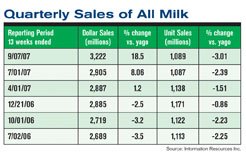

Dollar sales for all milk rose 18.5% in the most recent quarter. You might want to give that a second to sink in. It seems that through the second quarter of 2007, retail prices hadn’t really taken off in reaction to higher gate prices. But that changed with the period ended Sept. 7.

While unit sales have started to drop off in the middle of last year, and continued to do so in the two most recent reporting periods, those declines seem to be much less severe than we might have expected. The average loss for these three quarters was only around 2.6 %.

It looks like milk has a bit more price resilience than it is sometimes given credit for.

For the 52-week period ended Dec. 2, dollar sales for skim and lowfat rose just over 12% while unit sales backslid about 1.2%.

Looking at brands of lowfat and skim for that same period, we are not necessarily seeing an exodus from brands in favor of private label. In fact, private label, still the 800-lb gorilla, lost a bit of market share to the still-growing specialty and organic brands.

Lactaid remains the top brand with Horizon Organic and Deans considerably smaller in sales and quite close to one another at No.2 and No. 3.

Another lowfat brand that continued its strong growth in the period was Organic Valley, which has less than 1% unit share, but saw dollar sales jump 11% for the period and units gain more than 8%.