Sales within the retail frozen novelties category show no signs of cooling off. Dollar sales shot up 5.8% to $7,023.3 million during the 52 weeks ending Dec. 26, 2021, according to data from Chicago-based market research firm IRI. Unit sales increased 1.8% to 1,865.1 million.

Ice cream/ice milk desserts are hot

The retail frozen novelties category encompasses three subcategories: frozen novelties, frozen ice cream/ice milk desserts, and ice pop novelties. The second largest of those subcategories, frozen ice cream/ice milk desserts, saw the greatest sales increases.

Dollar sales within the subcategory jumped 10.4% to $343.3 million. Unit sales climbed 9.6% to 19.1 million.

Leading the top 10 brands in sales growth was Hershey’s, with dollar and unit sales gains of 53.5% and 52.7%, respectively. The Abilyn’s brand also impressed — dollar sales rose 33.0%, and unit sales increased 37.5%.

Only one top 10 brand — Turkey Hill — posted sales declines. The brand’s dollar and unit sales fell 11.6% and 12.2%, respectively.

Ice pops impress, too

The smallest subcategory, frozen ice pops, posted strong gains, too. Dollar sales were up 5.8%, while unit sales saw a 3.7% uptick.

The Jel Sert Co.’s brands recorded the strongest growth among the top 10 brands, with dollar and unit sales gains of 83.6% and 43.5%, respectively. Icee Slush posted the second-largest gains, with dollar sales rising 31.2% and unit sales increasing 27.5%.

Two top 10 brands struggled, however. Private label brands saw dollar and unit sale fall 4.6% and 5.5%, respectively. And Fun Pops recorded a 4.4% decline in dollar sales and a 4.2% decrease in unit sales.

Healthy growth for largest subcategory

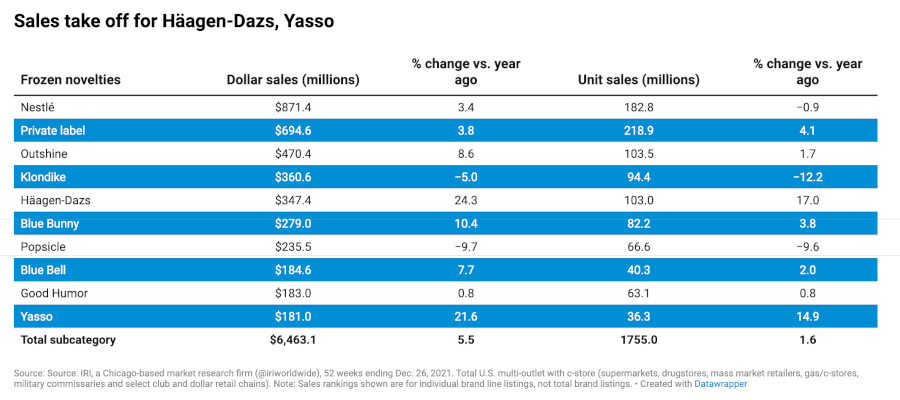

The largest subcategory — frozen novelties — was no sales slouch, either. The subcategory’s dollar sales shot up 5.5% to $6,463.1 million. Its unit sales rose 1.6% to 1,755.0 million.

Two of the top 10 brands posted very impressive results. Häagen-Dazs posted a 24.3% increase in dollar sales and a 17.0% improvement in unit sales. And Yasso saw dollar and unit sales gains of 21.6% and 14.9%, respectively.

Not faring nearly as well among the top 10 brands were Popsicle and Klondike. Popsicle’s dollar and unit sales tumbled 9.7% and 9.6%, respectively. And Klondike posted a 5.0% decline in dollar sales and a 12.2% decrease in unit sales.