Novelties, Ice Cream Go Cold

It's enough to send a chill up the spine of an ice cream marketer!Ice cream and sherbet sales remain flat, and what's worse, novelty sales are now also showing a steady pattern of negligible declines.

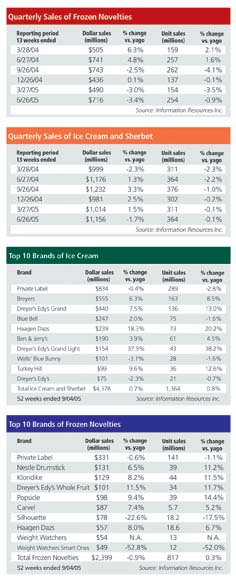

The most recent figures from Information Resources Inc. show that quarterly sales of all types of novelties have dropped ever so slightly in each of the last four quarters. This is the same category that was experiencing near-double digit growth just a couple years ago. Things began to hit the skids about a year ago.

For packed ice cream and sherbet, the numbers have been consistently dull for about a year, but it's a slightly better story than the one we were hearing a year ago. When measured by units in particular, sales have been virtually flat in the last three quarters rather than slipping by about 2% each period as they did in 2003 and early 2004.

Cold comfort, we're sure!

In the 52 weeks ended Sept. 4, overall ice cream sales grew by just 0.7% when measured by dollars and 0.8% when measured by units. Novelty numbers were only slightly worse. These IRI figures are for food stores, drugstore and mass merchandisers, but do not include Wal-Mart.

Looking at the individual brands for both ice cream and novelties it's easy to see that there are plenty of success stories to tell. It should be noted that IRI collects and distributes data for the top individual brands, not total SKUs for a given brand line.

In ice cream, six of the top ten brands had some growth in that 52-week period. Some, especially Häagen-Dazs and Edy's Grand Light are doing very well. Private label shrunk a bit. Last time Dairy Market Trends checked on this category, with numbers through May of 2005, five of the top brands were down in unit sales.

For novelties too, private label also took a hit during this period. Only two other brands were in the red when units were measured, both are diet brands. This is an active area of the category, where some business alignment changes may be affecting brand performances.

Remarkably, four of the brands had more than 10% growth.

In July we noted that a low-carb brand was still doing well, and that perhaps no one had told ice cream lovers that low-carb was passé. But now that brand's growth has slowed and it's out of the top 10.

New Ice Cream Marketer Offers Gourmet Appeal

HALLENDALE, Fla.-SheerBliss™, a new super premium ice cream packaged in a distinctive tin can, has been making a splash in gourmet ice cream circles this year.SheerBliss was introduced in the Los Angeles and New York markets in April by a group of South Florida businessmen who are operating as SheerBliss Ice Cream LLC.

Its unique package was a finalist for best packaging honors at the summer Fancy Food Show in New York.

"It looks like no other ice cream-nor does it taste like any other," says Gary Barron, SheerBliss president and CFO. "We've found that people are really taken with our decorative tin-and then are pleasantly surprised when they taste the incredibly flavorful and creamy ice cream inside."

The SheerBliss team is made up of four partners: Siroos Asbaghi, Barron, Sean Cavandi and Ron Prupis. All of them have serious business credentials, but none have been in the food marketing business.

Thanks to an exclusive agreement with POM Wonderful®, of California, SheerBliss incorporates POM Wonderful Pomegranate Juice when creating their pomegranate-based ice cream flavors.

Barron says Eskimo Pie Co. provides distribution to high-end food retailers and supermarket chains in the greater New York area, parts of New Jersey and New England, and in Southern California.