Global dairy demand in 2023 was weaker than expected, but there were some pockets where demand was better than forecast. We faced slowing economic growth and pressure on consumer budgets from inflation across most markets, but one other thing the weakest countries had in common was rebounding domestic milk production that reduced their dependence on imports. While the weakest countries had many things in common, the strongest countries seem to have less in common.

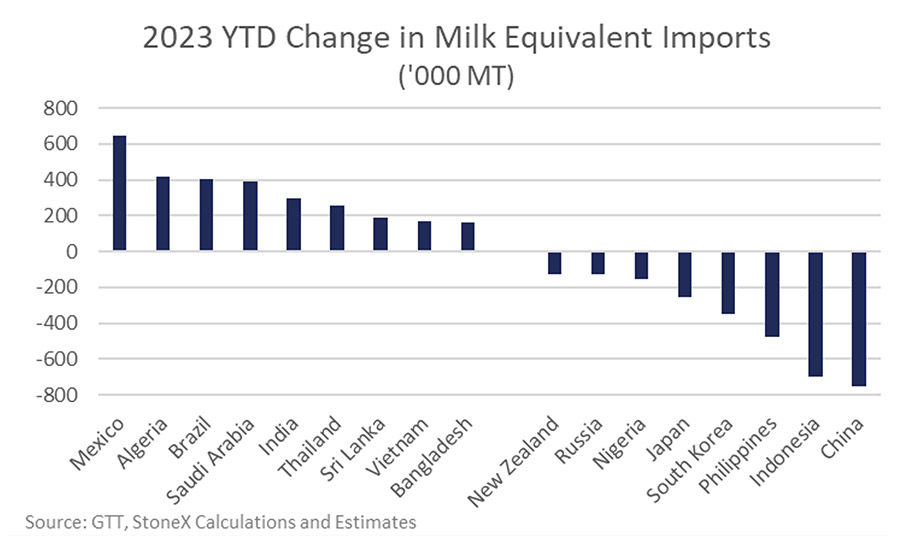

As of this writing, we don’t have all of the 2023 import data yet, but we have most of it through November. As a result, we can make some definitive statements. By far the strongest performer on imports in 2023 was Mexico, where imports were up about 650,000 MT of milk equivalents. This came on top of officially reported milk production that was also strong, up 1.7% for the year.

A strong domestic economy, increased tourism, and a favorable exchange rate all seemed to help Mexico’s import demand. Anecdotally, exporters tell us demand cooled in December and into January 2024, but their domestic milk production has also slowed down, which could keep imports from crashing back in 2024.

In our dataset, Algeria was the second strongest, up about 415,000 MT of milk equivalents in 2023. Algeria has a long history of stockpiling milk powders when prices are low, so the strong imports probably did not go directly into consumption, but they will reduce imports as prices rise and use the inventory that they built up in 2023.

Brazil was the third strongest in 2023, up about 402,000 MT. Milk production in Brazil fell hard in 2022, which increased their reliance on imports. Milk production started to recover in 2023, which I thought would limit the import growth, but demand growth outpaced production and kept imports growing.

By far the weakest importer was China, which was down about 750,000 MT compared to 2022. There was a hope that Chinese demand would surge as COVID restrictions were lifted in late 2022 and early 2023, but consumers faced weak economic growth, rising unemployment, and a falling property market that kept consumers nervous and confidence weak. The weak demand combined with continued growth in their domestic milk production to limit the demand for imports.

Indonesia’s imports surged in 2022 as their dairy herd was hit with foot and mouth disease that reduced its milk production. As their domestic milk production recovered, imports dropped in 2023. Consumers in the country have also been hit with high food inflation that averaged a 4.9% increase for the year. Unlike many other countries, food inflation was accelerating again toward the end of 2023, up 6.2% in December.

The Philippines imported about 476,000 MT less in 2023. I don’t know the whole story for the Philippines, but it looks like food inflation stressed consumer budgets. Early in the year food inflation was running over 10% although it cooled to 5.4% in December.

Global demand was a mixed bag in 2023, and overall, it was weaker than expected. The good news is that imports did manage to grow, up an estimated 0.5% for the year despite some pockets of significant weakness. My demand models say 2024 should be stronger, but early in the year demand does not feel particularly strong.

This material should be construed as market commentary, merely observing economic, political, and/or market conditions, and not intended to refer to any particular trading strategy, promotional element, or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”) or StoneX Markets LLC (“SXM”). SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the viewpoints and trading strategies employed by SFI or SXM.