Dairy processors need to look at their customer base and ask themselves if they are positioned to take advantage of the changing trends in shopping for food. Dairies would also be wise to understand consumers’ mindsets towards nutrition research and large food companies.

That advice comes from separate reports by the International Dairy-Deli-Bakery Association, Madison, Wis., and the Dairy Council of California, Sacramento.

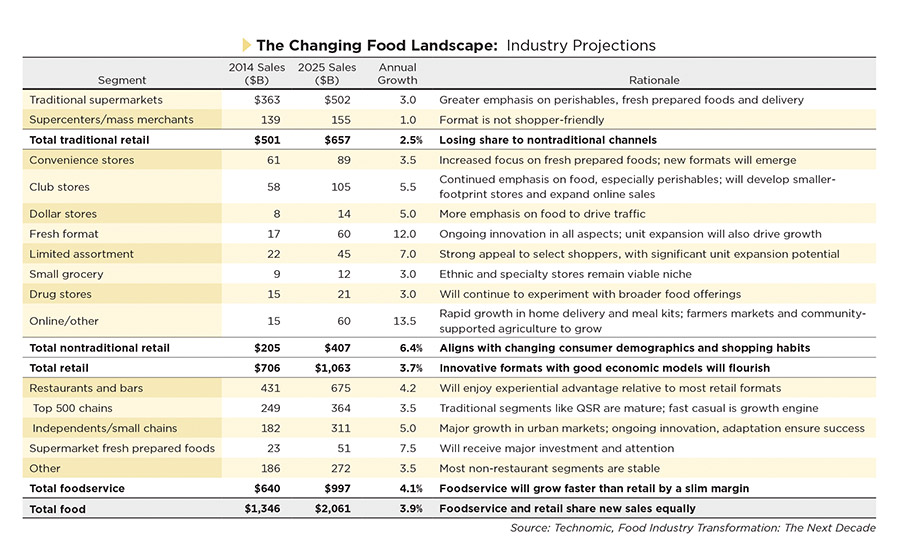

Convenience stores, drug stores, farmers markets, online shopping sites and other nontraditional retail channels are seeing continued growth and garnering a larger percentage of the food retail market, according to an IDDBA report. Consumers — particularly Millennials and Gen Z — view them as viable shopping alternatives to traditional supermarkets and grocers, according to “What’s in Store 2016,” the association’s annual trends research report.

IDDBA found that e-commerce sales for food and consumables will grow 12.1% annually through 2019. Despite increased competition, almost 50% of grocery retailers are significantly more optimistic about 2015 than they were a year ago. Cheesemakers should note that with grocery deli departments now competing directly with foodservice, the retail sector is seeing a “premiumization” of cheese, specialty meats and olives, as well as complementary items.

IDDBA drew upon multiple industry experts, retail analysists and government statistics for its report. Tim O’Connor, vice president, RetailNet Group, told IDDBA that it is better to look not at traditional channel definitions but instead look more at positioning and strategy for the retailers to see who will grow or decline.

“Small box supermarkets with great proximity to shoppers and progressive fresh stores will grow well,” he said. “Traditional grocers who expect shoppers to keep coming to their stores when so many more convenient and positive experience options are available will see their trips, volume, sales and return on invested capital continue to decline.”

The book is organized around five themes: Channels & Competition, the Economy & Retail Trends, Consumer Lifestyles, Eating Trends, and Technology and Marketing. Each chapter goes in-depth into the bakery, cheese, dairy and deli departments.

Consumers, dairy and health

Consumer skepticism about nutrition research and the practices of Big Food businesses are two of the four trends identified by the Dairy Council of California in its Autumn 2015 Trends newsletter. The other two are an interest in the link between foods and cognitive health and a growing belief that cheese is coming back into favor for its high protein content and other nutritional benefits.

The council says the acceptance of the Dietary Guidelines for Americans is being challenged by changing scientific and social norms. The Dietary Guidelines Advisory Committee (DGAC) report, which becomes the basis for the actual guidelines, focuses on dietary patterns that are associated with lower risk of chronic diseases such as heart disease, Type 2 diabetes, overweight and obesity.

The report also covers hot topics such as how much sodium, saturated fat and added sugars people should be eating, as well as sustainability issues. (Note: the Trends report was published before the DGAC report was released.)

A number of factors made the discussion more controversial. First, research is not clear-cut on some of the topics. Second, scientific research is not as respected as it once was, with many consumer and advocacy groups skeptical of methods used, funding agencies and study conclusions. Third, social media has given groups who call into question the credibility of the DGAC a platform to express their non-traditional views quickly and broadly.

Eat local, fresh and sustainable

Consumers are increasingly vocal about wanting to know where their food comes from. They are skeptical of big food industry practices with regard to animal welfare, genetically modified organisms and use of pesticides and antibiotics. As personal beliefs and subjective feelings come into play, decision-making becomes more complex than simply buying a carton of milk for breakfast or a loaf of bread for lunch.

Consumers are driving this movement. Public policy and health professionals have not yet widely embraced it, the council states. There is a small but growing movement back to whole foods as a way to eat more natural and fewer processed foods. For dairy, this means a growing acceptance of whole milk, butter and full-fat yogurt, because dairy fats are perceived more favorably.

Linking nutrition and mental health

Many experts consider foods to assist mental and cognitive health as the next “big thing” in nutrition. As the U.S. population continues to age, there is growing interest in the ability of foods and dietary components to optimize cognitive health and prevent dementia in later years. Brain development in babies and children is also a focus in nutrition research.

Some components being examined are choline, protein, probiotics, healthy fats (such as omega-3 fatty acids), selenium, zinc and other select vitamins and minerals. Studies show that stress, sleep habits and social relationships are also critical to optimize mental health.

Cheese is back

Cheese — once shunned for its high content of saturated fat and sodium — is “cautiously” coming back into favor for its high protein and calcium levels and low sugar and lactose levels, according to the council. With only a few ingredients, cheeses such as Cheddar, Colby, Monterey Jack, mozzarella and Swiss are seen as natural and fresh.

Dietary patterns such as the Mediterranean, DASH and some vegetarian diets include cheese, making it acceptable for health professionals to advise in moderate amounts.

— Read the full Autumn 2015 Trends Report at healthyeating.org. To receive a hard copy, write to KHouse@DairyCouncilofCA.org. Order “What’s in Store 2016” from iddba.org.