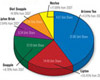

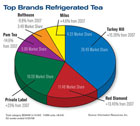

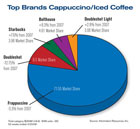

Canned and bottled tea make up the largest part of the category, with more than $1.1 billion sales for the 52 week period ended April 20. Refrigerated tea, where many dairy companies participate represents about $284 million a year, looking at the same time frame. Finally iced cappuccino and iced coffee account for about $269 million.

Our partners at Mintel Research say the Ready to Drink Category is strong in general and that tea and coffee are among its stars.

Ready-to-drink teas, in particular, have been bolstered by their strong healthy halo. Black, white, red and green teas-already considered to be antioxidant-rich “superfoods”-have strengthened their nutritional profile with the addition of superfruit ingredients. Pomegranate and açaí have been among the most popular, but emerging ingredients such as goji berry have also started to appear in RTD teas. Coca-Cola has been quite active in this space with the recent launch of Minute Maid Pomegranate Tea, and Mango Açai White Tea by Honest Tea-an organic RTD tea manufacturer in whom Coca-Cola recently purchased a 40% stake. Retailers including Trader Joe’s and Target, as well as a number of niche manufacturers, are also driving innovation in the superfruit-enriched RTD tea segment. One of the most interesting superfoods to be added to RTD teas recently is not a fruit at all, but rather, a plant. Energizing yerba mate, native to Latin America and regularly consumed there in tea format, is now being added to U.S. RTD teas that often emphasize its Amazonian roots.

Beyond functionality, RTD coffees and teas have also been especially progressive in sustainability initiatives. The Fairtrade movement, which requires certified manufacturers to provide fair wages and working conditions to producers in developing countries, has gained solid traction in the RTD segment. Fairtrade first emerged in coffee and tea, but it has now taken off in RTD versions of these beverages.

For instance, JavaPop’s Javaccino is made with Fairtrade-certified organic coffee from Sumatra, while Santa Cruz Organic and its recently launched line of RTD teas are all Fairtrade-certified. Even more significantly, in May Unilever pledged to source its entire tea supply, including RTD products, according to Rainforest Alliance standards. Unilever’s commitment to the Rainforest Alliance, a sustainability movement similar to Fairtrade, underscores how pivotal ethical sourcing will become to RTD beverages.

Segments of this report were contributed by Krista Faron, Senior Analyst, Mintel Research Consultancy.