Mozzarella cheese is used as a topping,

condiment and a cooking cheese. Convenient pizza-making kits let consumers add

as much as they want to make their own signature creation.

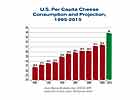

Americans are eating more cheese than ever before, with consumption showing no signs of abating. In fact, according to data compiled by the Wisconsin Milk Marketing Board, from 2005 to 2015, it is projected that, on average, every American will be consuming an additional three pounds of cheese each year. That’s a lot of cheese!

But not as much cheese as consumed in other countries. Greece ranks first with 56 pounds per capita and France is second with 54 pounds. (The United States comes in sixth place.)

What’s important to keep in mind is that most of this increased intake by Americans is not in the form of cheese alone. It is and will continue to be in prepared foods: those foods prepared at home, through foodservice and via retail packaged products. And, applications through each of these venues often have different functional and flavor requirements, which have cheesemakers seeking out innovative ingredients and processes.

Interestingly, when it comes to the varieties of cheese that Americans are consuming more of, it’s not Cheddar or other American-styles. Per capita consumption growth is coming from mozzarella and other Italian cheeses, as well as “other” cheeses, which includes those of other ethnic origin and domestic signature cheeses that can be classified as farmstead or specialty. Such cheeses will be increasingly used as a condiment . . . and some, as a dessert.

To meet these needs, there is a great deal of innovation taking place in the cheese manufacturing arena. Larger cheese manufacturing plants are being built and existing ones are being expanded. This is not to just meet demand, but also to improve production efficiency.

According to a recent article published in theJournal of Dairy Science(89:1174-1178), some of the largest natural cheese manufacturing plants have capacities that can handle in excess of eight million pounds of milk per day. Furthermore, the number of USDA-inspected cheese plants has dropped from 737 in 1980 to 399 in 2003. This is particularly true of those that produce Cheddar, Swiss and mozzarella, the so-called commodity cheeses. In contrast to the decrease in the number of cheese plants producing commodity cheeses, there has been a steady increase in the number of “other” cheese plants. Of all cheese varieties, mozzarella production has shown the most dramatic increase of all cheeses, jumping from 689 million pounds produced in 1980 to 2,806 million pounds in 2003.

New plants, highly automated processes, the desire to increase efficiencies, expanding cheese varieties and more are driving the development of enhanced cheese ingredient technologies. One of which is the introduction of more direct-vat cultures.

Indeed, many cheesemakers are switching from bulk starter cultures to direct-vat cultures, explains Jeff Lambeseder, North American product manager for Danisco Cheese Cultures and Enzymes, Madison, Wis.

Two decades ago direct-vat cultures arrived on the market. While some 80% of fresh dairy manufacturers use these particularly user-friendly cultures on a daily basis, the cheese industry has been more reluctant to convert. One of the major barriers to conversion is the higher cost-in-use associated with direct-vat cultures.

Frozen

convenience foods increasingly rely on cheese to add flavor and pizzazz.

Danisco recently launched new Choozit AC brand direct-vat cultures for American-style cheeses. The cultures are said to secure the distinctive flavor development along with the reduced residual galactose necessary to avoid browning when using the cheese in baking. “There’s also the Choozit Q 1000 and 2000 series, which offers single-strain cultures for fast and efficient pizza cheese production, while Choozit ST-20 targets the market for stable soft cheeses such as Brie and Camembert,” says Lambeseder.

Cargill Texturizing Solutions-Product Line Cultures, based in Waukesha, Wis., is rolling out a direct-vat culture for mozzarella-type cheeses. “Ultra-Gro Tempo brand direct-vat set cultures have been developed for production of high-quality mozzarella cheese, string cheese and similar cheese types,” says Terri Rexroat, global product manager-lactic cultures at Cargill. “Our use of carefully selected bacterial strains along with innovative fermentation and blending technology allow Tempo cultures to provide a fast fermentation at a very low inoculation rate. A rotation of six cultures is available in convenient frozen pellet form.”

Direct-vat cultures also help overcome phage issues, one of cheesemakers’ biggest nightmares. Phage viruses only pose a threat when the direct-vat cultures are growing, unlike the greater window of time when batch-set cultures are being grown on site. And, if phage does occur with direct-vat cultures, the result is simply a longer fermentation time. With batch-set culture growth, there is a great deal of product loss and equipment down time.

