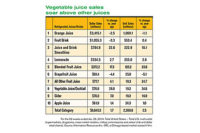

Sales of staple refrigerated juices like orange and grape are dropping, while those of refrigerated vegetable juice/cocktail and juice smoothies are increasing. In the refrigerated juice/drinks category, dollar sales dropped 1% to $6.6 billion and units fell 4.3% to 2.2 billion, according to Information Resources Inc. (IRI), Chicago, for the 52 weeks ended Feb. 22, 2015.

The category includes these segments:

- Orange juice ($3.3 billion; units down 5.7%)

- Fruit drink ($1 billion; units down 11.8%)

- Juice and drink smoothies ($827.9 million; units up 6.2%)

- Lemonade ($577.9 million; units up 4.3%)

- Vegetable juice/cocktail ($103.5 million; units up 42.7%)

- Apple juice ($63.2 million; units up 1.1%)

- Grape juice ($5.4 million; units down 42.4%)

Sales of refrigerated orange juice dropped 3.3% to $3.3 billion with unit sales down 5.7% to 1 billion. Among the top 10 brands, only a few companies saw units out of the negative. Tree Ripe (Johanna Foods) showed a jump of 11.1% in dollars and 10.3% in units. Minute Maid (Coca-Cola Co.) saw dollar sales rise 5.9% and units rise 7.4%. Citrus World Donald Duck’s dollar sales improved 8.8%, with units up 5.8%. On the flip side, dollar sales dropped 10.5% and units fell 12.3% for Minute Maid Premium. Orange juice segment leader Tropicana Pure Premium saw sales decrease 3.5% to $974 million and had a 3.3% decline in units. Simply Orange’s dollar sales increased 0.3%, but units decreased 3.6%.

Lemonade sales were sweet

The lemonade segment saw better success. Dollar sales increased 6.2% to $577.9 million and units improved 4.3% to 271.4 million. Among the top 10,Simply Lemonade (Simply Orange) dominated in overall sales with $329.4 million. Dollar sales rose 6.6% and units increased 6% to 129.8 million. Private label lemonades saw much success, with dollar sales up 54.3% to $40.8 million and units up 84.6%. Sunny D (Sunny Delight) saw its dollar and unit sales skyrocket 61.6% and 95.9%, respectively. Minute Maid Premium struggled with dollar sales down 25.1% and units down 38.4%.

The juice and drink smoothies segment’s dollar sales improved 6.4% to $827.9 million, while units increased 6.2% to 234.4 million. Suja Essential outperformed the rest in the segment — dollar and unit sales skyrocketed 37,728.6% and 38,171.2%, respectively. Florida’s Natural (Citrus World) also showed increases in dollar and unit sales of 111.9% and 110.6%, respectively. Naked (The Naked Juice Co.) led the segment with $457.7 million. Dollar sales were up 8.3% and units increased 7.9%. Bolthouse Farms saw success; dollar and unit sales increased 21.6% and 28.2%, respectively. Struggling was OdwallaSuperfood. Its dollar sales dropped 43.8% and units fell 49.9%.

One other segment showing promise in the category was vegetable juice/cocktail. Dollar sales jumped 37.5% to $103.5 million and unit sales increased 42.7% to 26.6 million. Numbers were across-the-board amazing for most in the top 10. Here are some that stood out: Bolthouse Farms led the segment with $58.3 million (up 20.2%) and units up 27.3%. Forager Project’s dollar and unit sales skyrocketed 14,259.7% and 15,074.1%, respectively. Naked also saw dollar sales jump 1,962.4% and units increase 1,796.7%.