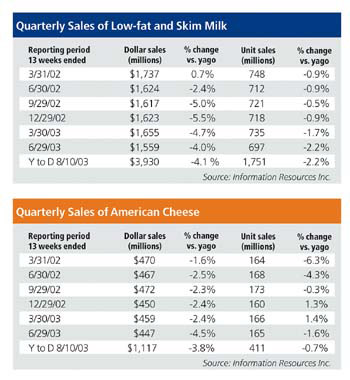

Dollar sales of skim/low-fat milk, as well as American cheese are off 4.1% and 3.8% respectively, for the 52 weeks ended August 10, according to Information Resources Inc. Unit sales fared a bit better, with low-fat milk off by just 2.2% and American cheese down 0.7%. These figures reflect food drug and mass merchandisers, but do not include Wal-Mart or convenience stores.

Quarterly figures going back to March of last year show steady dollar declines of about 2.5% in most quarters for American cheese, while unit sales actually grew a bit in the final quarter of 2002 and the first period this year. For low-fat milk, the unit declines were about 1% each quarter in 2002 and began to worsen this year.

Some of these declines may have been affected by low raw milk prices and by Wal-Mart's continued growth of market share.

Meanwhile, a look at the top 10 vendors of yogurt not only tells individual success stories, but speaks to the growing strength of the category.

In the 52 weeks ended Aug. 10, all but two of the top 10 vendors experienced positive sales growth, according to IRI. Several saw double digit growth over the prior year in both dollar sales and unit sales. Stonyfield Farm grew its sales by more than 25% during the period. Meadow Gold Dairy lost some market share during the period, but keep in mind that Meadow Gold is part of Dean Foods.

Finally we turn to ice cream.

The top 10 ice cream vendors didn't do quite as well as their yogurt counterparts during the same 52 week period, as the category overall was a bit stagnant.

Dreyer's Grand Ice Cream, the category leader after private label, saw a sales decline of .7% in dollar sales and just over 1% in unit sales. That's pretty close to the overall category performance, which was off by a half percent by dollar. Meanwhile Ben & Jerry's, and Friendly each saw substantial growth, while Turkey Hill rebounded from operational problems, posting 13.2% growth in dollar sales.