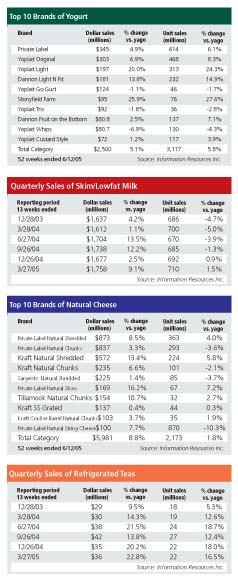

Yoplait and Dannon have been and remain the top players in yogurt-with five Yoplait brands among the top 10. Keep in mind that Information Resources Inc., now keeps separate figures on yogurt drinks. Also, these numbers are for supermarket, drugstore and mass merchandiser retailers but don't include Wal-Mart.

In April 2003, Dairy Market Trends looked at the top brands including cup yogurt and yogurt drinks. Yoplait and Dannon dominated through Jan. 26 of that year too, but sales were sluggish at best. Even light brands were not doing much. Stonyfield Farm wasn't even in the group yet. About a year later, Stonyfield was 7th after private label.

It's not an exact comparison, but in the most recent data, which is for the 52 weeks ended June 12, the action is in the light category, with Yoplait Light and Dannon Light N Fit showing outstanding growth. Stonyfield's natural and organic offerings are growing even faster, and the brand is now in 5th place after private label.

In the milk case, lowfat and skim have experienced some modest growth in unit sales during the two recent quarters. Dollar sales are growing less rapidly compared to the same reporting periods a year prior. The decline that preceded this growth seems to have peaked in the winter and spring of 2003 and 2004. Unit losses were less dramatic in the summer, even as prices spiked.

A look at the top 10 brands of natural cheese in all forms shows spotty growth in terms of units and some brands in decline. Private label is actually doing well here, especially slices. In terms of dollar sales, all the top brands are up, but for the overall category, growth by unit was just 1.8%.

Finally there's iced tea, one of those product categories that a lot of dairies participate in; and it's easy to see why. Both dollar and unit sales are jumping, with double-digit growth for the last five quarters.