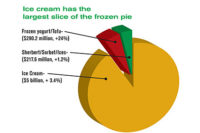

Sales of ice cream and frozen novelties grew only 9% from 2008 through 2013 to $11.2 billion. A slow climb, according to Chicago-based Mintel, that equates to a loss of 1% when adjusted for inflation. Ice cream is the leading segment in the ice cream and frozen novelties category, boosted by its familiarity, said Mintel, but an expanding array of frozen treats could be affecting growth.

Keeping with this slow growth, the ice cream/sherbet category showed dollar sales up 1.1% to $6.1 billion, with units also up 1.1% to 1.6 billion, in the 52 weeks ended May 18, 2014, according to data from Information Resources Inc. (IRI), Chicago. In the same time period, the frozen novelties category saw dollar sales drop 2.5% to $4.5 billion, and units fell 4.1% to 1.5 billion.

The ice cream/sherbet category consists of these segments:

- Ice cream ($5.6 billion; units up 1.6%)

- Frozen yogurt/tofu ($346.8 million; units up 0.4%)

- Sherbet/sorbet/ices ($204.5 million; units down 6.9%)

- The frozen novelties category consists of these segments:

- Frozen novelties ($4.1 billion; units down 3.9%)

- Frozen ice cream/ice milk desserts ($214.7 million; units down 5.7%)

- Ice pop novelties ($144.2 million; units down 6.9%)

Among the top 10 in the ice cream segment, the numbers vary from good to bad. Blue Bell saw dollar sales up 7.3% and units up 5.4%; Ben & Jerry’s (a unit of Unilever) dollar sales went up 7.2% and units were up 6.9%; andHäagen Dazs’ (Nestlé’s) dollar sales jumped 10.4%, with units up 11.5%. While Unilever’s Breyers showed dollar sales down 6.3% and units down 5.8%, Nestlé’s Dreyer’s/Edy’s Grand showed numbers up. Dollar sales increased 13.2% and units jumped 14.4%. Though not among the top 10, Talenti (Talenti Gelato) showed significant increases, with dollar sales up 89% and units up 90%.Well’s Blue Bunny struggled as dollar sales dropped 14.2% and units fell 12.9%.

In the sherbet segment Talenti was the only company among the top five to see sales go up. Its dollar sales jumped 66.3% and units were up 64.8%. Blue Bell’s dollar sales went up 1.6%, but units were down 1.2%. Struggling was Häagen Dazs and Kemps (Dairy Farmers of America), with dollar sales down 11.6% and 12.5%, respectively; units also were down, 13.2% and 13.1%, respectively. Though not among the top 10, Dean’s Country Fresh (Country Fresh Inc.) saw significant increases. Dollar sales skyrocketed 235.3% and units also jumped 255%.

Sticks are stuck

The frozen novelties segment didn’t fare much better; each company in the top five showed units down. Nestle’s Drumstick saw dollar sales go up 2%, but units dropped 0.9%. Skinny Cow (also a Nestle brand) saw dollar sales drop 16.1% and units were down 25.9%. Klondike’s (Good Humor) sales were down 3.6% and units dropped 6.2%. One anomaly among the top 10 was Nestle’s Dreyer’s/Edy’s Outshine, which saw dollar sales skyrocket 534.6% and units also jumped 474.1%. This jump in sales could have to do with a new unique fruit and veggie bar introduced into the category earlier this year.