Sales of natural shredded cheese continue to grow, albeit at a more moderate pace, while natural chunks are losing a bit of market share.

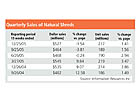

Looking at unit sales to avoid the distortion of price fluctuations, quarterly sales for shreds have jumped in each of the last six quarters. And for the 52 weeks leading up to Feb. 19, dollar sales were off just slightly, but unit sales increased 2.2%. These numbers, from Information Resources Inc., are for food, drug store and mass merchandisers other than Wal-Mart.

The quarterly figures show that this convenience form experienced significant unit sales growth in late 2004 and early last year, but the growth slowed a bit in the latter half of 2005.

Nearly all of the top-10 brands had lower dollar sales for the year leading up to Feb. 19, but that may have been driven in part by price fluctuation. It's interesting to note that private label is growing quickly, as more store brand managers see shredded cheese as a home-run category.

Sales of shredded cheese have been growing substantially for a few years now, so perhaps it's not much of surprise that consumers who keep the cheese grater in the kitchen cabinet are purchasing a bit less in the way of natural chunks lately. Quarterly unit sales of chunks have shrunk a bit in nearly each of the last six quarters.

Shreds have done well because they offer convenience, and as the opportunity has arisen, marketers have added value to this category with packaging improvements. The same can be said for natural slices, a category we highlighted in the February issue of Dairy Foods.

And where is the market share coming from that's going to natural slices? That's easy-sales of processed slices are shrinking.

The most recent figures on processed slices, through Feb. 19, show that all of the top-10 brands are losing steam in terms of both dollar and unit sales. Private label shrunk more than the top brand Kraft Singles during the period. Overall the sub category was down by more than 7% by both measures.