Dairy processors seeking to transport products in the most effective manner are facing a bumpy road. Such factors as driver shortages, escalating fuel prices, and inconsistent schedules are making it difficult for operators to minimize transportation expenses while achieving optimal efficiencies.

“The truck driver shortage is creating unprecedented challenges across the transportation industry,” says Mike Medeiros, senior vice president, operations-dedicated contract carriage for Penske Logistics, a Reading, Pa.-based transportation management services provider that employs more than 11,300 truck drivers across North America.

Indeed, he notes that rapidly escalating driver wages, along with the nature of the work — which includes finding drivers who are willing to work nights and weekends — are “creating headwinds.”

The Arlington, Va.-based American Trucking Associations (ATA) estimates that the national truck driver shortage is at a historic high of more than 80,000 drivers, which is the difference between the number of drivers currently in the market and the number necessary to handle freight demands. While noting that “all sectors in the industry struggle with finding enough drivers,” the ATA says the shortage is most acute in the longer-haul, or non-local for-hire truckload, market.

Primary factors for the shortage include the high average age of current drivers, which is leading to a greater number of retirements, and the inability of current and potential drivers to pass a drug test, which the ATA states is a problem that is exacerbated by an increasing number of states legalizing marijuana, a substance that is still banned federally.

The Arlington, Va.-based American Trucking Associations estimates that the national truck driver shortage is at an historic high of more than 80,000 drivers.

Barriers to entry also include the inability of some potential candidates to meet carriers’ hiring standards, which often involves driving records or criminal histories, and the federally mandated minimum age of 21 to drive commercially across state lines, which “poses a significant challenge to recruiting new drivers,” the ATA notes. In addition, the COVID-19 pandemic is causing some drivers to leave the industry or potential candidates to avoid driver training schools, the ATA states.

The ATA forecasts that the driver shortage could surpass 160,000 and that the industry will have to recruit nearly a million new drivers over the next decade to replace retiring drivers leaving voluntarily or involuntarily and to keep pace with market growth. Rising pay rates, meanwhile, will not alone solve the shortage because some drivers will choose to work less at a higher wage, negating the impact of the increase, the ATA states.

“The solution to the driver shortage will most certainly require increased pay, regulatory changes and modifications to shippers’, receivers’ and carriers’ business practices to improve conditions for drivers,” the ATA notes.

Make driving more desirable

A shortage of drivers, meanwhile, can also impact the quality and merchandising of dairy products because most products have expiration dates and are highly perishable, says Russell Zwanka, director of the food marketing program and associate professor – food marketing at Western Michigan University in Kalamazoo. He notes that processors could better adapt to the current transportation obstacles by shrinking supply lines to focus more on local deliveries.

“That’s a decent alternative and actually decreases the carbon footprint of the supply chain,” he notes.

To make driving more appealing to potential candidates, processors should follow consistent production and transport schedules, Medeiros states, adding that “store support with unloading of product and flexibility in delivery times, such as moving after-hours nighttime deliveries to early morning daytime, creates a more attractive work schedule for drivers in this challenging environment.”

A lack of available truck parking locations also is hampering transportation operations, as it is causing many drivers to stop working earlier so they can get a spot for the night, the ATA notes. It also is increasing traffic congestion, which limits drivers’ ability to safely and efficiently make deliveries.

Along with greater driver-related expenses, operational inefficiencies that include wasted fuel through excessive idle times when making deliveries also are driving up transportation costs, analysts state.

Indeed, the Fort Wayne, Ind.-based North American Council for Freight Efficiency (NACFE) reports that sleeper tractor fleets burn about a billion gallons of diesel annually while idling, which is approximately 8% of the total fuel burn.

“Due to the volatility of fuel prices, concern about the impact of diesel emissions on the environment, and a desire to minimize engine wear, the trucking industry is under pressure to reduce or even end the idling of engines,” the NACFE states. “Although some level of idling is unavoidable, a plethora of new idle-reduction systems now on the market is capable of reducing idling significantly below current averages.”

Savings through sophistication

Processors could further enhance transportation efficiencies by using electronic logging device data to gain insights into how they are employing equipment, and to better address all potential improvement opportunities.

Such technologies include automatic idle shutdown systems, which truckers can program to cease idling after a certain amount of time, and electronic engine idle parameters, which control the exact speed at which an engine will idle and enable truckers to set the idle time length and establish boundaries when idling.

“It is important to look for any and all opportunities to mitigate idle time of equipment to reduce fuel consumption associated with idle time and delay,” Medeiros says.

Processors could further enhance transportation efficiencies by using electronic logging device (ELD) data to gain insights into how they are employing equipment, and to better address all potential improvement opportunities, says Mark Finger, senior vice president, maintenance and operations for Transervice Logistics Inc., a Lake Success, N.Y.-based provider of transportation services.

An EDL can automatically record driving time and hours of service; capture data on the vehicle’s engine, movement, and miles driven; and monitor idle time by unit, which enables operators to better coach drivers on how to conserve fuel and reduce waste, he notes. It also enables processors to rebalance equipment in accordance with miles or hours in operation, and to enhance the equipment life cycle and driving behaviors, Finger states.

Indeed, many fleet operators are extending vehicle life cycles to compensate for a decrease in equipment availability due to supply chain disruptions, he says.

“This is expected to increase operating costs for repairs that might not normally be incurred if the equipment was replaced within the established life cycle,” Finger states. “Additionally, drastic increases in fuel pricing are driving the need to ensure equipment is operating at peak performance with minimal idling.”

