Milk sales continue to head in the right direction, albeit not at the same pace as they were in the first half of 2006. Refrigerated iced tea is still the juggernaut of the beverage business, and there are some changes underway in the refrigerated juice category, although orange juice still really rules the roost.

First we look at milk. The table here breaks down lowfat and skim milk sales month-by-month from December, through the first quarter, with the data coming from Information Resources Inc. The numbers are decent, with unit sales on the increase each monthly period with the exception of the four weeks ended March 25. But this still isn’t the kind of movement that was taking place early in 2006. MilkPEP’s numbers which combine IRI’s numbers and USDA figures show a total 1% volume growth rate in 2006, for all milk. That was the best total growth figure since 1999.

IRI numbers shown here are for food, drug stores and mass merchandisers, but don’t include Wal-Mart.

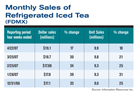

Look at the numbers here! Both dollar and unit sales are growing by 20 to 30 percentage points each month compared to the same periods a year ago. And this is nothing new. RTD tea had the fastest growth rate in 2006 among CSDs, fruit drinks and juices, milk, bottled water and sport drinks. And as we’ve noted before in Dairy Market Trends, this growth stretches all the way back to 2003, at least.

Finally we look at the refrigerated juice market, with data from IRI.

So don’t forget about your opportunities in iced tea and fruit juice, and let’s keep an eye on milk.

Next month we’ll have expanded Dairy Market Trends coverage in Dairy Foods’ annual Buyers Guide and Source Book.