No? It must be true: Mintel has reported sales up 15% over the past three years and projects growth of more than 20% in the next three. The USDA reports cheese production hit a record 10 billion pounds in 2009. And select artisan cheeses and other upscale comfort foods are one of the Top 5 menu trends for 2010, says a study conducted by food industry research firm Technomic.

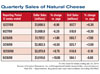

But even the best performers can have a bad day – or quarter, in this case – as data for the most recent 13-week period appears to indicate. Chicago-based Information Resources Inc. statistics show conventional forms of cheese sold in grocery stores took a hit, and some specific brand performance was off significantly compared to the same quarter last year.

For example, the natural cheese category settled in with a 3.4% drop in sales, as of Jan. 24, IRI data shows.

In the cubed segment, Kraft saw a 71% plunge in sales for its Snackables cubed cheese line, while Hoffman’s sustained a 49% decline, according to IRI data. Meanwhile, ConAgra’s Swissroll County Line took a 30% hit, Danish cheesemaker Rosenborg’s cubed sales dropped more than 25% and Heluva Good saw a dip of nearly 10%.

On the other hand, Kraft managed to rake in a whopping 134,619.6% jump in cubed cheese sales, according to IRI data, while Malcore’s, from that Wisconsin-based regional processor, saw a 71% increase.

But there was some joy in shredsville: IRI reports a 135% jump in sales for Sargento Artisan Blends, while Yoder’s Meat & Cheese Co. – a boutique brand in Indiana’s Amish country – experienced a 122% increase in its shredded sales.

Furthermore, sales in the natural chunk cheese segment dropped 3.4% overall, according to IRI data. Among individual brands, Land O’Lakes logged a 25% drop for its chunk cheese, while Joseph Farms dropped 18%, Heluva Good nearly 15%, Kraft 13% and Kraft’s Cracker Barrel brand more that 10%, IRI reports. Even though private label snagged the No. 1 spot for this category, its sales also dropped about 4%.

The natural cheese category didn’t stumble alone; the processed cheese category also fell by nearly 7%.

Process slices felt a drop of nearly 10% overall; that encompassed individual brand performances for Kraft Singles, which fell a reported 50%, Borden Singles at 28%, American Accent at 26%, Borden Sandwich Mate at more than 21% and Land O’Lakes at nearly 20%, according to IRI data.

On the bright side, Great Lakes saw an increase in sales of nearly 81%, while Dutch Farms rose almost 54%, according to IRI stats.

The imitation cheese sector, meanwhile, experienced a 5.5% drop in sales overall, but individual brands saw some big jumps in sales. For example, IRI reported an increase of more than 1,500% for Borden Shred Mate, while Fresh Gourmet and Borden Ched-O-Mate experienced reported jumps of 476% and 206%, respectively, IRI says.

Consumers may love their cheese, but IRI stats suggest they may have been getting their recent cheese fixes at local restaurants instead of their hometown grocery aisles.