Tea lovers, for instance, can achieve complete satisfaction in the $2.1 billion canned or bottled tea segment.

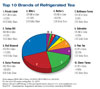

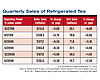

According to Chicago-based SymphonyIRI Group, AriZona Beverage topped the charts at $587.4 million in sales as of March 21, with its unsweetened tea that comes in a 10-ounce resealable PET bottle and is pre-priced at $1. The Cincinnati-based beverage company also enjoyed a leap in dollar sales of more than 150%, SymphonyIRI data says, for its AriZona Arnold Palmer line of Half & Half tea, which combines black tea and lemonade into a 20-ounce PET bottle.

Meanwhile, Lipton Brisk tea experienced a 23% climb in sales, according to SymphonyIRI data, while Gold Peak snagged the eighth slot with a nearly 24% jump in sales for its new chilled tea selection, which comes in a multi-serve 59-ounce carafe bottle and is available in Sweetened and Lemon flavors.

Turkey Hill Dairy placed second with $93.4 million in sales, thanks in part to the re-introduction of its decaffeinated iced tea in a half-gallon bottle.

Likewise, Swiss Premium Tea came in fourth with a 60% jump in sales for its lineup of Regular, Diet, Southern Style Sweet and Green Tea with Ginseng and Honey offerings that come in gallon, half-gallon and pint sizes.

Rutter’s Dairy, meanwhile, saw sales rise nearly 48% over last year for its broad assortment of tea items, SymphonyIRI data shows. The York, Pa.-based processor urges consumers to enter the Cold Drink Zone of its company-owned convenience stores, filled with iced tea, tea coolers, brewed tea, sweet tea and fruit-flavored tea offerings.

On the other hand, Pom Wonderful experienced a 33% drop in sales since last year, SymphonyIRI data says, despite the Los Angeles-based company’s revamp of its Anitoxidant Super Tea line. However, the company experienced a 200% leap in sales for its PomX ready-to-drink coffee line.

Others in the $22.1 million RTD coffee category also saw some impressive gains.

For example, SymphonyIRI reports Shock Coffee’s sales skyrocketed more than 12,000% since last year, as the brand continues its meteoric rise by finding new outlets for its products. Meanwhile, Adina Coffee’s sales saw a less jaw-dropping but still impressive rise of nearly 133%.

Instant gratification can be hard to come by, but today’s makers of tea and coffee beverages are helping consumers get closer to being completely satisfied.