Carving Out A Niche

by James Dudlicek

The dairy industry is booming — if you’re

making the right thing.

Could anyone in recent

history have imagined a time when demand for fluid milk would be outpacing

supply to such an extent that a processor would be compelled to restrict

shipments?

It’s happening.

Did you ever think demand for cheese would ever be so strong that New Mexico would join the ranks of the top dairy states?

It’s happening.

Who could imagine a summer with sagging ice cream sales, while development of better-for-you frozen treats continues to expand?

It’s happening.

Did you ever expect American consumers to finally catch on to the benefits of probiotics in cultured dairy products?

It’s — well … it’s starting to happen.

Did you ever think demand for cheese would ever be so strong that New Mexico would join the ranks of the top dairy states?

It’s happening.

Who could imagine a summer with sagging ice cream sales, while development of better-for-you frozen treats continues to expand?

It’s happening.

Did you ever expect American consumers to finally catch on to the benefits of probiotics in cultured dairy products?

It’s — well … it’s starting to happen.

Yes, it’s all true, friends. Demand for fluid

milk is rapidly outstripping supply — in the organic sector, leading

Dean Foods to consider rationing organic milk shipments this winter until

it can catch up with demand for its Horizon Organic products. Meanwhile,

the nation’s top dairy processor is spending millions to help family

farmers transition to organic and expand grazing land and milking

operations for its Idaho organic dairy herd.

New Mexico became the country’s seventh-largest

milk producing state in 2004, according to the latest USDA reports; that

state wasn’t even on the list in 1980. Much of that milk is feeding

the new Southwest Cheese mega-plant in Clovis. Just over the state line in

the Texas panhandle, Hilmar is constructing another major facility, while

throughout the west new or expanding plants are helping processors keep up

with Americans’ insatiable appetite for cheese.

Per capita cheese consumption has more than doubled

since 1980, the USDA reports, with Italian and other ethnic cheeses making

strides against traditional American and cheddar styles.

And even as a heat wave grips much of the nation,

overall ice cream sales appear to have slipped, perhaps a casualty of

growing concerns over health, wellness and obesity. On that side of the

coin, processors continue to develop better-for-you alternatives that taste

as good as the real thing.

Gut-health truths understood for decades abroad may

finally have started to make inroads here, with the U.S. launch of

Dannon’s Activia leading the way after years of success in Europe.

This step bodes well for the already booming yogurt segment that’s

blessed with an innate wellness profile.

Overall, per-person consumption of dairy products

climbed by 0.4% per year since 1995, the USDA reports, with most of that

demand growth coming from increased cheese consumption in restaurants or as

part of pre-packaged foods. The agency says this may make dairy demand more

sensitive to general economic conditions than in the past.Despite

strides in school milk, increased attention toward wellness and broad

recognition by household gatekeepers of the dairy-weight loss link,

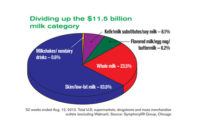

beverage milk sales are virtually the same as in the mid-1980s. Fluid milk

products represented 36 percent of total milk use in 2004, down from almost

50 percent three decades ago.

“The once clear-cut dramatic substitutions of

lower-fat milks for whole milk have not been seen since the

mid-1990s,” the USDA reports. “Recent data suggests little or

only slow growth in any of the key fluid milk categories.”

Eating out and food processing account for a majority

of dairy product use, according to the USDA. Restaurant demand —

mainly for cheese, butter and cream — has become particularly

important in recent years. Cheese has become the primary end use for raw

milk, with its share more than doubling since 1975 to 52 percent in 2004.

Processed food manufacturers are showing greater interest in using dairy

ingredients — milkfat, skim solids, whey proteins and lactose —

in their products due to their desirable taste, nutritional and functional

attributes.

Globally, the dairy industry is doing well. The

indexed return for dairy companies outpaced the Dow Jones, Nasdaq and

S&P 500 indexes in nearly every period over the past year, according to

data from Chicago-based Houlihan Lokey Howard and Zukin. Among dairy

companies worldwide, France’s Groupe Danone leads the pack with

revenue of more than $17.4 billion; the U.S. leader, Dallas-based Dean

Foods Co., follows at more than $10.5 billion, according to Houlihan

Lokey’s 2006 mid-year report. Rounding out the top five in that

report are France’s Bongrain SA ($5.2 billion), Canada’s Saputo

Inc. ($3.2 billion) and U.K.-based Dairy Crest Group plc ($2.5 billion).

Growing global demand for American dairy products and

the loosening of trade barriers will certainly open new opportunities for

U.S. processors, despite a breakdown in World Trade Organization Doha Round

talks announced shortly before press time.

Meanwhile, the trends are clear at home. Follow our

category-by-category report for ideas on how to succeed in the dairy

business by really trying.

Is it happening for you?

$OMN_arttitle="Carving Out A Niche";?>