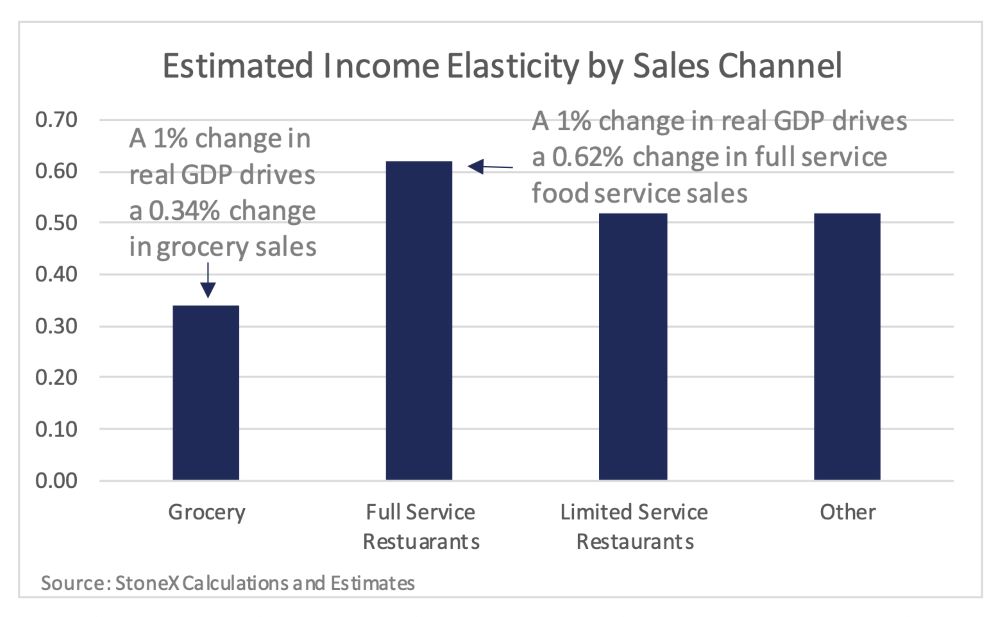

Whether we slip into recession or not is a technicality. As economic growth slows down and consumer spending slows, dairy demand will slow as well. We don’t have to technically enter a recession to see weaker demand. The good news for dairy processors is that people still have to eat. The bad news is they will look for ways to cut expenditures and shift away from food service and toward retail.

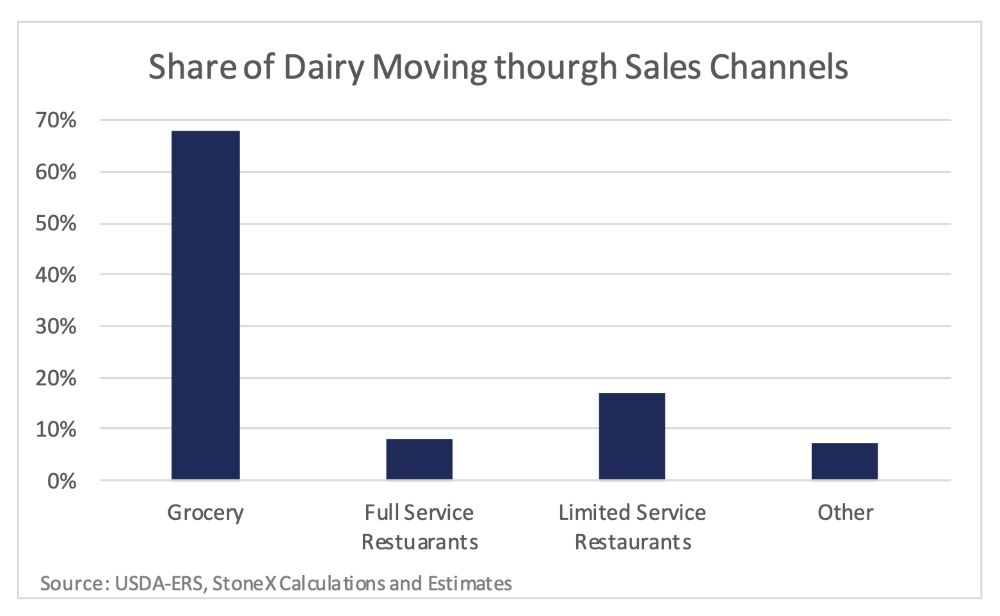

Based on a study by the USDA, about 68% of dairy volume moves through retail, and those sales are the least impacted by economic growth. In our modeling, every 1% change in real gross domestic product (GDP) growth only changes retail food sales by 0.34%. The most sensitive channel is full-service restaurants. The USDA estimates that about 8% of dairy volume moves through that channel, but in my calculations, every 1% change in real GDP drives a 0.62% change in full-service restaurant sales. About 17% of dairy volume flows through limited-service restaurants, and every 1% change in real GDP drives a 0.52% change in their sales.

It doesn’t take a full-blown recession to see an impact on dairy, all it takes is a slowdown in economic growth and consumer spending, which we are currently seeing. The second big factor in demand in prices. Falling prices help to offset the weaker economic conditions, so it is entirely possible we will see dairy sales continue to grow even as consumers are feeling more financial stress. Retail dairy prices are still running well above year ago levels, but those prices are flattening out or pulling back on a month-to-month basis which should be supportive for volume movement but might squeeze margins for some processors and retailers.

I don’t know if the recession will start tomorrow, next quarter, or if we’ll squeak by with a “soft landing,” but I am looking forward to some free beer tomorrow.

This material should be construed as market commentary, merely observing economic, political, and/or market conditions, and not intended to refer to any particular trading strategy, promotional element, or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”) or StoneX Markets LLC (“SXM”). SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the viewpoints and trading strategies employed by SFI or SXM.

.jpg?height=200&t=1623938483&width=200)