To effectively manage such issues, it is important that dairy processors clearly communicate the challenges internally to ensure visibility and understanding amongst the various departments, he notes.

“Continue to perform comprehensive p.m. inspections on a timely basis in accordance with original equipment manufacturer or proven operational best practice intervals,” Finger states.

Operators could further control transportation expenses by establishing short-term guidelines that ensure that the equipment they are extending beyond the intended life cycle remains operational without having to overinvest in repairs, he adds.

It also is critical for processors to maintain a strong and effective cold chain despite driver shortages, Zwanka says. That can entail having retailers monitor the temperatures inside vehicles when receiving products and ensuring that they do not accept products close to the expiration dates, he notes.

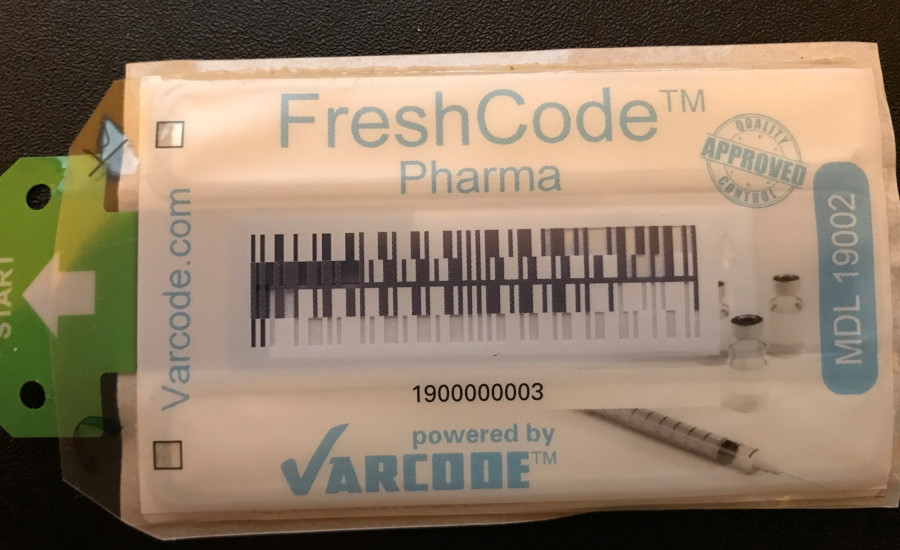

“Exposure to increased temperatures is not good for product safety, as bacteria grows more quickly the higher the temperature,” says Cyndi Metallo, director of customer experience for Varcode, a Chicago-based provider of equipment for digitally tracking, analyzing and reporting cumulative temperature excursions over time and producing permanent digital records. “In addition, impacts are made on the shelf life of the product, which affects good taste. In a category with rigorous competition like dairy, any opportunity to improve taste and safety is good.”

Cold chain problems can occur when dairy products undergo fluctuating temperatures during transport to the warehouse or store, she notes, while unrefrigerated docks and old or missing dock seals also can lead to temperature and product quality issues.

“The retailer generally has accountability for the product between the warehouse and store,” Metallo states. “Understanding where temperatures were breached helps to assign accountability for products gone bad.”

An alternative to traditional transport

The need to contain supply chain transportation costs, meanwhile, is enhancing operator interest in clean transit solutions that enable vehicles to run on propane Autogas, which is a liquefied petroleum gas that uses less carbon dioxide, and electricity instead of diesel and gasoline, says Todd Mouw, executive vice president of sales and marketing for Roush CleanTech. The Livonia, Mich.-based company is a developer of alternative-fueled vehicles.

“Ultimately, fleet operators want to distribute their products in the most efficient, cleanest, and safest way possible,” Mouw notes.

Processors could better determine the optimal clean transportation solutions for their specific circumstances by selecting a technical partner that understands, and has been a technology developer, for all possible options, Mouw states. That includes vehicles that use compressed natural gas, liquefied natural gas, propane, and hydrogen fuel cells, as well as battery electric vehicles, he notes.

It also is important for operators to consider such elements as payload, range, route, duty cycle, available incentives, and access to energy and service locations when making the technology decisions, Mouw notes. The NACFE reports that alternative-fuel vehicles, especially battery-electric trucks, are ideal for regional hauls of within 300 miles because of the return-to-base operation.

“Infrastructure to charge electric or alternative fuel trucks is a critical barrier to deployment,” the NACFE states. “Having confidence in the location of the infrastructure to support these vehicles is important to deciding to move forward with electric trucks.”

The use of such vehicles, meanwhile, is a solid way for processors to demonstrate their eco-consciousness, analysts note.

“Shippers, carriers, investors, and consumers are increasingly acting in ways that demonstrate the value they put on sustainability,” reports A.T. Kearney Inc., a Chicago-based global management consulting firm. ”They see the economic consequences of the global climate crisis and demand that their business partners participate in shared journey to lower carbon emissions. Companies can join these journeys using three pillars: sustainable operations, sustainable service, and sustainable supply.”

Other vehicle alterations are helping to improvement transportation operations as well, Medeiros states, including trucks with electronic stability control and less overall trailer weight, which are enabling safer and more efficient equipment use.

Yet, while vehicle manufacturers are “dedicating tremendous resources to design and engineering,” with many initiatives intended to improve efficiencies, it still is critical for processors to properly understand vehicle specifications at the time of order if they are to leverage transports with the best performance and total cost of ownership, Fingers says.

“High efficiency requires a commitment from both fleet leadership and driver,” the NACFE states. “Many technologies exist to improve the efficiency for these regional routes. Understanding each in-depth will help in making choices to save fuel, money, and emissions.”