Researchers have made great strides using genetics to help overcome the chance of phage attack. Lactic acid bacteria genetics is also being used to control the development of flavor in cheese. “Much of these efforts are to identify specific flavor components, match the flavor component to a specific flavor attribute in cheese and then to determine the exact chemical and metabolic pathways giving rise to them,” says Mark Johnson, senior scientist, Wisconsin Center for Dairy Research, Madison, Wis. “Another important realization that has occurred in the past two decades is that these studies must be conducted under conditions that actually exist in cheese. Specific environmental factors that have been identified include partitioning of reactants and end products between serum and fat phases, water activity, redox potential, and anaerobic vs. aerobic conditions.”

In recent years, the genomes of select strains of lactic acid bacteria have been characterized by Todd Klaenhammer, director of the Southeast Foods Research Center and professor of food science at North Carolina State University, Raleigh, N.C., and colleagues from around the world. This information will aid in the development of specific adjunct bacteria to manufacture consistent desired flavor in cheese.

The use of adjunct microorganisms, specifically yeasts and lactobacilli strains, has already gained acceptance as the preferred means to introduce specific flavor attributes in a variety of cheeses. For example, adjunct cultures such asLactobacillus helveticusandLactobacillus caseican increase flavor and aroma production in low-fat Cheddar cheese.Brevibacterium linens, typically used for brick and Limburger cheeses, have also been successfully used as an adjunct to speed flavor development in reduced-fat and full-fat Cheddar cheeses.

Managing melt

Researchers have gained a great deal of insight into what makes cheese melt . . . or not melt. The former belief was that as cheese got warmer, the fat became more liquid and leaked out, causing the cheese to melt. Today scientists know that melt depends more on protein than fat. When heated, the proteins in cheese shift and unwind, releasing any free oil. This discovery has important implications in designing cheeses for special melt applications. It also dispels the theory that low-fat cheese inherently has poor melt characteristics.Controlling cheese melt and texture is accomplished by modifying proteins. This can be particularly challenging for the natural cheesemaker since often times Standards of Identity dictate some of the processing and ingredient variables. Hence, many prepared foods applications, where melted cheese is an important attribute, use process cheese products, as process cheese is all about controlling functionality. Or, they use non-standardized cheeses, which can be made with ingredients that influence melt and texture.

Emulsifying salts are a common group of ingredients used to influence the melt and texture of select cheeses. Great strides are being made by ingredient suppliers with development of emulsifiers that complement the more sophisticated cheeses being made by today’s cheesemakers, even ones that make nutrient content claims.

For example, “VersaCal MP is a micronized form of tricalcium phosphate. Typical tricalcium phosphate may cause grittiness in some cheese applications because of larger insoluble particles,” says Amr Shaheed, senior scientist, Innophos Inc., Cranbury, N.J. “Some comments from professional food sensory analysts is that typical tricalcium phosphate contributes to a sandiness profile in the mouthfeel and appearance. What is so innovative with VersaCal MP is that it is micronized to a much smaller particle size distribution. It is undetectable in the mouth and in the cheese’s appearance.

Gene Brotsky, senior technical service representative at Innophos adds, “VersaCal MP has the greatest opportunity in soft cheeses such as cottage cheese and ricotta, in cheese spreads and in cream cheese, and for the formulation of cheese sauces, where grittiness is especially evident. Incidentally, these products are much lower in natural calcium and have a greater need for added calcium to achieve designation as an ‘excellent source’ of calcium.”

Sometimes modern cheesemakers are not willing to mess with traditional ingredients . . . even ones that seem rather ancient. For example, “Producing artisan cheeses is like producing a piece of artwork,” says Joe Widmer a Wisconsin Master Cheesemaker who carries on the family name as a third generation Wisconsin cheesemaker for Widmer’s Cheese Cellars, Theresa, Wis. Adamant about sticking to traditional cheesemaking methods from previous generations, Widmer uses the same bricks-that’s right, bricks-and bacteria cultures that his grandfather did to produce Brick cheese. These contribute to the same quality and flavor that has made the Widmer name synonymous with award-winning Wisconsin artisan cheeses.

A versatile cheese with flavors ranging from mild and sweet when young to pungent and tangy when aged, Brick cheese is one of those “other” cheeses that are gaining popularity. Chefs and foodservice operators are using it in dishes ranging from macaroni and cheese to potatoes au gratin.

Widmer sums up the ingredients one should use when making cheese, “Take no shortcuts and accept nothing less than excellence.”